Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

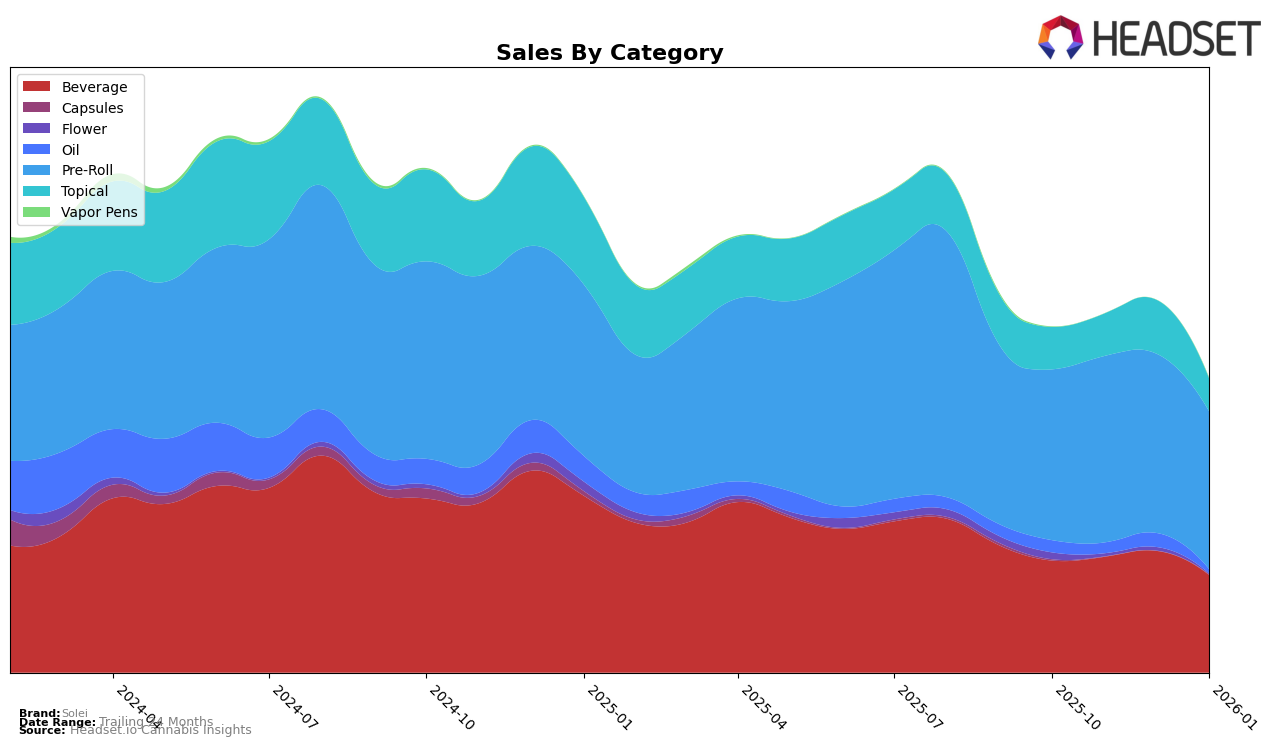

Solei has demonstrated varied performance across different Canadian provinces and product categories. In Alberta, Solei maintained a stable presence in the Beverage category, consistently ranking around the 10th position, although there was a slight dip in January 2026. In the Topical category, Solei experienced a notable fluctuation in sales, with a peak in December 2025, but dropped to 6th in January 2026. Meanwhile, in British Columbia, Solei showed an impressive upward trend in the Beverage category, climbing from 16th to 11th place by January 2026, indicating a growing preference for their offerings in this segment.

In Ontario, Solei's performance in the Beverage category remained steady at 14th place throughout the observed months, suggesting a consistent consumer base. However, in the Oil category, Solei's absence from the top 30 in January 2026 might be a point of concern. In Saskatchewan, Solei's Topical products have consistently held the 2nd position, reflecting strong demand, while their Beverage category saw a consistent top 4 ranking until the end of 2025, with no data available for January 2026. This absence could suggest a strategic shift or market dynamics that merit further exploration.

Competitive Landscape

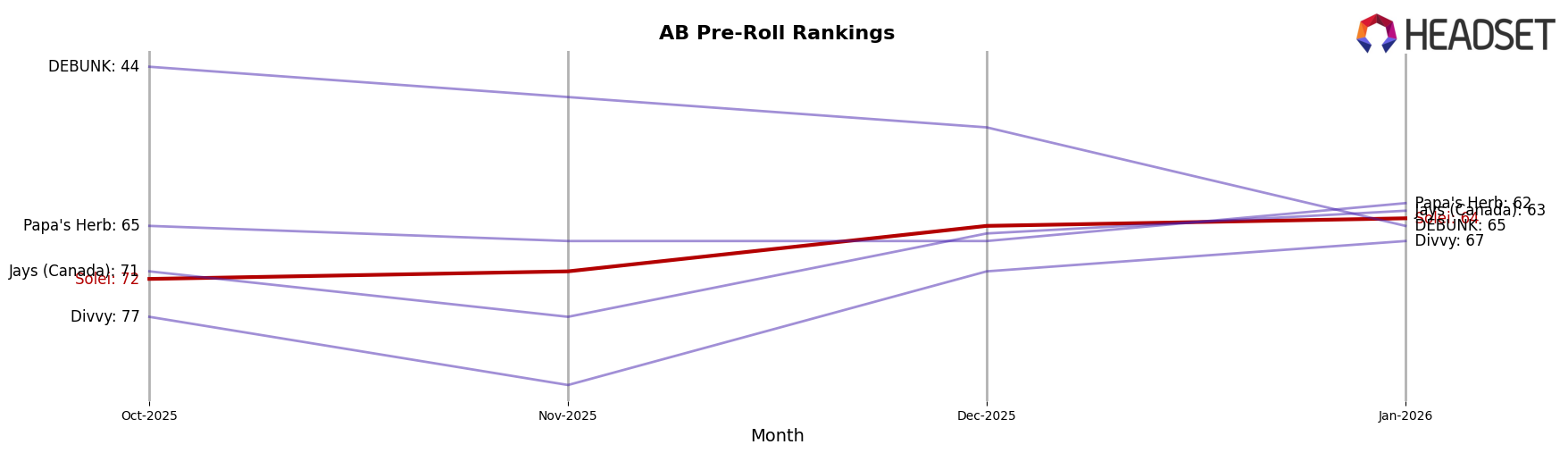

In the competitive landscape of the Pre-Roll category in Alberta, Solei has shown a consistent improvement in its ranking from October 2025 to January 2026, moving from 72nd to 64th position. This upward trend indicates a positive reception in the market, despite the brand not being in the top 20. Solei's competitors, such as Papa's Herb and Jays (Canada), have experienced fluctuating ranks, with Papa's Herb improving slightly from 65th to 62nd, while Jays (Canada) showed a similar upward trend from 71st to 63rd. Meanwhile, Divvy and DEBUNK have seen more volatility, with DEBUNK dropping from 44th to 65th, indicating potential challenges in maintaining their market position. Solei's steady climb in rank amidst these fluctuations suggests a strengthening brand presence, potentially driven by strategic marketing efforts or product differentiation, and positions it well for continued growth in the Alberta Pre-Roll market.

Notable Products

In January 2026, Solei's top-performing product was CBD Dragonfruit Watermelon Sparkling Water in the Beverage category, maintaining its number 1 rank for four consecutive months with sales of 7,385 units. The CBD Mango Passionfruit Sparkling Soda also held steady at the second position, showing consistent performance in the Beverage category. Notably, the Slims - Free Pre-Roll 10-Pack climbed to the third rank, up from fifth place in the previous months, indicating a significant increase in consumer preference. The Slims - Balance Pre-Roll 10-Pack (4g) dropped to fourth position, while the Slims - Balance Pre-Roll 10-Pack (4.4g) fell to fifth place, reflecting a shift in demand within the Pre-Roll category. Overall, the January 2026 rankings highlight the continued dominance of beverage products while showcasing a dynamic shift among pre-roll offerings.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.