Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

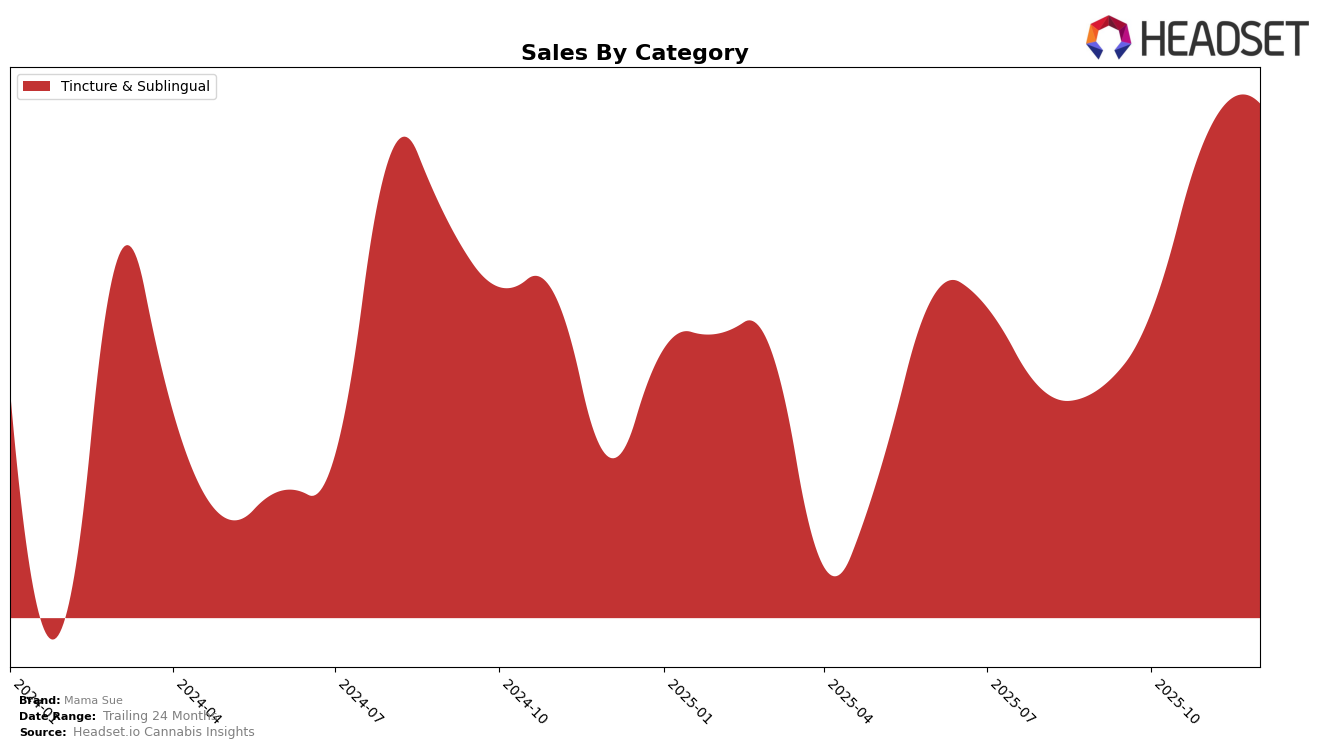

In the state of California, Mama Sue has made a notable entrance into the Tincture & Sublingual category rankings by December 2025. Previously absent from the top 30 brands in this category from September to November, the brand secured the 22nd position by the end of the year. This upward movement suggests a positive market reception and potentially effective strategies in product placement or consumer engagement. However, the absence of rankings in the preceding months indicates that Mama Sue may have faced challenges in establishing its presence earlier in the year.

Despite the late entry into the top 30 in California, the performance of Mama Sue in other states remains unspecified, which could imply a lack of significant market penetration or data availability. This absence of ranking in other regions could be a point of concern if the brand aims for broader geographical expansion. The only raw sales figure available, from December 2025, shows sales of 10,201 units, which provides a glimpse into the brand's potential scale within California. Observing the trend in California, it will be interesting to see if Mama Sue can replicate this success in other states or if they will continue to focus on strengthening their position within California's Tincture & Sublingual market.

Competitive Landscape

In the California Tincture & Sublingual category, Mama Sue experienced a notable shift in its competitive positioning by December 2025, as it entered the top 25 brands, ranking at 22nd place. This marks a significant entry into the competitive landscape, especially considering that brands like Chemistry and Casa Flor were not in the top 20 during the same period. Meanwhile, High Power saw a decline from 14th to 20th place over the last four months, indicating a downward trend in sales, which could provide an opportunity for Mama Sue to capture more market share. Additionally, Emerald Spirit Botanicals appeared in the rankings in November but did not maintain a top 20 position in December, further highlighting the dynamic shifts within this market segment. Mama Sue's entry into the rankings suggests a positive trajectory in sales and brand recognition, positioning it as a rising competitor in the California market.

Notable Products

In December 2025, Mama Sue's top-performing product was the CBD/CBN 1:1 Sleep Tincture, maintaining its number one rank consistently from September through December, with sales increasing to 259 units. Following closely, the CBD/THC Full Spectrum Everyday Wellness Tincture held the second position across the same period, though it experienced a slight dip in sales to 79 units in December. Notably, both products are part of the Tincture & Sublingual category, which seems to dominate Mama Sue's sales. The consistent rankings suggest strong customer loyalty and satisfaction with these products. Over the months, while the Sleep Tincture saw a steady rise in popularity, the Everyday Wellness Tincture experienced some fluctuations but remained a solid performer.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.