Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

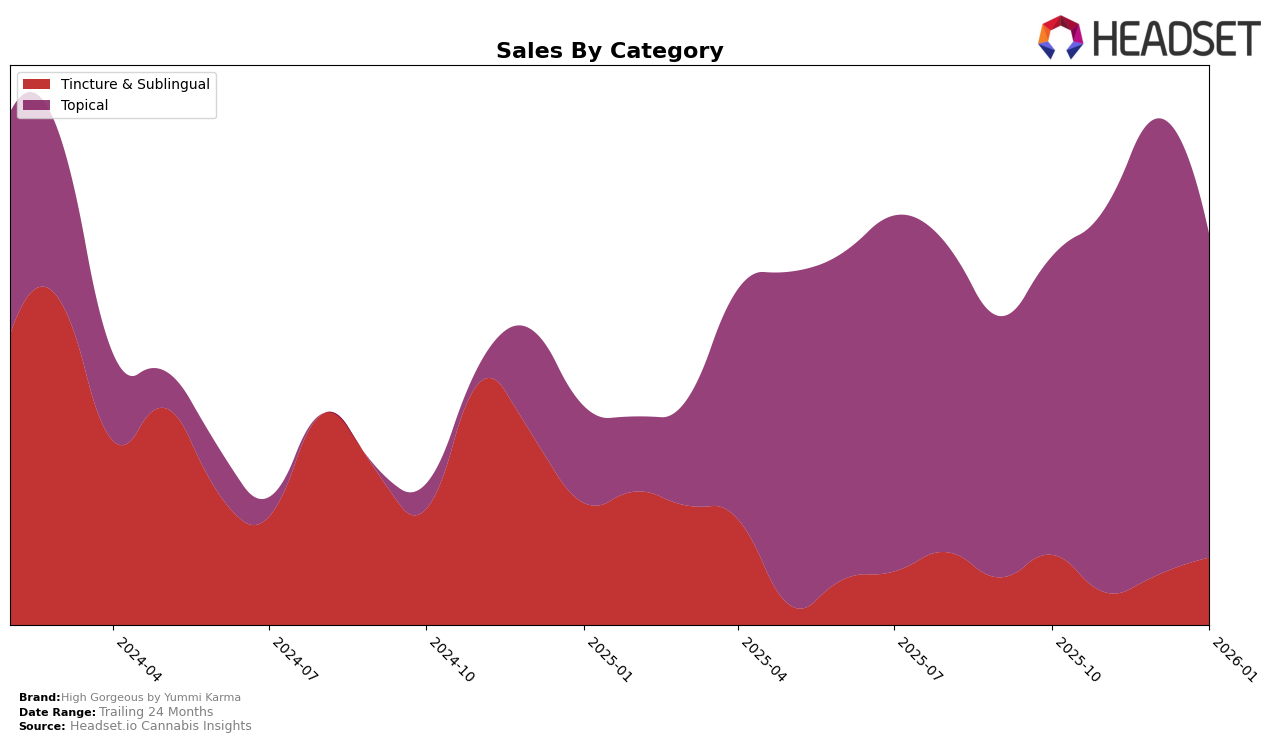

High Gorgeous by Yummi Karma has shown a dynamic performance in the Topical category within the California market over the last few months. In October 2025, the brand ranked 11th, moving up to 9th in November before slightly dropping back to 11th in December and then to 12th in January 2026. This fluctuation suggests a competitive market environment where High Gorgeous is maintaining a relatively strong position, though not consistently in the top 10. The brand's sales trajectory from October to December indicated a positive growth trend, peaking in December before experiencing a decline in January. This sales pattern could be indicative of seasonal demand or promotional efforts that bolstered sales during the holiday season.

Despite not breaking into the top 30 rankings in other states or provinces, High Gorgeous by Yummi Karma's performance in California is notable, given the state's significant market size and competitive landscape. The absence of rankings in other regions may highlight potential growth opportunities or challenges in brand expansion efforts. The brand's ability to maintain a consistent presence in California's rankings suggests a strong local customer base and effective market strategies. However, the absence from other state rankings could also imply a need for strategic adjustments or increased marketing efforts to gain traction in additional markets.

Competitive Landscape

In the competitive landscape of the California topical cannabis market, High Gorgeous by Yummi Karma has experienced fluctuating rankings over the past few months, reflecting a dynamic market environment. In October 2025, the brand was ranked 11th, but it climbed to 9th in November, only to drop back to 11th in December and further to 12th in January 2026. This volatility is contrasted by High Desert Pure, which maintained a relatively stable position, ranking 10th in both October and January, despite a dip to 12th in November and December. Meanwhile, OM showed a positive trend, improving from 12th in October to 9th in December, before slightly declining to 11th in January. Blue Sage was not in the top 20 by December and January, indicating a potential decline or strategic shift. These shifts suggest that while High Gorgeous by Yummi Karma has seen strong sales, particularly in November and December, it faces stiff competition and must strategize to maintain and improve its market position amidst competitors like OM and High Desert Pure.

Notable Products

In January 2026, the top-performing product for High Gorgeous by Yummi Karma was the CBD/THC 1:1 Ice Goddess Cooling Roll-On (750mg CBD, 750mg THC) in the Topical category, maintaining its number one rank consistently over the past four months with sales of 326 units. The CBD Plain Jane Tincture (1000mg CBD, 30ml) climbed to the second position in the Tincture & Sublingual category, showing a significant improvement from December 2025 when it was ranked fourth. The CBD/THC 1:1 Cheeky Minx Body Lotion (250mg CBD, 250mg THC, 100ml, 3.4oz), also in the Topical category, held the third spot, dropping slightly from its second position in the previous two months. The CBD/THC 2:1 Ice Queen Cooling Roll-On (300mg CBD, 150mg THC, 89ml) re-entered the rankings at fourth place after not being ranked in November and December 2025. Finally, the CBD/THC/THCA 2:2:1 Pina Co Canna Lotion (200mg CBD, 200mg THC, 100mg THCa) rounded out the top five, slipping from its third-place rank in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.