Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

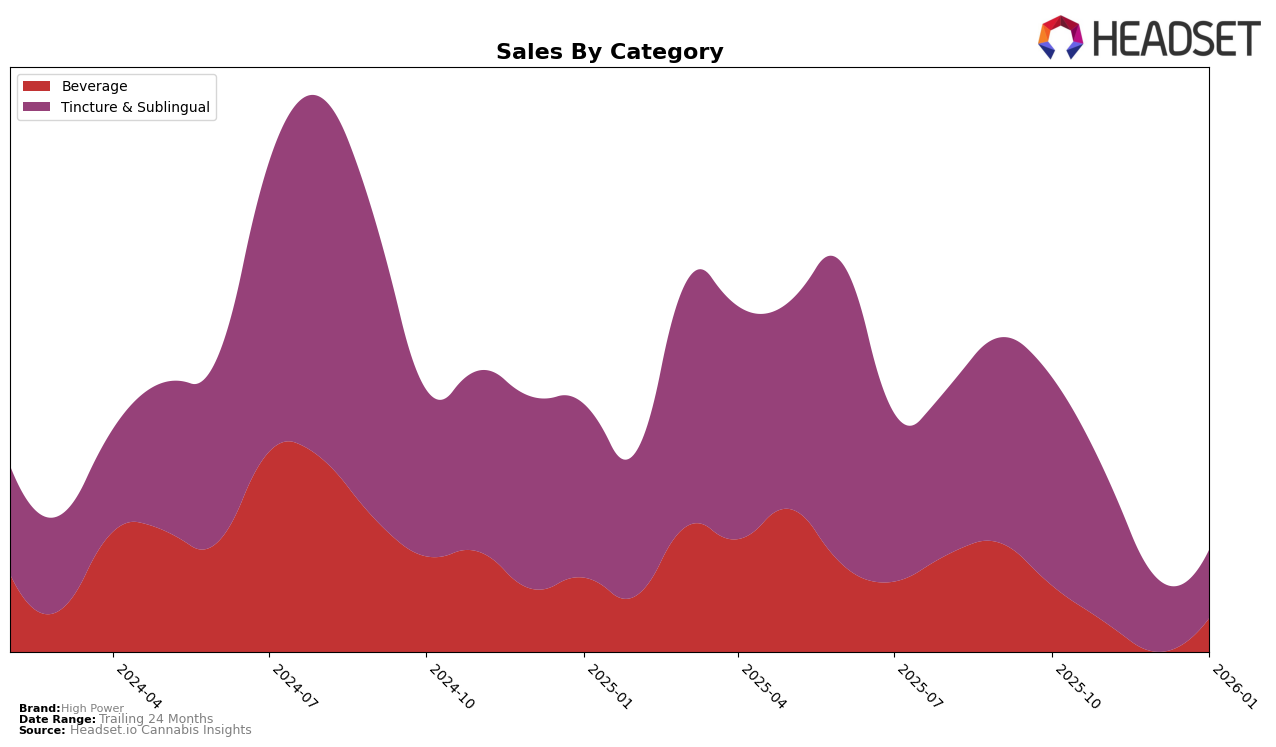

High Power's performance in the California market shows interesting trends across different product categories. In the Beverage category, High Power experienced a drop in rankings from 18th in October 2025 to 23rd in November 2025, with a notable absence from the top 30 in December 2025. This absence indicates a potential challenge in maintaining a competitive edge during the holiday season, though they rebounded to 20th by January 2026. The sales figures reflect this fluctuation, with a decline from October to November, a gap in December, and a slight recovery in January. This suggests that while High Power faces stiff competition, there is room for improvement and strategic adjustments to regain their standing.

In contrast, High Power's Tincture & Sublingual products in California show a more stable performance. The brand maintained a consistent presence within the top 20, moving from 14th in October 2025 to 19th in December 2025, before slightly improving to 18th in January 2026. This consistency in rankings highlights a steady demand for their tincture products, despite a gradual decline in sales over the months. The ability to remain in the top 20 suggests a loyal customer base or effective product differentiation in a competitive market. These trends indicate that while High Power faces challenges in the Beverage category, their Tincture & Sublingual products could provide a foundation for future growth and stability.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, High Power experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 14th in October, High Power saw a decline to 16th in November and further to 19th in December, before slightly recovering to 18th in January. This downward trend in rank coincided with a significant drop in sales, from a high in October to a lower level by January. In contrast, Moods Spray maintained a consistently higher rank, holding steady at 13th for three months before dropping to 15th in January, yet still outperforming High Power in sales. Meanwhile, Kind Medicine and Carter's Aromatherapy Designs (C.A.D.) showed more stable rankings, with Kind Medicine improving its position over the period. The absence of Casa Flor from the top 20 until January highlights the competitive pressure within this segment. These dynamics suggest that while High Power remains a significant player, it faces challenges from both established and emerging competitors, necessitating strategic adjustments to regain its market share.

Notable Products

In January 2026, the top-performing product for High Power was Watermelon Syrup 4-Pack (1000mg) in the Beverage category, which secured the first rank with notable sales of 167 units. The Berry Tincture 4-Pack (1000mg THC, 200ml) in the Tincture & Sublingual category ranked second, dropping from its top position in December 2025. Berry Syrup 4-Pack (1000mg THC, 200ml) followed closely in third place, marking its entry into the rankings for the first time. Berry Syrup (250mg) maintained a steady presence, ranking fourth, although it experienced a slight drop from its third-place position in December 2025. Meanwhile, Grape Syrup (250mg) held the fifth position, showing a consistent performance since its appearance in October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.