Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

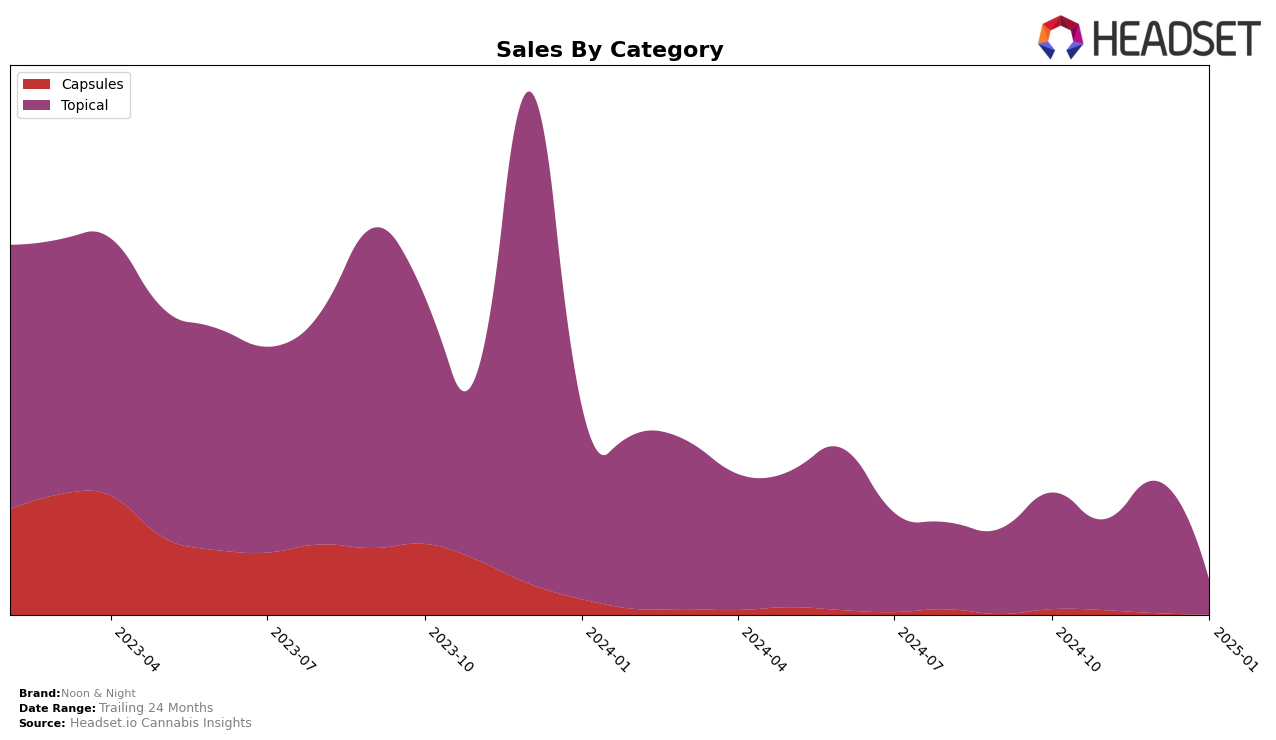

Noon & Night has shown a varied performance across different states and categories in recent months. In Alberta, the brand held a steady position in the Topical category, ranking 7th in October 2024. However, the absence of rankings in subsequent months suggests that Noon & Night did not maintain a position within the top 30 brands, which could indicate a decline in market presence or increased competition. This drop off in ranking could be a point of concern for the brand as it may reflect challenges in sustaining market share in Alberta.

In contrast, the performance in Ontario paints a different picture. Noon & Night achieved an 8th place ranking in October and December 2024 in the Topical category, suggesting a strong foothold in this market. However, the lack of data for November 2024 and January 2025 might imply fluctuations in their ranking or sales volume, which could be attributed to varying consumer preferences or promotional activities during those months. The brand's ability to re-enter the top 10 in December could indicate successful efforts in regaining consumer interest or effective marketing strategies during that period.

Competitive Landscape

In the Alberta topical cannabis market, Noon & Night has shown fluctuating visibility, as evidenced by its rank of 7th in October 2024, but absence from the top 20 in subsequent months. This suggests a competitive landscape where maintaining a consistent presence is challenging. Notably, Wildflower emerged in December 2024, securing the 6th position, indicating a strong market entry or resurgence. Meanwhile, LivRelief demonstrated resilience, ranking 6th in October 2024 and 7th in December 2024, despite missing from the top 20 in November and January. This competitive dynamic highlights the need for Noon & Night to strategize effectively to regain and sustain its market position, potentially by analyzing the tactics of its competitors who have managed to secure higher ranks intermittently.

Notable Products

In January 2025, the CBD/THC 10:1 Lavender Fizz Bath bomb maintained its position as the top-performing product for Noon & Night, despite a notable drop in sales to 178 units. The CBD Bath Fizz Collection Bath Bombs 3-Pack also held steady in second place, continuing its consistent performance from previous months. The CBD Freshly Minted Roll-On remained in third place, showing stability in its ranking. A new entry in the rankings, the CBD:THC 1:1 Eucalyptus Fizz Bath Bomb, secured the fourth position, marking its debut in December 2024. The CBD Shinrin Yoku Fizz Bath Bomb saw a decline in sales, dropping to fifth place, reflecting a downward trend from its higher rank in October 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.