Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

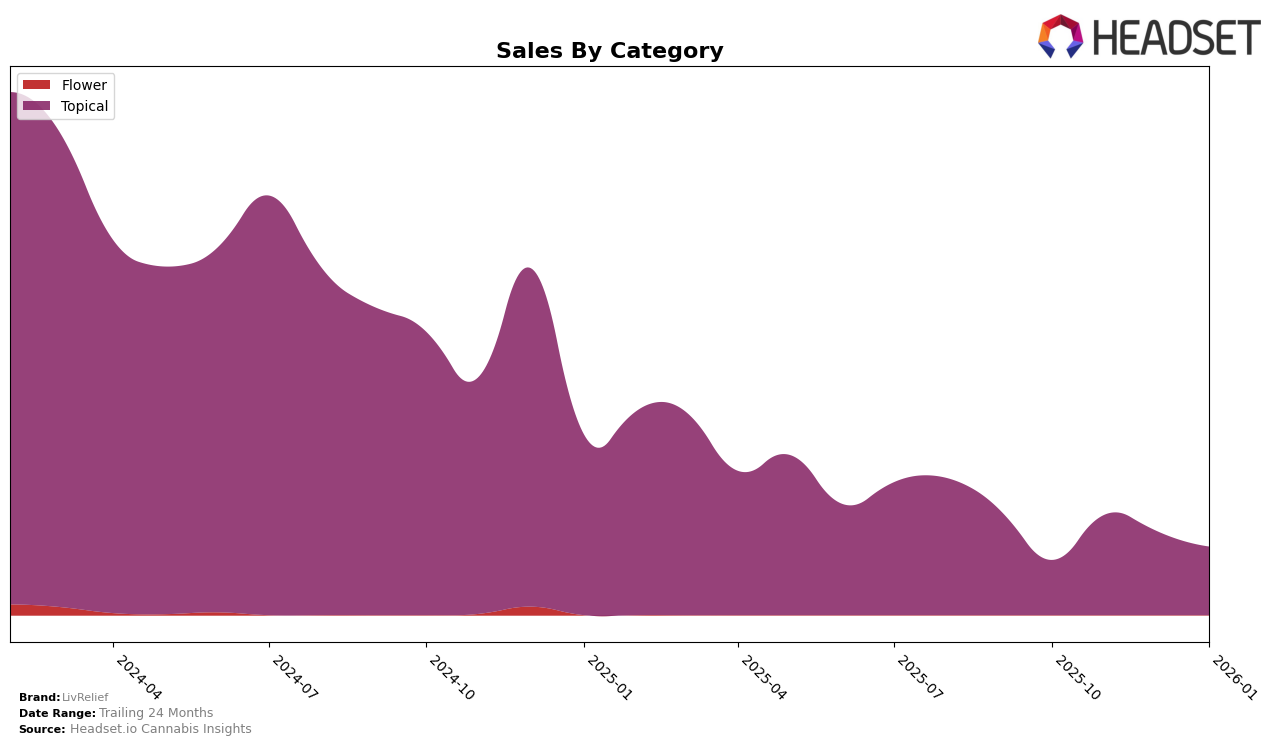

LivRelief has demonstrated a noteworthy performance in the topical category within Ontario. In November 2025, LivRelief secured the 7th position, marking a significant entry into the top 30 brands in this category. This is a considerable achievement given that they were not ranked in October 2025, suggesting a strong upward trajectory in market presence and consumer preference. However, it is important to note that the brand did not maintain its top 30 status in December 2025 and January 2026, indicating potential volatility or increased competition in the market.

The absence of LivRelief from the top 30 rankings in the subsequent months could reflect various market dynamics, such as shifting consumer trends or the introduction of new competitors in the topical category. While this fluctuation might be seen as a setback, it also highlights the challenges and opportunities within the cannabis market in Ontario. Understanding these trends is crucial for stakeholders looking to navigate and capitalize on the evolving landscape. The brief peak in November 2025 suggests that with the right strategies, LivRelief can potentially regain and sustain a competitive position in the future.

Competitive Landscape

In the Ontario topical cannabis market, LivRelief experienced notable fluctuations in its competitive positioning from October 2025 to January 2026. Initially absent from the top 20 in October, LivRelief surged to rank 7 in November, indicating a significant improvement in market presence. However, this upward trajectory was not sustained, as the brand did not maintain a top 20 position in December and January. In contrast, ufeelu consistently held strong rankings, moving from 5th to 4th place in December before dipping to 6th in January, showcasing a robust market performance with sales figures significantly higher than LivRelief's. Meanwhile, Dosecann and RHO Phyto also showed competitive strength, with Dosecann ranking 7th in October and RHO Phyto achieving the same rank in December. These dynamics suggest that while LivRelief has the potential to climb the ranks, maintaining a consistent presence amidst strong competitors remains a challenge.

Notable Products

In January 2026, the top-performing product for LivRelief was the CBD/THC 1:1 Transdermal Cream (125mg CBD, 125mg THC, 50ml) in the Topical category, which achieved the first rank with notable sales of 109 units. This product showed a significant improvement, climbing from fourth place in December 2025. The CBD Transdermal Cream (250mg CBD) maintained a strong position, ranking second, consistent with its performance in November 2025. The CBD Extra Strength Transdermal Cream (750mg CBD) dropped to third place after leading in December 2025. Meanwhile, the CBD Extra Strength Transdermal Cream (1200mg CBD) fell to fourth place, a notable decline from its first-place ranking in November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.