Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

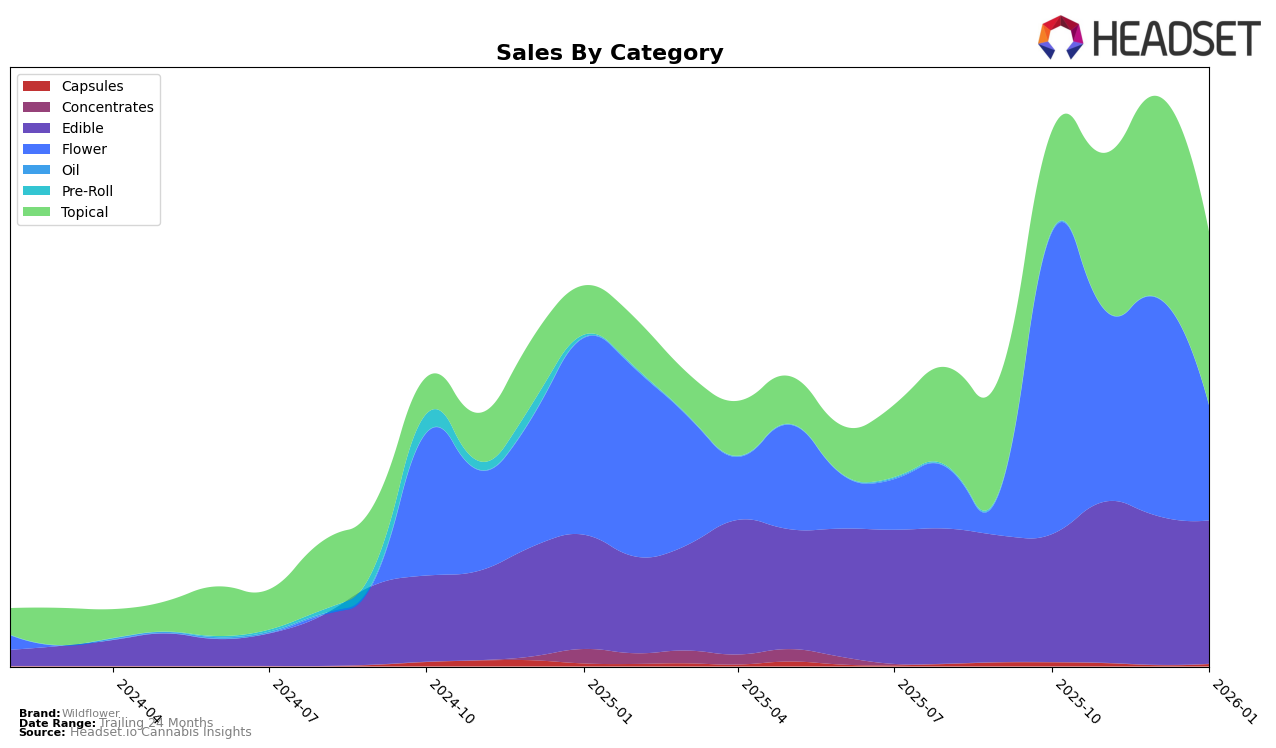

Wildflower's performance in the Edible category shows a varied trajectory across different provinces. In Alberta, the brand has consistently maintained a presence within the top 15, improving from 12th to 10th place from October 2025 to January 2026. However, in British Columbia, Wildflower's presence was less stable, starting outside the top 30 in October and only reaching 24th by December. In Ontario, Wildflower remained steady at the 26th position from November 2025 to January 2026, indicating a plateau in their ranking despite a noticeable increase in sales from October to November.

In the Topical category, Wildflower has shown strong and consistent performance. In Alberta, it has maintained a solid 3rd place ranking from October 2025 through January 2026, with sales peaking in December. Meanwhile, British Columbia saw Wildflower climbing from 5th to 3rd place in December, though it slightly dipped to 4th in January. In Ontario, Wildflower fluctuated between 4th and 6th positions, ultimately securing the 4th spot by January 2026. The Flower category in Maryland tells a different story, with Wildflower dropping from 32nd to 46th over the same period, reflecting a significant decline in sales and market presence.

Competitive Landscape

In the Alberta edible market, Wildflower has shown a steady performance with a slight improvement in rank from 12th in October 2025 to 10th by January 2026. This upward movement suggests a positive reception or strategic adjustments that have resonated with consumers. Despite this progress, Wildflower remains behind competitors like Chowie Wowie and Monjour, who consistently rank higher, indicating stronger market positions. Notably, Chowie Wowie maintained a top 10 position throughout the period, while Monjour also showed resilience, reflecting their robust sales figures. Meanwhile, Emprise Canada experienced a slight decline, falling to 11th in January 2026, which could present an opportunity for Wildflower to capture more market share. Lord Jones consistently ranked lower, suggesting a weaker competitive threat. Overall, Wildflower's gradual rank improvement indicates potential for growth, but capturing a larger market share will require strategic initiatives to outpace dominant competitors.

Notable Products

In January 2026, Wildflower's Sweet Dreams - CBD/CBN/THC 1:1:2 Goji Berry Chews 5-Pack maintained its position as the top-performing product with sales of 11,046 units, continuing its streak from previous months. The CBD/THC 1:1 Extra Strength Relief Stick held steady at the second rank, showing consistent performance since November 2025. New entries in the rankings include Starburst and Dogwalker, both in the Flower category, achieving third and fourth ranks respectively. The CBD Sport Stick, another Topical product, secured the fifth position in January 2026. These rankings indicate a stable preference for Edible and Topical products, with a notable introduction of Flower category items in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.