Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

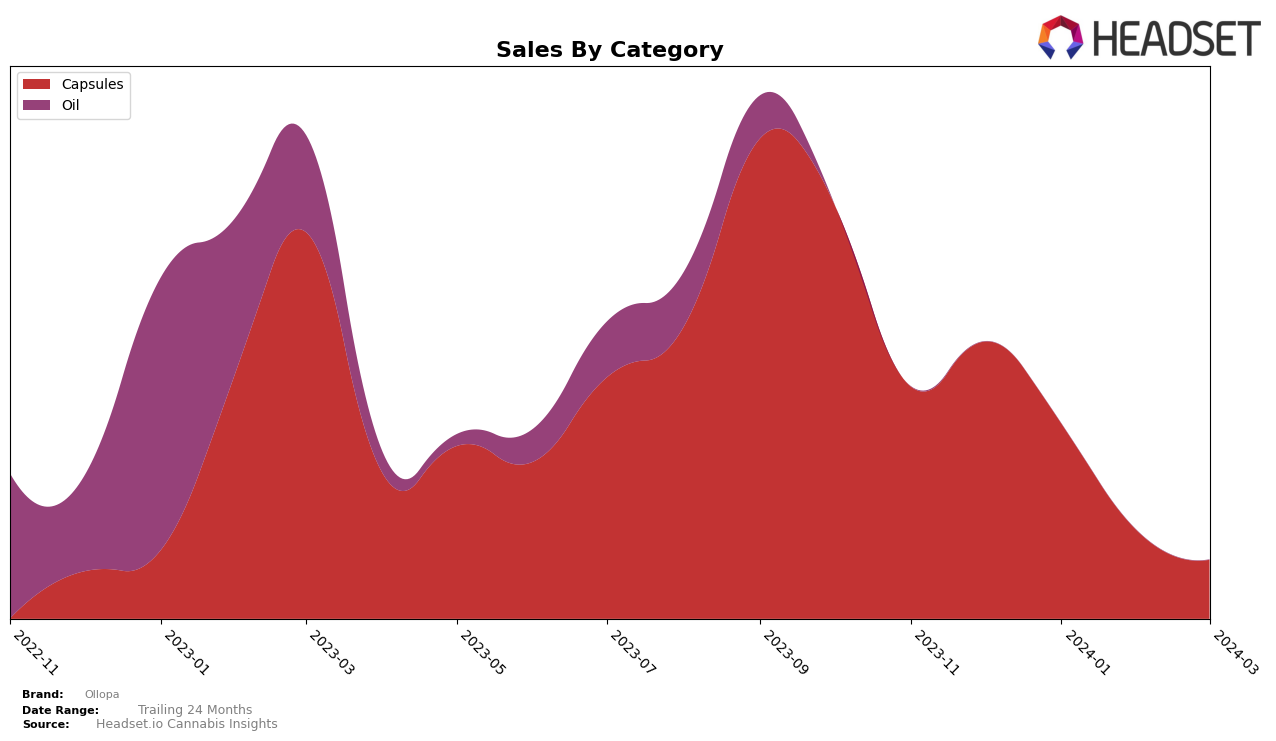

In the capsules category, Ollopa has shown a varied performance across different states and provinces, which indicates a diverse market reception. In Alberta, Ollopa's ranking fluctuated, missing from the top 30 brands in December 2023 and February 2024, but making a notable appearance at rank 21 in January and improving to rank 20 by March 2024. This inconsistency in ranking suggests a volatile market position in Alberta, yet the sales in January and March, with an increase from 315 to 425 units, indicate a positive consumer reception when the brand is ranked. Conversely, in Ontario, Ollopa maintained a consistent presence in the top 30 from December 2023 through March 2024, with rankings slightly dropping from 21 to 24. Despite this steady presence, sales figures tell a story of decline, from 9582 units in December to 1624 in March, highlighting a significant challenge in maintaining consumer interest over time.

The contrasting performance of Ollopa in Alberta and Ontario offers valuable insights into the brand's market dynamics. Alberta presents an opportunity for growth, as evidenced by the sales increase when the brand is ranked, suggesting that with consistent visibility, Ollopa could potentially improve its market share. On the other hand, Ontario, despite the brand's consistent ranking, shows a concerning decrease in sales, hinting at possible saturation or competitive pressures. This differentiation in market response underscores the importance of tailored strategies for each region to bolster Ollopa's overall performance. While the brand shows potential in specific areas, addressing the declining sales trend in Ontario will be crucial for sustained success across categories and states/provinces.

Competitive Landscape

In the competitive landscape of the cannabis capsules category in Ontario, Ollopa has experienced a fluctuating trajectory in terms of rank and sales from December 2023 to March 2024. Initially ranked 21st in December, Ollopa saw a slight improvement in January, maintaining the 21st position, but then experienced a decline, dropping to 24th by March 2024. This decline in rank is mirrored by a significant decrease in sales over the same period. Competitors like Briight and WholeHemp showed more resilience, with Briight initially ranking higher than Ollopa in December and maintaining a lead, despite a drop to 22nd by March. WholeHemp, although not in the top 20 initially, showed substantial sales growth, indicating a potential to challenge Ollopa's position further. Notably, Dr. Well, despite entering the rankings later, has shown impressive growth, reaching the 25th position by March, suggesting a rapidly changing competitive environment that Ollopa must navigate. The data suggests that Ollopa's competitors are not only retaining their positions but in some cases, are on an upward trajectory, highlighting the need for Ollopa to reassess its strategy to maintain or improve its market position in the Ontario cannabis capsules market.

Notable Products

In Mar-2024, Ollopa's top-performing product was Titan 15 Capsules 15-Pack (150mg) within the Capsules category, maintaining its number one rank consistently from Dec-2023 through Mar-2024. This product saw sales figures reaching 123 units in March, showcasing its continued popularity among consumers. There was a noticeable decline in sales from Dec-2023, where it had peaked at 624 units, indicating a downward trend over the months. No other products were mentioned, suggesting a focused analysis on this top-seller. This data highlights the product's strong market presence and consumer preference within Ollopa's product line.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.