Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

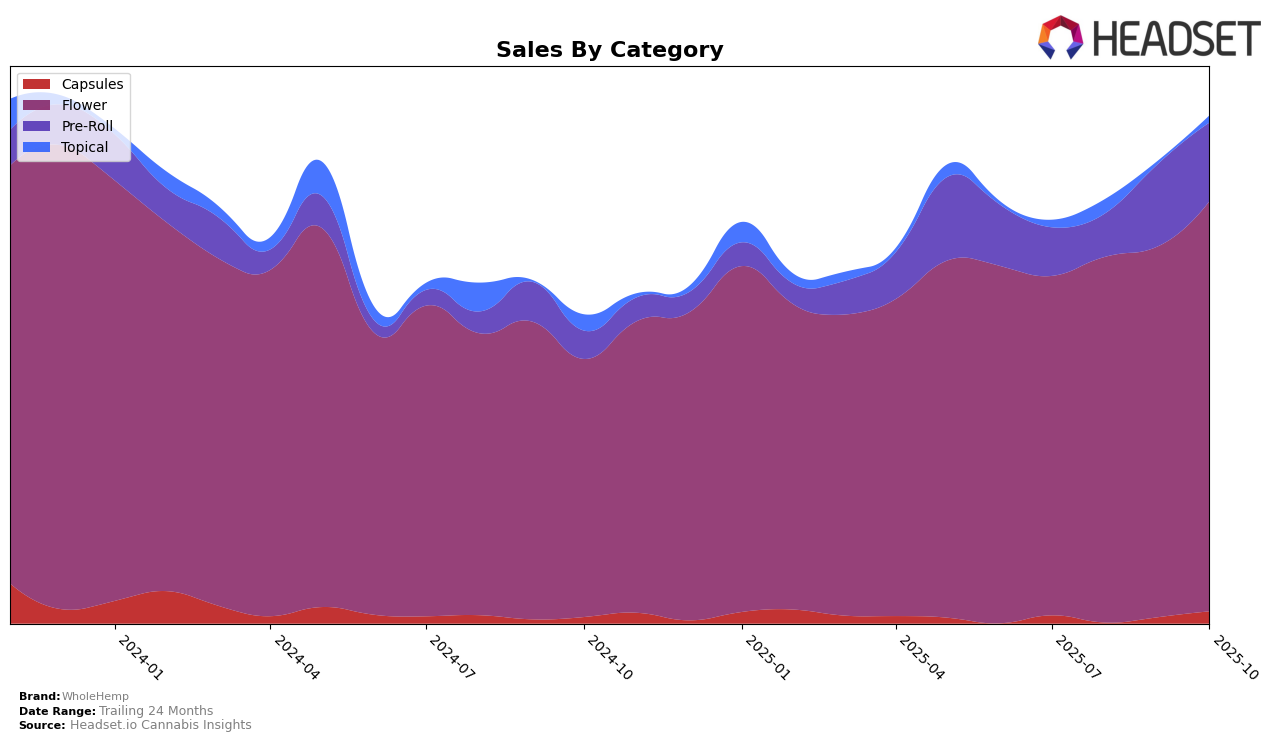

WholeHemp has shown a notable presence in the cannabis market, particularly in the Flower category. However, their performance has been inconsistent across different regions. In Alberta, WholeHemp did not secure a spot in the top 30 brands from July to October 2025, indicating challenges in gaining a foothold in this competitive market. Despite this, their sales figures in Alberta for October reached 14,321, suggesting a potential for growth and increased market penetration if they can improve their ranking and visibility in the coming months.

The absence of WholeHemp in the top 30 rankings across multiple months and categories highlights areas where the brand might need to focus its efforts to enhance its market presence. The lack of ranking data signifies that WholeHemp has yet to establish a strong competitive edge in these regions. The brand's performance across other states and categories would benefit from strategic initiatives aimed at boosting their rankings and expanding their reach, leveraging their sales momentum to break into the top tiers of the market. For a more comprehensive understanding of their market dynamics, examining additional states and categories would be beneficial.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, WholeHemp has faced significant challenges, particularly in terms of maintaining a strong market presence. As of October 2025, WholeHemp's rank has slipped to 99, indicating a struggle to stay within the top 100 brands. This is a notable decline considering competitors like Craftport have also seen fluctuations, dropping from a rank of 80 in September to 98 in October, yet still managing to stay ahead of WholeHemp. Meanwhile, brands such as Weed Me and Thumbs Up Brand have not appeared in the top 20 ranks in recent months, suggesting a broader competitive struggle in the market. However, Greybeard has maintained a consistent presence with a rank of 94 in October, indicating a stable performance compared to WholeHemp. These dynamics suggest that WholeHemp may need to reassess its market strategies to regain its competitive edge and improve its sales trajectory in the Alberta Flower category.

Notable Products

In October 2025, WholeHemp's top-performing product was Premium CBD (3.5g) in the Flower category, maintaining its number one rank from previous months with sales reaching 3046 units. The Premium CBD Pre-Roll 10-Pack (7g) held steady at the second position, showing consistent performance since September. CBD Cherry Blossom Pre-Roll 5-Pack (2g) climbed to the third rank, recovering from a dip in September. CBD Cherry Blossom (3.5g) was ranked fourth, a slight drop from its third position in September. Notably, Premium CBD (14g) debuted at the fifth spot, indicating a strong entry into the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.