Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

In the state of Illinois, the cannabis brand oOYes has demonstrated a noteworthy performance in the Tincture & Sublingual category. While the brand did not appear in the top 30 rankings for the months of October, November, or December 2024, it made a significant leap to secure the 5th position by January 2025. This rapid ascent into the top 5 indicates a strong upward trajectory and suggests that oOYes has likely implemented successful strategies to enhance their market presence. The absence from the rankings in the previous months could be seen as a concern, but the brand's ability to break into the top tier within a few months is indicative of a robust growth strategy and possibly an increase in consumer demand or effective marketing tactics.

Despite the lack of ranking data for the initial months, the available sales figure for October 2024 was $10,282, which provides a baseline for understanding their market entry point. The absence from the top 30 in the subsequent months might have been due to increased competition or a strategic shift in focus, but the eventual high ranking in January 2025 highlights a successful turnaround. The performance of oOYes in this category and state suggests that they have tapped into a growing consumer segment or have improved their product offerings to better meet consumer needs. Further analysis could reveal the specific factors that contributed to their rise, such as product innovation, pricing strategies, or expanded distribution networks.

Competitive Landscape

In the Illinois Tincture & Sublingual category, oOYes has shown a notable entry into the competitive landscape by securing the 5th rank in January 2025, indicating a significant upward trajectory in its market presence. This is particularly impressive considering that oOYes was not in the top 20 brands in the preceding months of October, November, and December 2024. The brand's emergence is set against the backdrop of established competitors like Breez, which maintained a strong position, ranking 3rd in October and 4th in November 2024, and Pure Essentials, which consistently held the 5th rank in October, November, and January. The rise of oOYes suggests a growing consumer interest and potential market disruption, as it competes closely with these well-entrenched brands. This shift in rankings could indicate a change in consumer preferences or effective marketing strategies by oOYes, making it a brand to watch in the coming months.

Notable Products

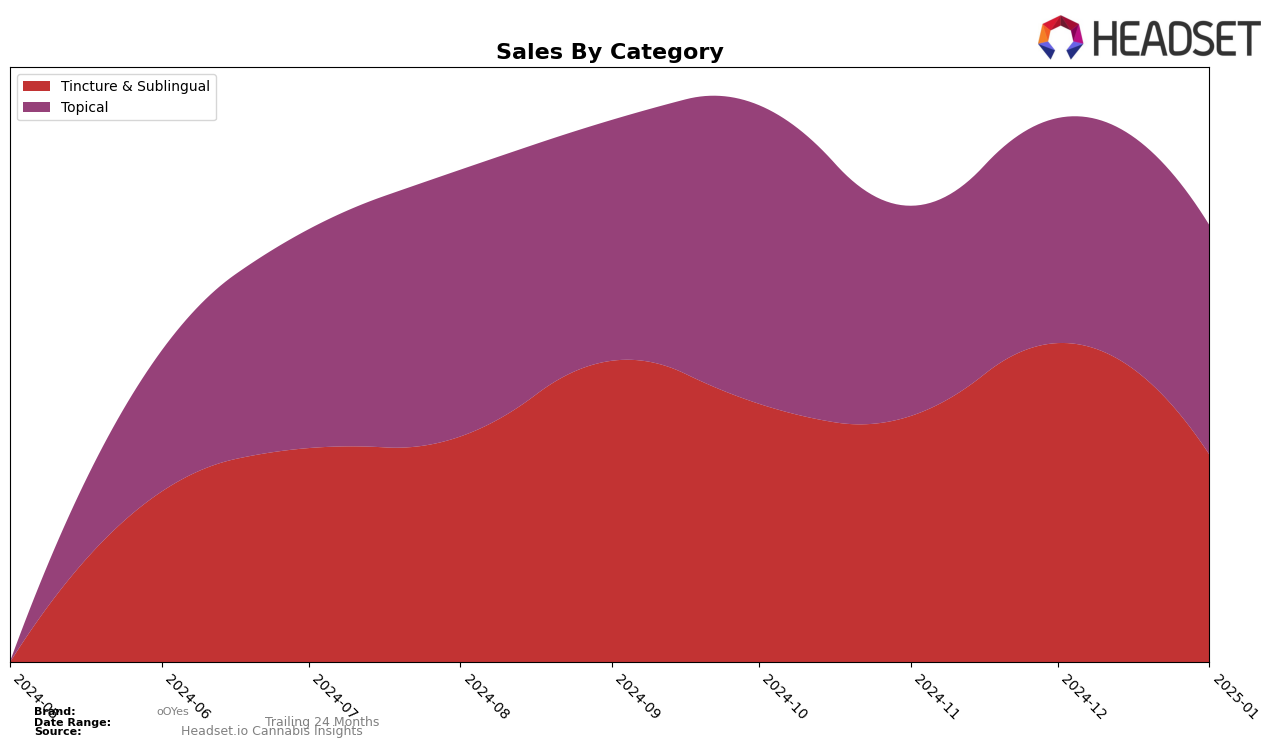

In January 2025, the top-performing product from oOYes was the CBD/CBG 3:2 Going Down Oral Sex Elixir, maintaining its first-place ranking for the fourth consecutive month, with sales reaching 396 units. The CBD/THC 1:1 Roll On Baby Roll Sex Oil continued to hold the second position, although its sales have decreased over the months, with January sales at 196 units. The CBD/CBG 3:2 Roll Baby Roll remained stable in third place, showing a gradual increase in sales from previous months, reaching 162 units in January. These rankings have remained consistent since October 2024, indicating a steady consumer preference for these products. The Tincture & Sublingual category, represented by the top-ranked elixir, continues to outperform the Topical category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.