Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

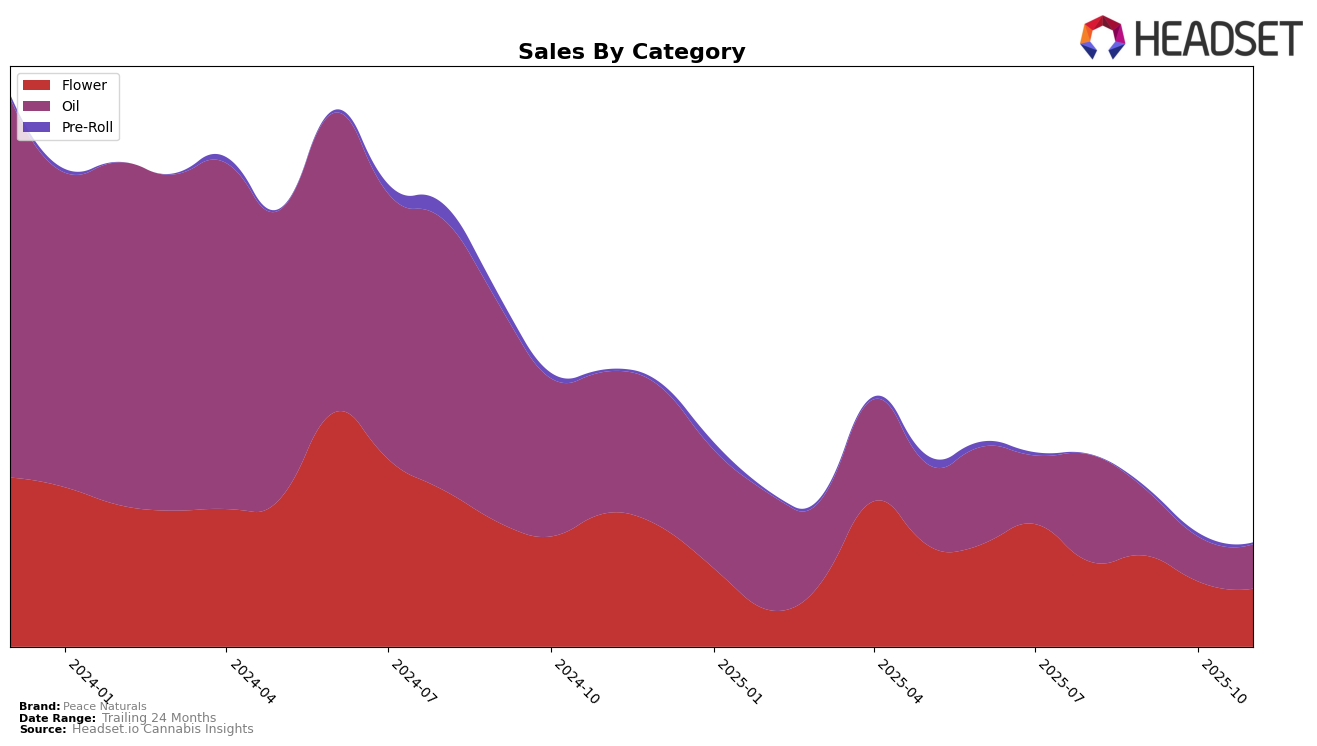

In the province of Ontario, Peace Naturals has shown a significant presence in the Oil category. As of August 2025, they secured the 21st position in the rankings. However, it is notable that in the subsequent months of September, October, and November, Peace Naturals did not appear in the top 30 rankings. This absence could be indicative of a decline in their market share or an increase in competition within the category. The initial ranking suggests that there was a potential for growth, but the lack of data in the following months points to challenges that might have impacted their standing.

The performance of Peace Naturals in the Oil category in Ontario highlights a fluctuating market presence. While their sales in August 2025 were notable, the absence from the top 30 in subsequent months raises questions about their strategic positioning and market dynamics. This trend suggests that while Peace Naturals had a foothold in the market, maintaining a competitive edge might require adjustments in marketing strategies or product offerings. The data indicates that other brands might have gained traction, leading to Peace Naturals' drop in visibility within the rankings.

Competitive Landscape

In the competitive landscape of the Oil category in Ontario, Peace Naturals has faced challenges in maintaining a strong market presence, as evidenced by its absence from the top 20 rankings from September to November 2025. In contrast, brands like Solei and Twd. have consistently held their positions, with Solei maintaining a steady rank of 17th and Twd. fluctuating slightly between 15th and 16th. Notably, Divvy has shown remarkable strength, securing a top 10 position in September and October. The competitive pressure from these brands, particularly those like Divvy with significantly higher sales, highlights the need for Peace Naturals to strategize effectively to regain its footing in the market. Additionally, the emergence of Feather in the rankings in November suggests new entrants are also vying for consumer attention, further intensifying the competitive environment.

Notable Products

In November 2025, Blue Dream (3.5g) maintained its top position among Peace Naturals products, continuing its streak as the number one ranked product since September 2025, despite a sales drop to 259 units. The CBD Peppermint 75 Oil (25ml) held steady at the second rank, showing consistent performance over the past few months. CBD 25 Peppermint Oil (25ml) remained in third place, reflecting stable demand. GMO Cookies Pre-Roll 3-Pack (1.5g) entered the rankings in October and secured the fourth position in November. Notably, Blueberry (3.5g) was absent from the rankings in the last two months after previously holding the fifth position in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.