Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

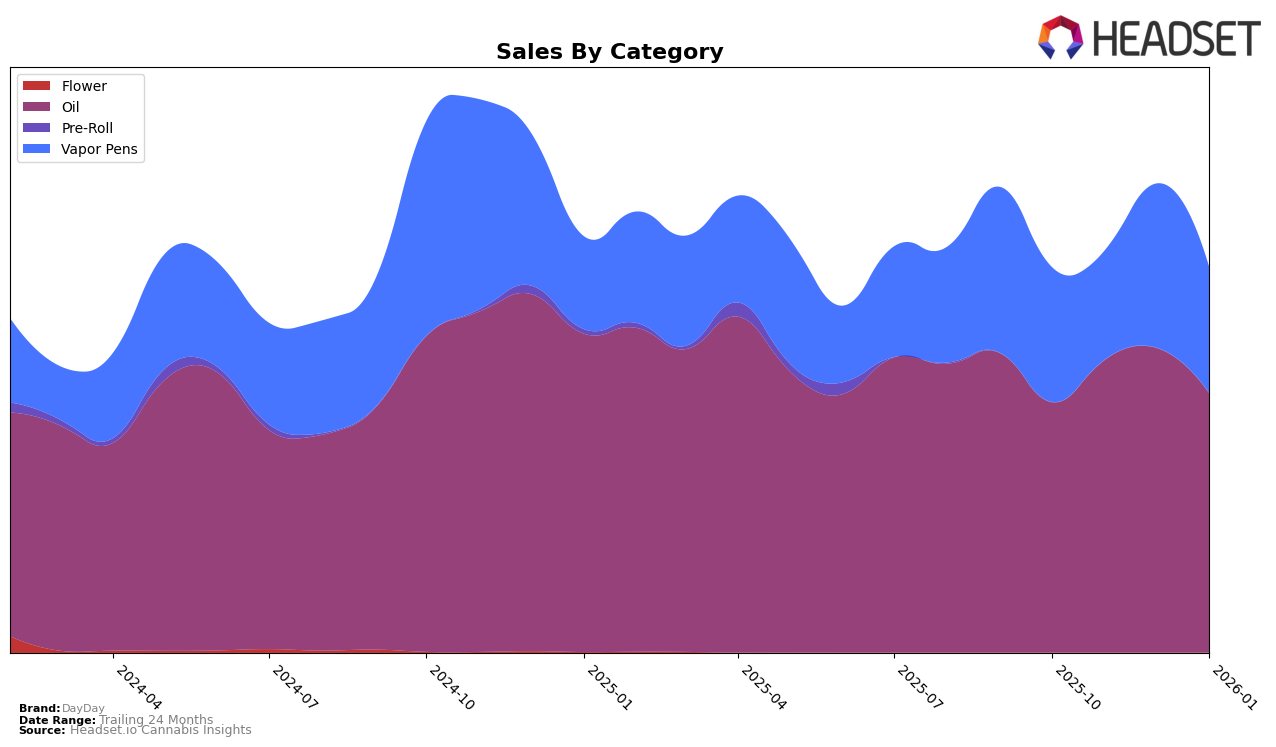

DayDay has shown varied performance across different Canadian provinces and product categories. In the Oil category, DayDay has maintained a steady presence in the top ranks in Alberta, consistently improving from 12th in October 2025 to 10th by January 2026. This upward trend is indicative of a strong market presence and increasing consumer preference. Meanwhile, in British Columbia, DayDay has held a stable position, remaining in the 8th rank for most of the observed months, suggesting a consistent demand. However, in Ontario, DayDay has not moved past the 12th rank in the Oil category, which might indicate a more competitive landscape or a need for strategic adjustments to improve their standing.

In the Vapor Pens category within Ontario, DayDay's performance has been more volatile and less impressive, with rankings fluctuating between 75th and 86th place over the four-month period. This indicates a significant challenge in capturing market share in this category, which contrasts with their relative stability in the Oil category. It's noteworthy that DayDay did not make it to the top 30 in Vapor Pens, highlighting the need for potential strategic reevaluation or innovation in this product line to enhance their competitive edge. These insights into DayDay's performance across categories and regions provide a glimpse into the brand's market dynamics and potential areas for growth.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, DayDay has experienced notable fluctuations in its ranking and sales performance from October 2025 to January 2026. DayDay's rank shifted from 83rd in October to 86th in November, then improved to 75th in December before dropping back to 83rd in January. This volatility in rank is mirrored by its sales performance, which peaked in December with a significant increase, only to decline again in January. Competitors like ufeelu and Electric Lettuce showed more consistent rankings, with ufeelu maintaining a top 80 position throughout the period and Electric Lettuce showing a gradual decline. Meanwhile, Frootyhooty experienced a significant drop in sales and rank, which may have temporarily benefited DayDay's December performance. However, DayDay's inability to sustain this momentum into January suggests potential challenges in maintaining competitive positioning against these brands in the Ontario vapor pen market.

Notable Products

In January 2026, the top-performing product for DayDay was the CBG:CBD 1:1 Full Spectrum Oil (30ml) in the Oil category, maintaining its first-place ranking from previous months with sales of 1671 units. The CBD/CBG/THC Mango Kush Full Spectrum Cartridge (1g) in the Vapor Pens category held steady at second place, despite a slight decrease in sales to 835 units from December 2025. The THC/CBG/CBD 1:1:1 Elev8 Oil (30ml) continued to rank third, although its sales decreased to 110 units. These consistent rankings suggest strong customer loyalty and product satisfaction. The sales figures indicate a slight dip in January for all top products compared to December, possibly due to seasonal variations.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.