Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

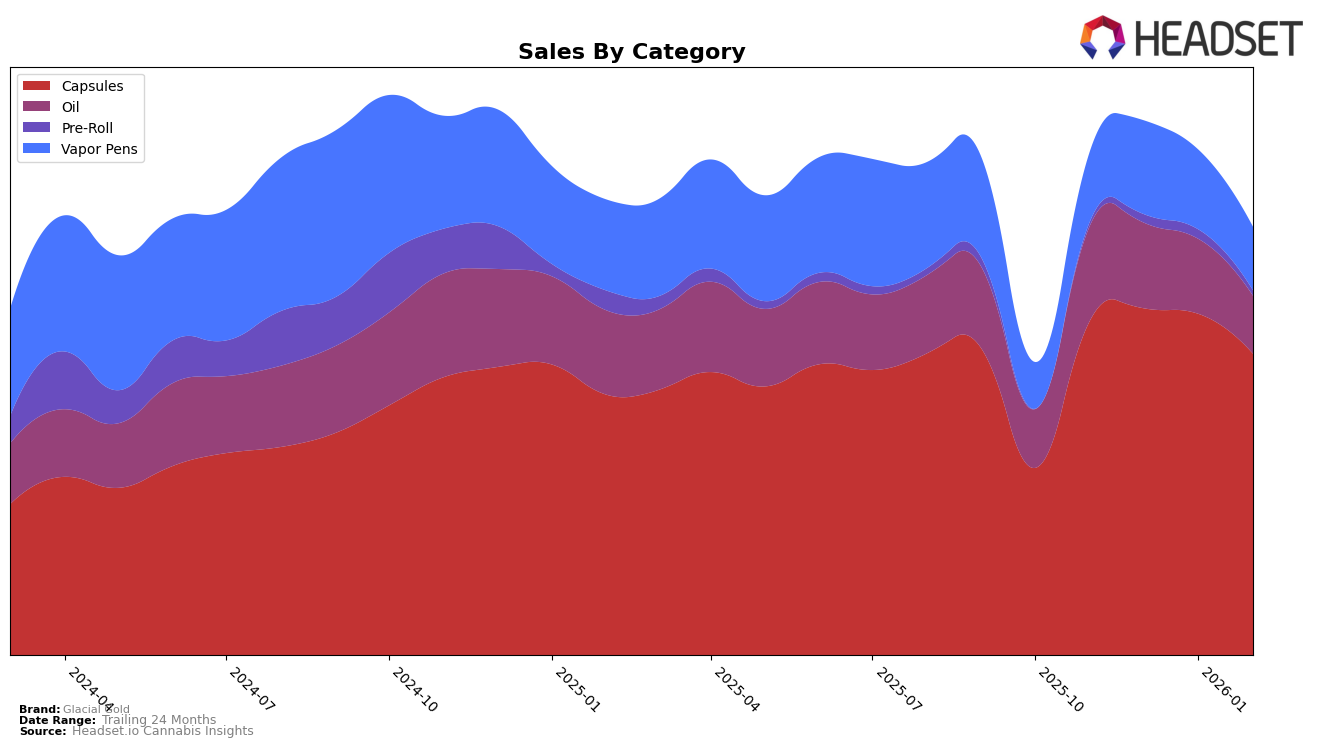

Market Insights Snapshot

Glacial Gold has demonstrated a strong presence in the British Columbia market, particularly in the Capsules and Oil categories, where it has consistently maintained the top spot over the past four months. This dominance is noteworthy, especially considering the slight decline in sales for both categories from January to February, which did not impact its ranking. In contrast, Glacial Gold's performance in the Vapor Pens category in British Columbia shows a different trajectory, with a drop from the 23rd position in December to 32nd in February, indicating a potential area for improvement.

In Alberta, Glacial Gold holds a steady second place in the Capsules category, although there is a noticeable dip in sales from January to February. The Vapor Pens category in Alberta tells a different story, as Glacial Gold did not make it into the top 30 in January and February, suggesting a significant gap in market presence compared to its strong performance in Capsules. Meanwhile, in Ontario, Glacial Gold maintains a solid position in Capsules, ranking third consistently, while its Oil category holds steady at fifth. However, its Vapor Pens performance remains on the cusp of the top 50, indicating room for growth. Notably, in Saskatchewan, Glacial Gold has achieved a remarkable first rank in the Capsules category, suggesting a strong entry into this market.

Competitive Landscape

In the competitive landscape of cannabis capsules in British Columbia, Glacial Gold has consistently maintained its top position from November 2025 through February 2026, demonstrating a strong market presence and consumer preference. Despite a slight decline in sales from January to February 2026, Glacial Gold's dominance remains unchallenged, with its closest competitors, Indiva and Emprise Canada, consistently ranking second and third, respectively. Notably, the sales figures for these competitors are significantly lower, highlighting Glacial Gold's substantial lead in the market. This consistent ranking suggests a robust brand loyalty and effective market strategies that keep Glacial Gold ahead of its competitors in the British Columbia capsules category.

Notable Products

In February 2026, the top-performing product for Glacial Gold was THC Softgels 100-Pack (1000mg), consistently holding the number one rank with sales reaching 6889 units. Following closely, the CBD/THC 1:1 Balanced Softgel 50-Pack (500mg CBD, 500mg THC) maintained its position at rank two, showing a slight decrease in sales compared to January 2026. The THC 10 Softgels 50-Pack (500mg) moved up to rank three, despite a dip in sales from the previous month. THC 10 Softgels 10-Pack (100mg) dropped to fourth place, experiencing a notable decline in sales figures. The CBD/THC 1:1 Balanced Softgel 100-Pack (1000mg CBD, 1000mg THC) remained steady at fifth place, continuing its downward trend in sales since November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.