Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

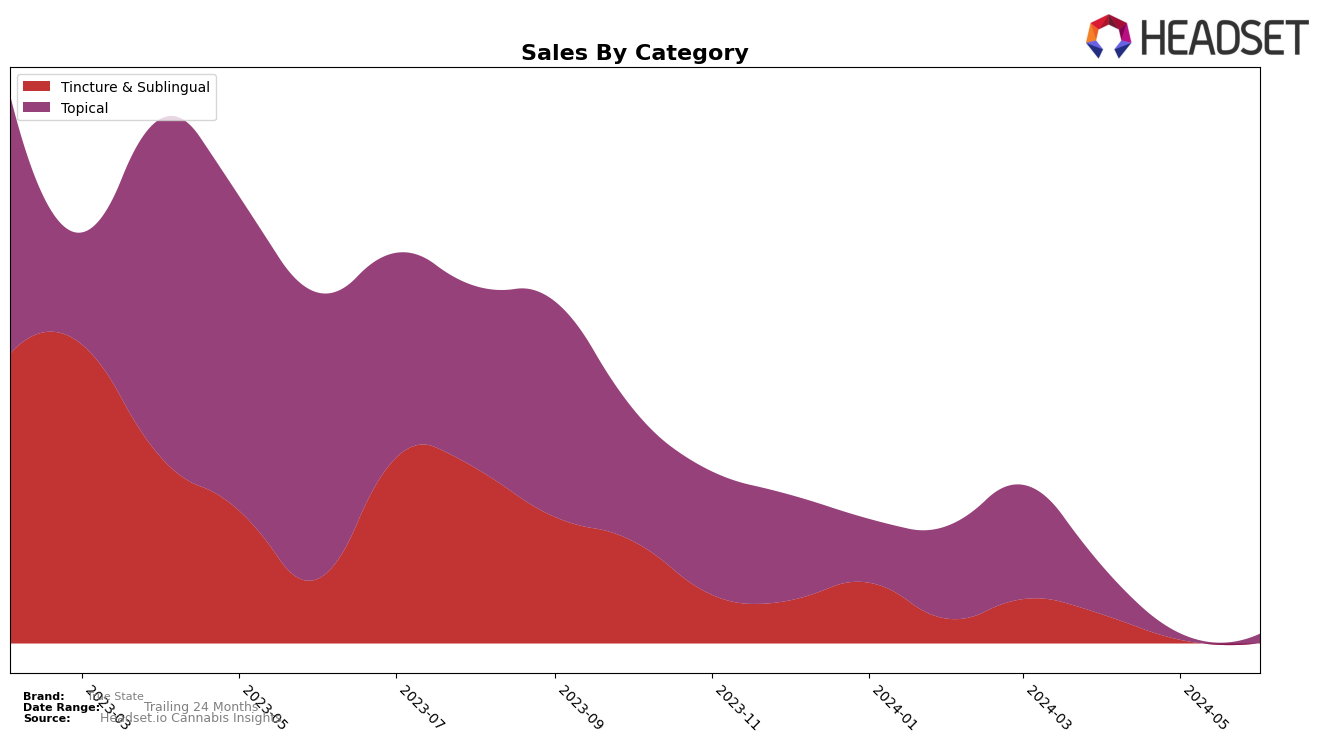

True State has shown a notable performance in the Topical category within Missouri. In March 2024, the brand secured the 8th position, reflecting a strong presence in this category. However, the absence of rankings for the subsequent months (April, May, and June) suggests that True State did not maintain its position within the top 30 brands in Missouri's Topical category. This decline could indicate increased competition or a shift in consumer preferences, which may require strategic adjustments from the brand to regain its standing.

The fluctuating performance of True State across various states and categories highlights the dynamic nature of the cannabis market. While the brand demonstrated a strong start in Missouri, the lack of consistent ranking in the following months could be seen as a concern. It is essential for True State to analyze these trends and identify the underlying factors contributing to their market position. By doing so, they can develop targeted strategies to enhance their competitiveness and ensure sustained growth in the highly competitive cannabis industry.

Competitive Landscape

In the Missouri Topical category, True State experienced notable fluctuations in its competitive standing. In March 2024, True State ranked 8th, but it fell out of the top 20 in subsequent months, indicating a significant drop in market presence. In contrast, Pharma Girl Cannabis World maintained a strong and consistent performance, holding the 7th rank in March and April, climbing to 6th in May, and then returning to 7th in June. This consistent ranking suggests a stable customer base and effective marketing strategies. Meanwhile, Drool re-entered the top 20 in June, securing the 8th rank, which could indicate a resurgence or successful promotional efforts. These dynamics highlight the competitive pressures True State faces and underscore the need for strategic adjustments to regain and sustain market share in the Missouri Topical category.

Notable Products

In June 2024, True State's top-performing product was the Topical Balm (250mg THC, 2oz), maintaining its leading position for four consecutive months with sales of 54 units. The Medical Tincture (600mg THC, 30ml) rose to the second spot from its consistent third-place ranking in previous months, showing an increase in popularity. Notably, the Liquid Tincture (250mg THC, 30ml) was not ranked in June after holding the second position earlier. Similarly, the Liquid Tincture (600mg THC, 30ml) also dropped out of the rankings after being second in May. This shift highlights a potential change in consumer preference towards the Medical Tincture category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.