Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

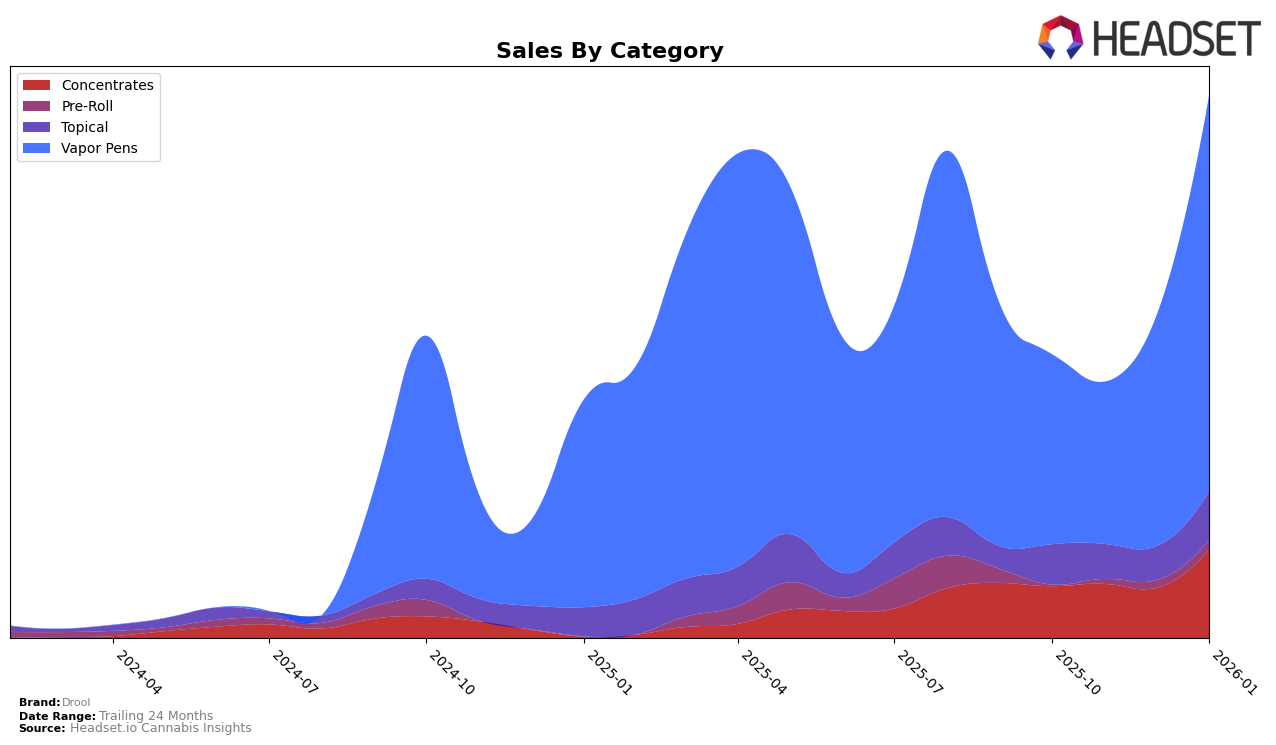

Drool's performance across various categories and states shows notable trends and movements. In Missouri, Drool has maintained a strong position in the Topical category, consistently holding ranks 5 and 4 from October 2025 to January 2026. This indicates a stable demand and possibly a loyal customer base for their topical products. However, their performance in the Vapor Pens category in Colorado is less prominent, as they did not make it into the top 30 brands. This could suggest limited market penetration or strong competition in that region. Meanwhile, in New Jersey, Drool's Vapor Pens made a significant leap from rank 52 in November 2025 to 23 by January 2026, reflecting a strong upward trend and possibly an increase in consumer interest or improved distribution strategies.

In New Jersey, Drool's performance in the Concentrates category also shows positive momentum, climbing from rank 24 in December 2025 to 16 by January 2026. This upward movement might be indicative of successful marketing efforts or product innovations resonating well with consumers. On the other hand, their absence from the top 30 in the Topical category in December 2025, despite being ranked 6 and 5 in the preceding months, suggests potential challenges such as supply chain issues or increased competition. Nevertheless, the rebound to rank 4 in January 2026 hints at a recovery or effective strategic adjustments. These dynamics across states and categories highlight both the strengths and areas for potential growth for the Drool brand.

Competitive Landscape

In the competitive landscape of Vapor Pens in New Jersey, Drool has demonstrated a significant upward trajectory in rank and sales from October 2025 to January 2026. Initially ranked 43rd in October, Drool's position improved to 23rd by January, showcasing a notable climb despite a dip in November where it ranked 52nd. This improvement is mirrored in its sales, which surged from $89,408 in October to $249,958 in January. In contrast, Black Label Brand also improved its rank from 47th to 24th, but its sales, although increasing, remained lower than Drool's in January. Meanwhile, (the) Essence and Another State maintained stronger positions throughout, with both brands consistently ranking higher than Drool, though the gap narrowed by January. JoyStick remained a strong competitor, consistently ranking in the top 22, although its sales showed a declining trend. Drool's rapid ascent in both rank and sales suggests a growing market presence and consumer preference, positioning it as a formidable competitor in the New Jersey Vapor Pens category.

Notable Products

In January 2026, the top-performing product from Drool was the Hybrid RSO Syringe (1g) in the Concentrates category, maintaining its number one rank for four consecutive months with a notable sales figure of 2139. The Strawberry Cough Live Resin Disposable (1g) in the Vapor Pens category debuted at the second position, reflecting a strong market entry. Alaskan TF Liquid Diamonds Disposable (1g) also saw an impressive rise, moving from fourth to third place with increased sales. The Girl Scout Cookies Live Resin Disposable (1g) saw a drop to fourth place from its previous second position in December 2025. Meanwhile, the CBD/CBG/THC 1:1:1 Recovery Stick Balm (500mg CBD, 500mg CBG, 500mg THC) in the Topical category entered the rankings at fifth place, indicating a growing interest in topical products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.