Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

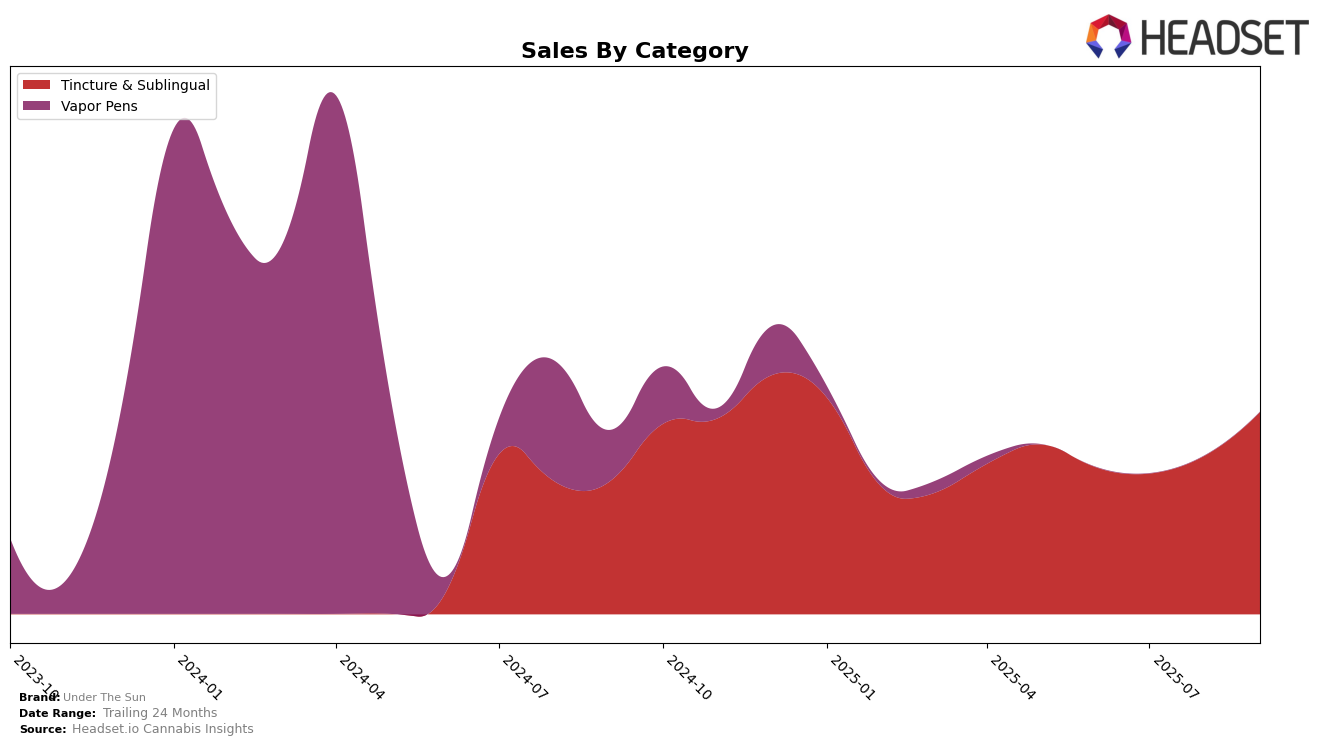

In the province of Alberta, Under The Sun has demonstrated a significant upward trajectory in the Tincture & Sublingual category. By September 2025, the brand achieved the top position, marking a notable entrance into the rankings as they were not in the top 30 in the preceding months. This rise to prominence suggests a strategic shift or successful marketing campaign that has resonated well with consumers in Alberta. The brand's ability to capture the number one spot indicates strong consumer demand and effective brand positioning in a competitive market.

Across other states and categories, Under The Sun's presence is less pronounced, as they did not make it into the top 30 rankings in any other tracked regions or product categories during the same period. This absence could imply either a focused strategy on Alberta's Tincture & Sublingual market or challenges in other markets that have yet to be addressed. The lack of presence in other rankings might also highlight potential areas for growth or diversification that the brand could explore to bolster its market share beyond Alberta.

Competitive Landscape

In the Alberta Tincture & Sublingual category, Under The Sun has demonstrated a remarkable surge in market presence, achieving the top rank in September 2025. This ascent is particularly notable given that Under The Sun was not ranked in the top 20 in the preceding months, indicating a significant strategic shift or successful campaign that propelled them to the forefront. In contrast, Kin Slips, a consistent performer in the market, maintained its position at rank 2 in both June and July 2025 but did not appear in the top 20 in August and September, suggesting a potential decline or market shift that Under The Sun capitalized on. This dynamic change highlights Under The Sun's effective market strategy and adaptability, positioning them as a formidable competitor in Alberta's Tincture & Sublingual segment.

Notable Products

In September 2025, Under The Sun's top-performing product was CBD Pure Tincture (5000mg CBD, 30ml) in the Tincture & Sublingual category, maintaining its number one rank for four consecutive months. This product achieved notable sales of 271 units, showing a significant increase from previous months. The consistent top ranking highlights its strong market presence and customer preference. Compared to earlier months, the sales figures for this product have steadily increased, indicating growing consumer demand. Overall, CBD Pure Tincture's performance has been exceptionally stable and dominant in its category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.