Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

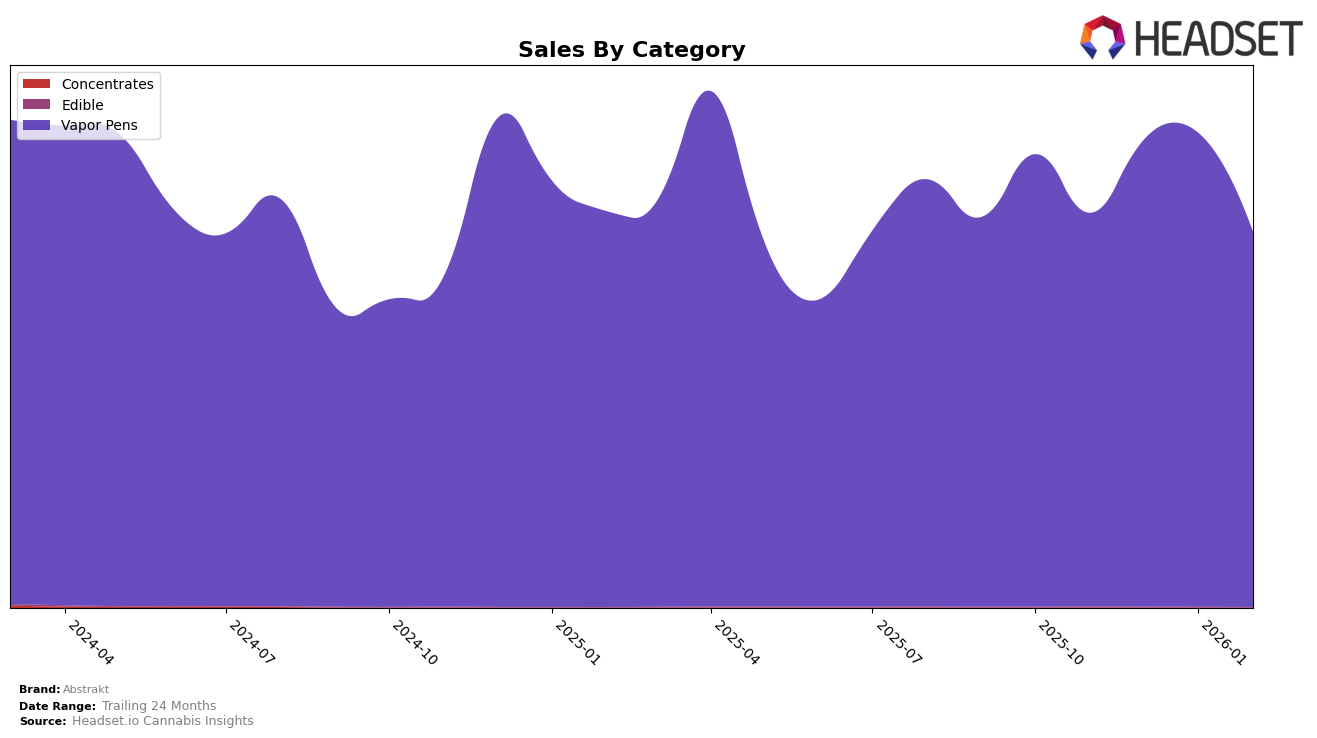

Abstrakt has demonstrated a consistent presence in the Vapor Pens category in Arizona, holding a steady rank of 4th place from November 2025 through January 2026. However, February 2026 saw a slight dip to 5th place. This movement indicates that while Abstrakt remains a strong contender in this category, there is some competitive pressure. The sales volume reflects this trend, with a noticeable decrease from January to February, suggesting that while they maintain a high ranking, there may be challenges in sustaining growth or market share in the short term.

Interestingly, Abstrakt's absence from the top 30 in other states and categories raises questions about its strategic focus and market penetration outside of Arizona. This could be seen as a limitation in their current market strategy or an opportunity for future expansion. The consistency in Arizona suggests a strong brand presence locally, but the lack of rankings elsewhere might imply untapped potential or areas needing strategic development. This data highlights the importance of regional strategies and the potential benefits of diversifying into other markets or categories.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, Abstrakt has demonstrated notable resilience and adaptability, maintaining a consistent presence in the top ranks. Despite a slight dip from 4th to 5th place in February 2026, Abstrakt's sales trajectory shows a robust performance, particularly with a peak in December 2025. This fluctuation in rank can be attributed to the dynamic movements of competitors such as Timeless, which improved its position from 6th to 4th, and Dime Industries, which consistently held strong in the 2nd and 3rd positions. Meanwhile, STIIIZY and Jeeter have shown fluctuations that suggest a competitive but volatile market. Abstrakt's ability to sustain high sales figures amidst these shifts highlights its competitive edge and potential for strategic growth in the Arizona vapor pen market.

Notable Products

In February 2026, the top-performing product for Abstrakt was Martian Piss Liquid Diamond Disposable (1g) in the Vapor Pens category, maintaining its position at rank 1 since November 2025, despite a sales dip to 10,000 units. Blue Cacti Liquid Diamond Disposable (1g) held steady at rank 2 for the third consecutive month, showing consistent demand. Bandit - Gelatti Liquid Diamond Disposable (1g) also maintained its rank at 3, reflecting stable sales performance. High Octane Liquid Diamond Disposable (1g) improved its ranking to 4 from 5 in January 2026, indicating a positive trend. Raspberry Lemonade Liquid Diamonds Disposable (1g) experienced a slight decline, moving from rank 4 in January to rank 5 in February 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.