Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

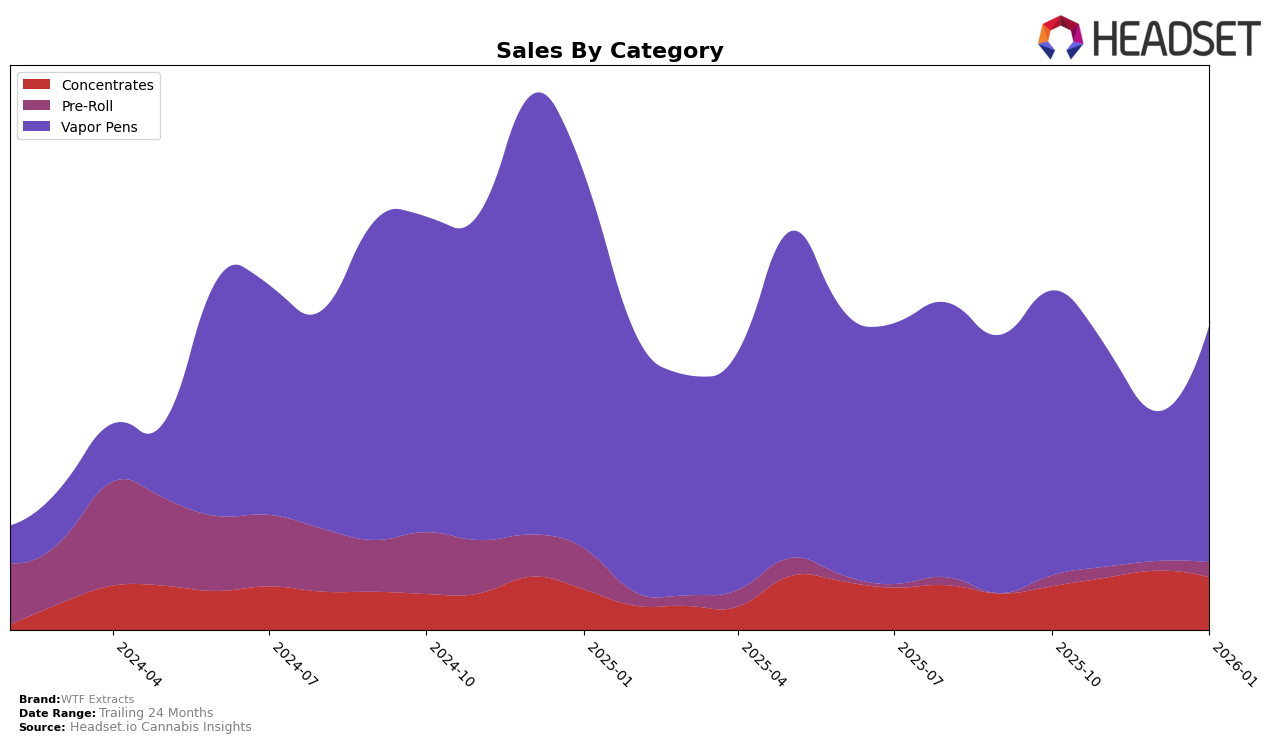

WTF Extracts has shown a consistent performance in the Arizona market, particularly in the Concentrates category. The brand maintained a strong position, ranking third in October, November, and January, with a slight dip to fourth place in December. This stability in ranking suggests a solid consumer base and effective market strategies in this category. In contrast, the Pre-Roll category saw some fluctuations, with the brand moving from 20th in October and November to 21st in December, before climbing to 18th in January. This upward movement in January could indicate a positive response to recent marketing efforts or product improvements.

In the Vapor Pens category, WTF Extracts exhibited a mixed performance. The brand started strong with a seventh-place ranking in October, slipped to eighth in November and December, and then regained its seventh-place position in January. This pattern suggests some challenges in maintaining consistent consumer interest or competition dynamics within the category. Notably, despite these fluctuations, the brand's sales in Vapor Pens experienced a significant rebound in January, which could be a result of strategic adjustments or seasonal demand changes. While these insights offer a glimpse into WTF Extracts' market dynamics, further exploration into their strategies and consumer engagement could provide a deeper understanding of their performance.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, WTF Extracts experienced fluctuating rankings from October 2025 to January 2026, indicating a dynamic market presence. Despite a dip in sales in November and December 2025, WTF Extracts managed to regain its 7th position by January 2026, showcasing resilience and potential for growth. Competitors like STIIIZY and Timeless consistently maintained higher ranks, with STIIIZY holding a steady 5th position in January 2026, reflecting strong brand loyalty and market penetration. Meanwhile, Jeeter and Session Premium Cannabis (AZ) showed varied performance, with Jeeter slightly outperforming WTF Extracts in certain months. These insights suggest that while WTF Extracts faces stiff competition, its ability to bounce back in rankings highlights potential areas for strategic marketing and product innovation to capture more market share.

Notable Products

In January 2026, the top-performing product for WTF Extracts was the Marshmallow Cured Resin Badder (1g) in the Concentrates category, which ascended to the number one rank from its previous second position in November 2025, with notable sales of 2,215 units. The Blue Dream Distillate Cartridge (1g) in the Vapor Pens category secured the second rank, marking its debut on the rankings. Following closely was the Strawnana Distillate Cartridge (1g), also in Vapor Pens, which achieved the third rank. The Coma Toma Diamond Infused Pre-Roll (0.5g) and the Triple OG Distillate Disposable (1g) rounded out the top five, ranking fourth and fifth respectively. This month marked the first appearance in the rankings for these Vapor Pens and Pre-Roll products, indicating a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.