Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

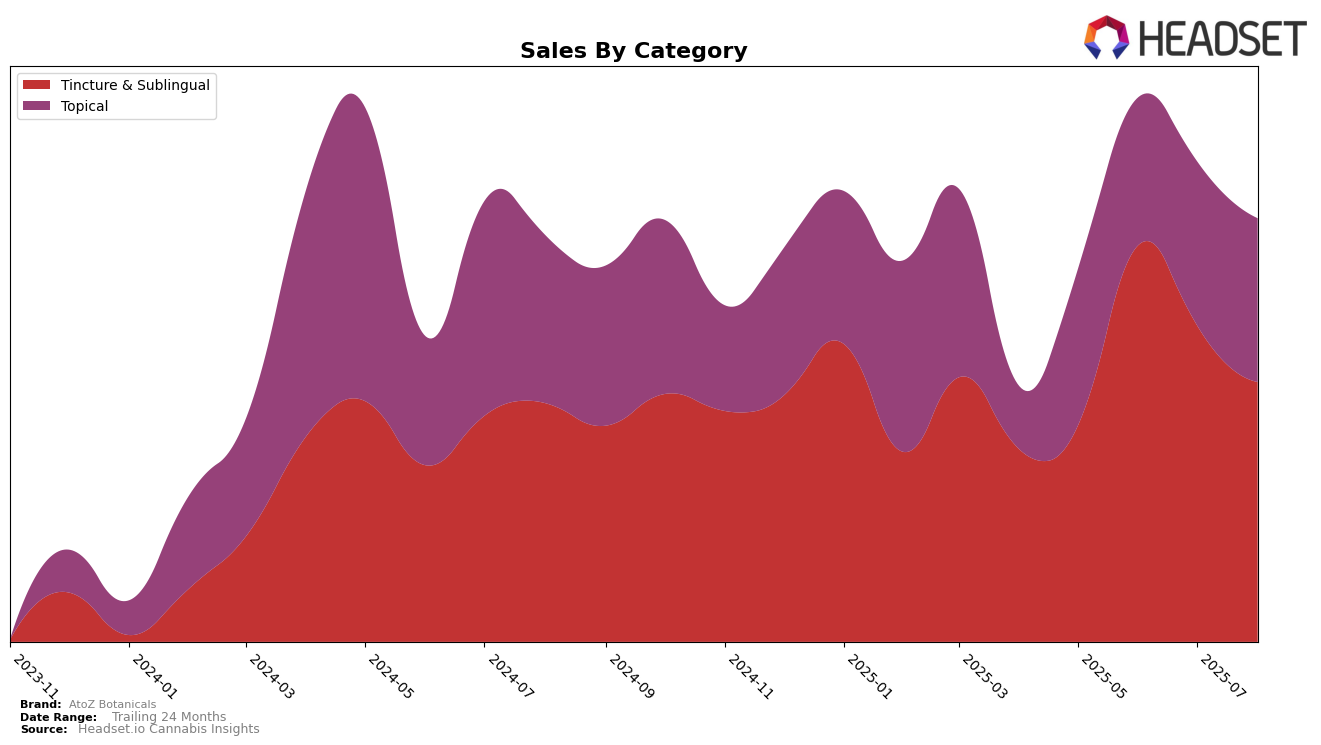

AtoZ Botanicals has shown notable performance in the Tincture & Sublingual category in Arizona. In June 2025, the brand achieved a significant breakthrough by entering the top 5, securing the 4th position. This is a considerable improvement from the previous months where they were not ranked in the top 30, indicating a strong upward trajectory in this particular market. The absence of rankings in May and the months following June suggests that while the brand had a moment of strong performance, maintaining a consistent presence in the top tier remains a challenge. This fluctuation highlights the competitive nature of the market and the potential for growth if AtoZ Botanicals can sustain their momentum.

Despite the promising performance in Arizona, AtoZ Botanicals did not make it into the top 30 rankings in other states or categories during this period. This lack of presence in other markets suggests that the brand's influence is currently concentrated in a specific niche and geographic area. The data indicates a potential opportunity for AtoZ Botanicals to expand their reach and diversify their product offerings to capture a larger share of the market. By analyzing the factors that contributed to their success in Arizona, the brand could strategize to replicate this success in other regions and categories.

Competitive Landscape

In the competitive landscape of Tincture & Sublingual products in Arizona, AtoZ Botanicals has demonstrated a fluctuating presence, notably securing the 4th position in June 2025. This indicates a strong competitive edge, especially when compared to brands like VET CBD, which maintained a consistent 4th rank in May and July, and Tru Infusion, which climbed to the 3rd position in July. Despite AtoZ Botanicals' absence from the top 20 in May, July, and August, its brief appearance in June suggests potential for growth and market penetration. The sales figures for AtoZ Botanicals in June were lower than those of its competitors, indicating room for improvement in sales strategies to capitalize on its ranking momentum. As the market evolves, AtoZ Botanicals' ability to sustain and improve its rank amidst strong competitors will be crucial for long-term success in the Arizona Tincture & Sublingual category.

Notable Products

In August 2025, the top-performing product for AtoZ Botanicals was the Ultra Pain Relief Rub (1000mg CBD, 4oz) in the Topical category, maintaining its number one position from July with sales reaching 66 units. The CBD Tangerine Mood Boost Tincture (1400mg CBD) climbed to second place, showing a slight decrease in sales from the previous month. The CBD Dog Drops Tincture (500mg CBD) saw a drop from its consistent first-place ranking in June and July to third place in August, with a notable decrease in sales. The Ultra Pain Relief Roll On (1000mg CBD, 1oz) held steady at fourth place across the months, while the CBD Tangerine Optimum Relief Tincture (4400mg CBD) remained in fifth place, showing a consistent decline in sales since June. These rankings highlight a strong performance in the Topical category and a shift in consumer preference towards specific tincture products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.