Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

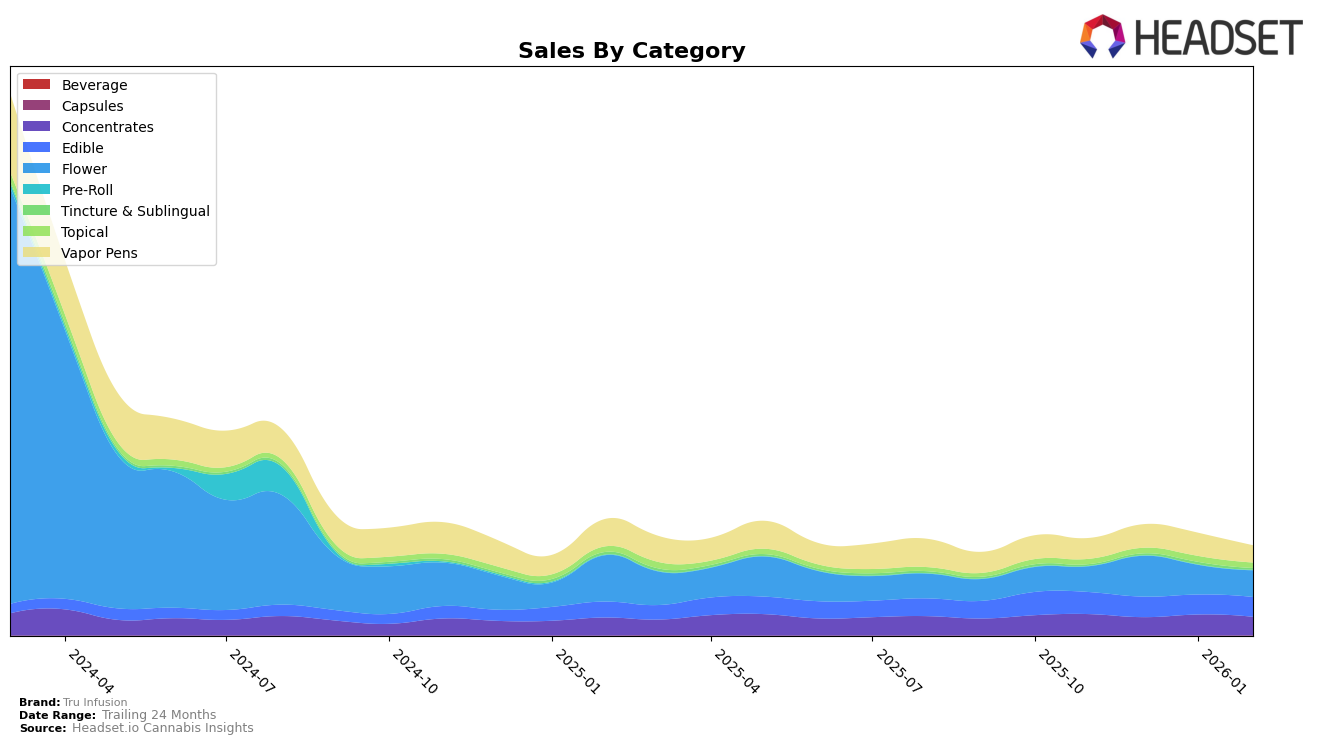

Tru Infusion's performance in Arizona showcases some notable shifts across various product categories. In the Concentrates category, the brand maintained a strong presence, consistently ranking around the 10th position, albeit with a slight dip to 11th in February 2026. This stability contrasts with their performance in the Edible category, where Tru Infusion experienced a gradual decline from 16th to 18th over the same period. Interestingly, the Flower category saw fluctuating ranks, with a notable improvement in December 2025, jumping to 29th, before returning to 34th by February 2026. This variance indicates a competitive landscape where Tru Infusion's position is subject to change. Meanwhile, the Tincture & Sublingual category saw Tru Infusion enter the top rankings in January 2026, securing the 4th position, which highlights a strong entry into this market segment.

In the Topical category, Tru Infusion experienced a slight decline from 3rd to 7th place between November 2025 and February 2026, suggesting increased competition or changing consumer preferences in the Arizona market. Vapor Pens showed a positive trajectory, moving from 30th to 26th in January 2026, before slipping slightly to 28th in February. This indicates a growing interest and possibly an expanding market share in this category. The sales figures reveal that while there were fluctuations in rankings, Tru Infusion managed to maintain a stable sales performance, particularly in the Concentrates and Edible categories. However, the absence of rankings in certain months for some categories suggests areas where Tru Infusion could focus on improving its market presence to secure a more consistent top 30 position.

Competitive Landscape

In the competitive landscape of the flower category in Arizona, Tru Infusion experienced fluctuating rankings from November 2025 to February 2026, maintaining a relatively stable presence around the 30s in rank. Notably, Tru Infusion's rank improved from 34th in November 2025 to 29th in December 2025, which coincided with a significant increase in sales. However, the brand faced challenges in maintaining this momentum, as evidenced by its drop back to 34th by February 2026. In contrast, Seed Junky Genetics showed a consistent upward trend, climbing from 48th to 33rd, indicating a strong growth trajectory that could pose a competitive threat. Meanwhile, Vortex Cannabis Inc. and Smoken Promises displayed volatile rankings, with Vortex Cannabis Inc. ending February 2026 at 31st, slightly ahead of Tru Infusion. The competitive dynamics suggest that while Tru Infusion has a stable market presence, it faces pressure from brands like Seed Junky Genetics that are rapidly gaining market share.

Notable Products

In February 2026, Tru Infusion's top-performing product was the Sativa Pink Lemonade Gummies 10-Pack, regaining its number one position from November and December after briefly dropping to second place in January. The Indica Watermelon Rosin Gummies 10-Pack, which led in January, ranked second in February with sales close to its January figures. Indica Blueberry Gummies maintained a consistent third-place ranking across the months, showing stable performance. The Sativa Strawberry Kiwi Gummies held steady in fourth place, while the CBN/THC 1:1 Mango Gummies re-entered the rankings at fifth place after being unranked in December and January. Notably, the Sativa Pink Lemonade Gummies achieved sales of 2264 units in February, indicating a strong recovery from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.