Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

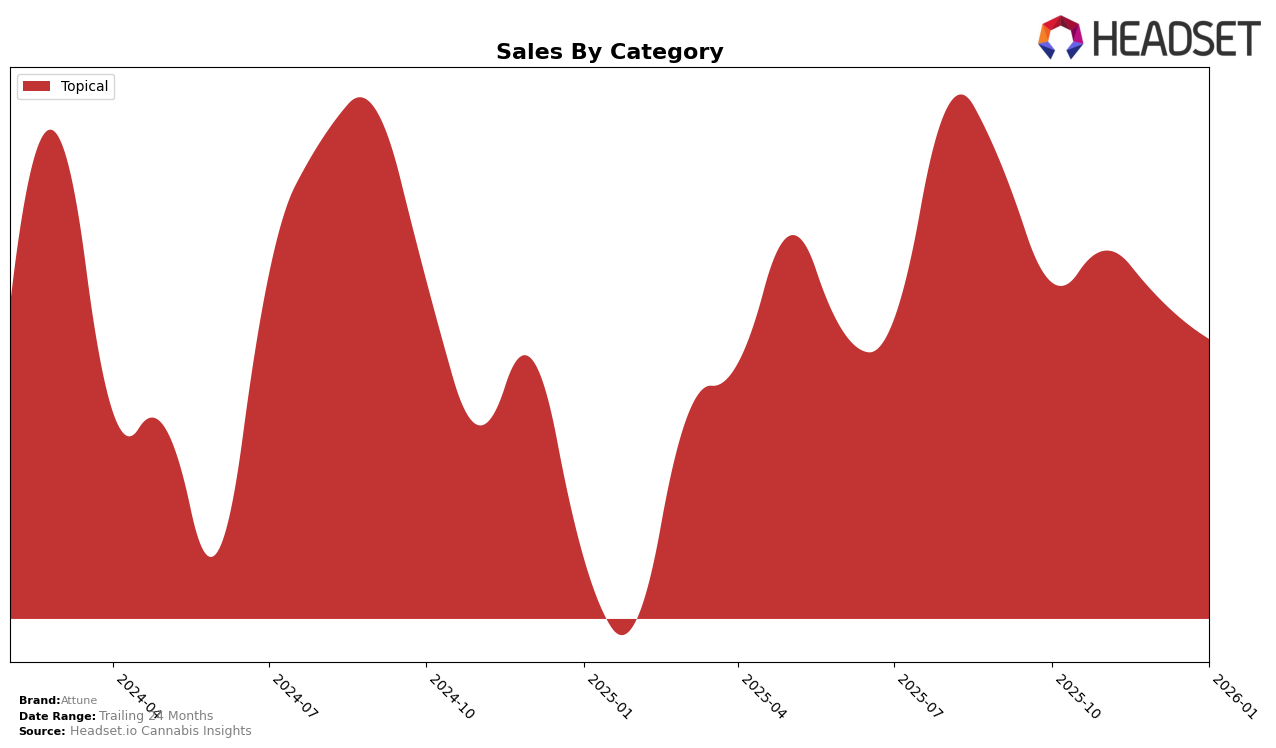

Attune has shown a consistent performance in the Topical category within the state of Massachusetts. The brand maintained a steady second-place ranking from October 2025 through January 2026. Despite a slight decline in sales from November to January, Attune's ability to hold its position suggests a strong brand presence and customer loyalty in this category. This consistent ranking is noteworthy, especially given the competitive nature of the cannabis market, which often sees fluctuations in brand positions.

However, it is important to note that Attune's presence in other states and categories is not mentioned, indicating that the brand did not make it into the top 30 rankings in those areas. This could suggest either a strategic focus on the Massachusetts market or potential challenges in expanding their market share elsewhere. The lack of presence in other states might be seen as a missed opportunity or a deliberate strategy to consolidate their position in a familiar market. Observers might want to keep an eye on whether Attune will make strategic moves to diversify its market reach in the coming months.

Competitive Landscape

In the Massachusetts topical cannabis market, Attune consistently holds the second rank from October 2025 to January 2026, demonstrating a stable position in the competitive landscape. Despite maintaining its rank, Attune faces significant competition from Treeworks, which leads the market with a commanding first-place position throughout the same period. Attune's sales figures, while robust, are notably lower than Treeworks, indicating a potential area for growth. Meanwhile, Chill Medicated and Nordic Goddess are also key competitors, with Chill Medicated consistently ranking third and Nordic Goddess fluctuating between fourth and sixth place. The data suggests that while Attune maintains a strong market presence, there is room to increase its market share by closing the sales gap with Treeworks and defending against the upward momentum of Chill Medicated.

Notable Products

In January 2026, the top-performing product for Attune was the CBD/THC 1:1 Muscle Freeze Lotion with 75mg CBD and 75mg THC, maintaining its consistent first-place rank from the previous months, though its sales slightly decreased to 581 units. The Muscle Freeze Lotion with 100mg THC and 30ml continues to hold the second position, showing a steady performance with minor fluctuations in sales. The CBD/THC 1:1 Muscle Freeze with 69mg CBD and 66mg THC remained in third place, experiencing a decrease in sales from December. The CBD/THC 1:2 Muscle Freeze Lotion, with 30mg CBD and 60mg THC, stayed in fourth place, while its sales saw a slight improvement from December. Lastly, the CBD/THC 1:1 Muscle Freeze Lotion with 50mg CBD and 50mg THC consistently ranked fifth, with a small increase in sales compared to the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.