Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

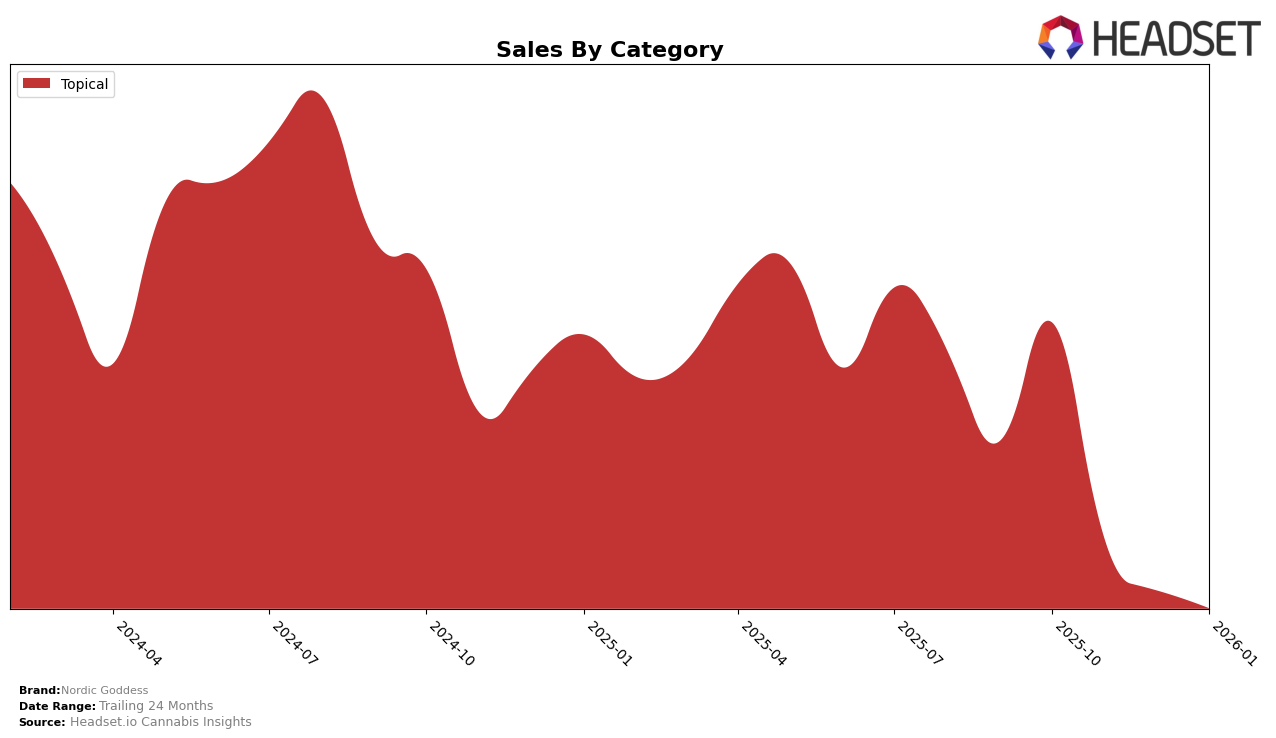

Nordic Goddess has shown a consistent performance in the Topical category in Colorado, maintaining a steady third-place ranking from October 2025 through January 2026. However, it's worth noting that their sales figures have experienced a downward trend over these months, from $62,995 in October to $53,052 in January. Despite this decline, the brand's ability to hold onto its ranking suggests a strong market presence and customer loyalty within the state. Conversely, in Massachusetts, Nordic Goddess has demonstrated some fluctuations in their rankings, moving from fifth in October to fourth in November, dropping to sixth in December, and then recovering back to fourth in January. This indicates a more competitive landscape, but also reflects the brand's resilience and capability to regain its footing.

In Nevada, Nordic Goddess achieved a notable first-place ranking in the Topical category in October 2025. However, the absence of subsequent rankings for November, December, and January suggests that the brand fell out of the top 30, which could be a point of concern. This sharp decline might indicate a significant drop in sales or increased competition in the market. The contrast between their performance in Nevada and the other states highlights the varying challenges and opportunities faced by Nordic Goddess across different regions. Such regional disparities underscore the importance for the brand to tailor its strategies to maintain and enhance its market position.

Competitive Landscape

In the competitive landscape of the Topical category in Colorado, Nordic Goddess consistently holds the third rank from October 2025 to January 2026, indicating a stable position amidst its competitors. Despite maintaining its rank, Nordic Goddess faces significant competition from Escape Artists, which dominates the market with a consistent first-place rank and substantially higher sales figures. Mary Jane's Medicinals also maintains a steady second-place position, with sales figures almost double those of Nordic Goddess. Meanwhile, My Brother's Flower and Care Division fluctuate between fourth and fifth positions, with sales figures trailing behind Nordic Goddess. This competitive scenario suggests that while Nordic Goddess has a solid foothold, there is a significant gap in sales compared to the top two brands, highlighting potential areas for growth and market share expansion.

Notable Products

In January 2026, the top-performing product for Nordic Goddess was the CBD/THC/CBG 10:10:1 Vibe 10X Body Balm, maintaining its rank as number one for the second consecutive month with sales of $535. The CBD/THC 1:1 Cooling Therapeutic Body Balm followed closely, ranking second once again, consistent with its performance in the prior two months. The CBD/THC 1:1 Therapeutic Body Balm held steady at third place, showing stability in its ranking from October 2025 through January 2026. The THC Cooling Balm remained in fourth place, indicating no change in its ranking over the past four months. Lastly, the Wrangler Body Balm consistently ranked fifth since its introduction in November 2025, despite a slight decrease in sales from December 2025 to January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.