Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

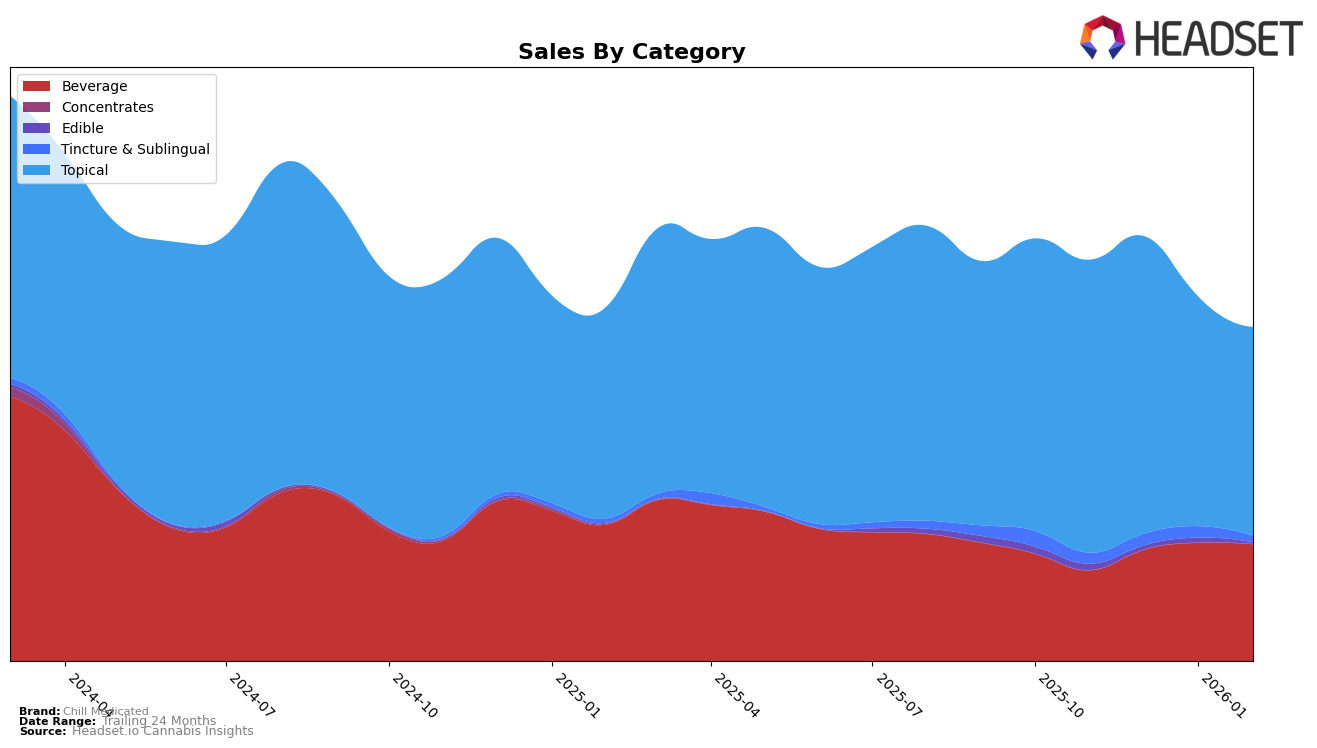

Chill Medicated has shown notable performance in the Massachusetts market, particularly in the Beverage category, where it maintained a steady rank of 6th place in November and December 2025 before improving to 5th place in January and February 2026. This upward movement is indicative of growing consumer preference or effective market strategies. In the Topical category, Chill Medicated held a strong position at 3rd place through November to January, before slipping to 4th place in February. This slight decline might signal increasing competition or shifting consumer trends. It's also worth noting that in the Tincture & Sublingual category, the brand consistently held the 6th position from November to January, but did not appear in the top 30 in February, which could be a potential area of concern or an opportunity for strategic reassessment.

In Michigan, Chill Medicated has firmly established itself as the top brand in the Topical category, consistently holding the 1st position from November 2025 to February 2026. However, there was a noticeable decrease in sales from December to February, which might suggest market saturation or seasonal fluctuations. In the Beverage category, the brand experienced fluctuations, starting at 8th place in November, dropping to 9th in December and January, and then climbing back to 6th place in February. Meanwhile, in New Jersey, Chill Medicated made a significant entry into the Beverage category, ranking 3rd in December 2025 and maintaining that position in January 2026. The absence of data for November and February might suggest either a new market entry or a temporary withdrawal from the top ranks, which could be an area for further exploration.

Competitive Landscape

In the highly competitive Michigan topical cannabis market, Chill Medicated has consistently held the top rank from November 2025 through February 2026, demonstrating its strong market presence and consumer preference. Despite a noticeable decline in sales from November 2025 to February 2026, Chill Medicated maintains a significant lead over its closest competitors. Mary's Medicinals, ranked second, has also experienced a sales decline but remains consistently behind Chill Medicated in sales volume. Meanwhile, Rise (MI) holds the third position, with sales figures substantially lower than both Chill Medicated and Mary's Medicinals. The consistent ranking of these brands suggests a stable competitive landscape, with Chill Medicated's leading position indicating strong brand loyalty and market penetration in Michigan's topical category.

Notable Products

In February 2026, Chill Medicated's top-performing product was the CBD/THC 1:1 Extreme X Body Rub, maintaining its consistent first-place ranking since November 2025, despite a slight decrease in sales to 3058 units. The Grape Syrup moved up to the second position, showing a notable increase in sales compared to previous months. Blue Raspberry Syrup climbed to third place, improving from its fifth-place ranking in January 2026. Cherry Syrup held steady at fourth place, while Strawberry Syrup re-entered the rankings in fifth position after being unranked in January. Overall, the beverage category showed dynamic changes in rankings, with notable shifts in product performance from the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.