Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

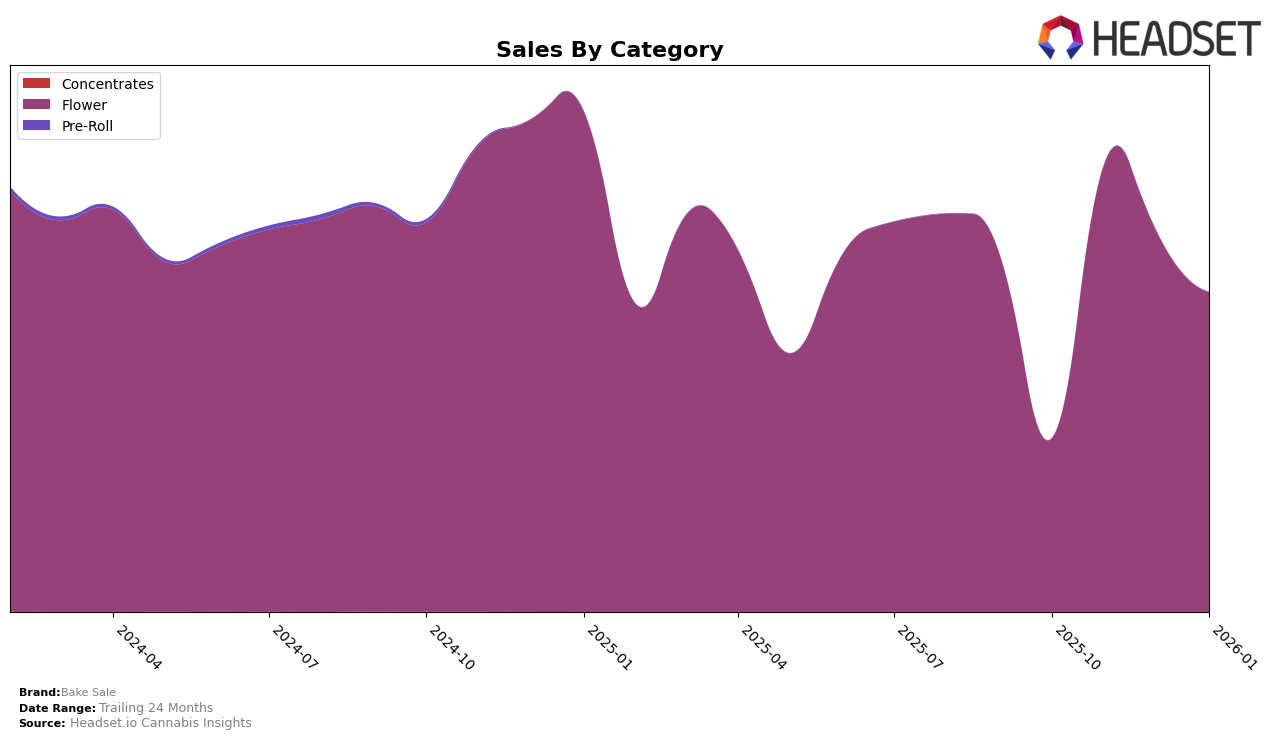

Bake Sale's performance across various Canadian provinces shows a dynamic landscape in the cannabis flower category. In Alberta, the brand experienced a notable decline in rankings, dropping from 14th place in October 2025 to 46th by January 2026. This downward trend is coupled with a significant decrease in sales, which fell from over 360,000 CAD in October to just above 120,000 CAD in January. This indicates a challenging market environment or increased competition in Alberta. Conversely, in British Columbia, Bake Sale has shown impressive growth. Starting from 9th place in October, the brand climbed to the top position by December, maintaining a strong 2nd place in January 2026. This rise in ranking is reflected in their substantial sales figures, which peaked in November.

In Saskatchewan, Bake Sale's performance has been more stable, with a gradual improvement in rankings from 26th in October 2025 to 13th in January 2026. This positive trajectory is supported by a steady increase in sales over the same period, suggesting a growing consumer base or effective market strategies. It's worth noting that while Bake Sale's presence in Saskatchewan is strengthening, their absence from the top 30 in certain months in other provinces might indicate areas for potential growth or market entry. Overall, the brand's varied performance across provinces highlights both opportunities and challenges in expanding their footprint within the Canadian cannabis market.

Competitive Landscape

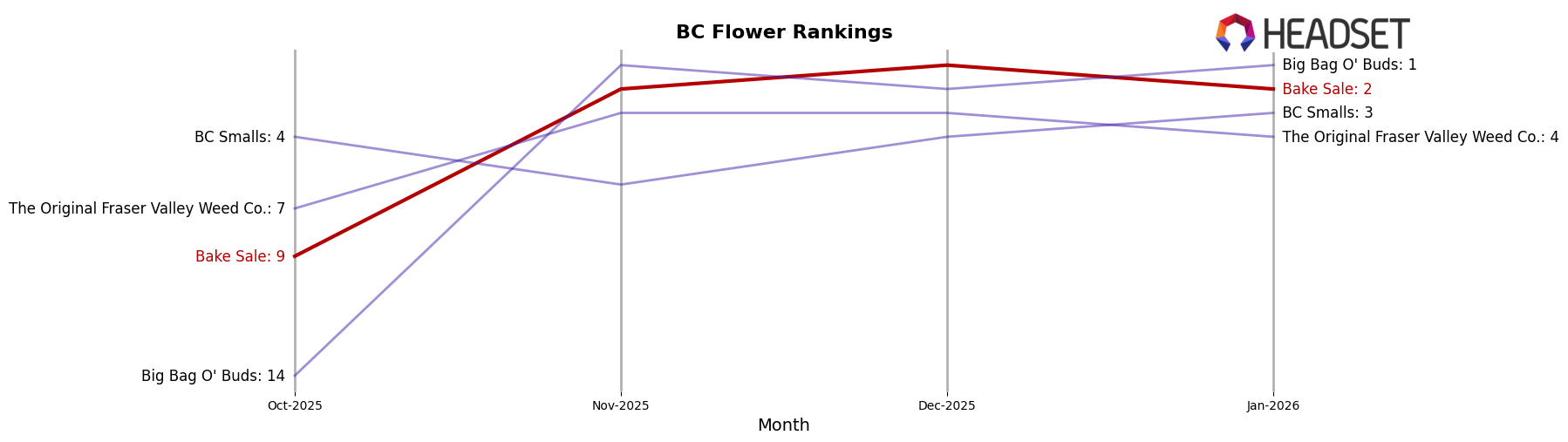

In the British Columbia Flower category, Bake Sale has demonstrated a remarkable upward trajectory in terms of rank and sales. Starting from a 9th place position in October 2025, Bake Sale surged to the top rank in December 2025 before settling at 2nd place in January 2026. This impressive climb highlights its growing popularity and market presence. However, the brand faces stiff competition from Big Bag O' Buds, which consistently maintained a strong position, reclaiming the top spot in January 2026. Meanwhile, The Original Fraser Valley Weed Co. and BC Smalls also remain significant competitors, with ranks fluctuating but consistently staying within the top 5. Bake Sale's ability to ascend rapidly in rank, despite the competitive landscape, suggests a robust brand strategy and consumer appeal, though maintaining this momentum will require continued innovation and marketing efforts to fend off close competitors.

Notable Products

In January 2026, the top-performing product for Bake Sale remained All Purpose Flower Sativa (28g), maintaining its first-place ranking consistently since October 2025, with sales figures reaching 8,970 units. All Purpose Flower Indica (28g) also held steady in the second position across the same period, demonstrating strong and stable demand. Notably, All Purpose Flower Indica (15g) and All Purpose Flower Sativa (30g), which were ranked third and fourth in December 2025, did not appear in the rankings for January 2026, indicating a potential discontinuation or stock issue. The consistent performance of the top two products highlights their continued popularity and reliability in the market. This stability suggests that Bake Sale's focus on these leading products has been effective in maintaining their market position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.