Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

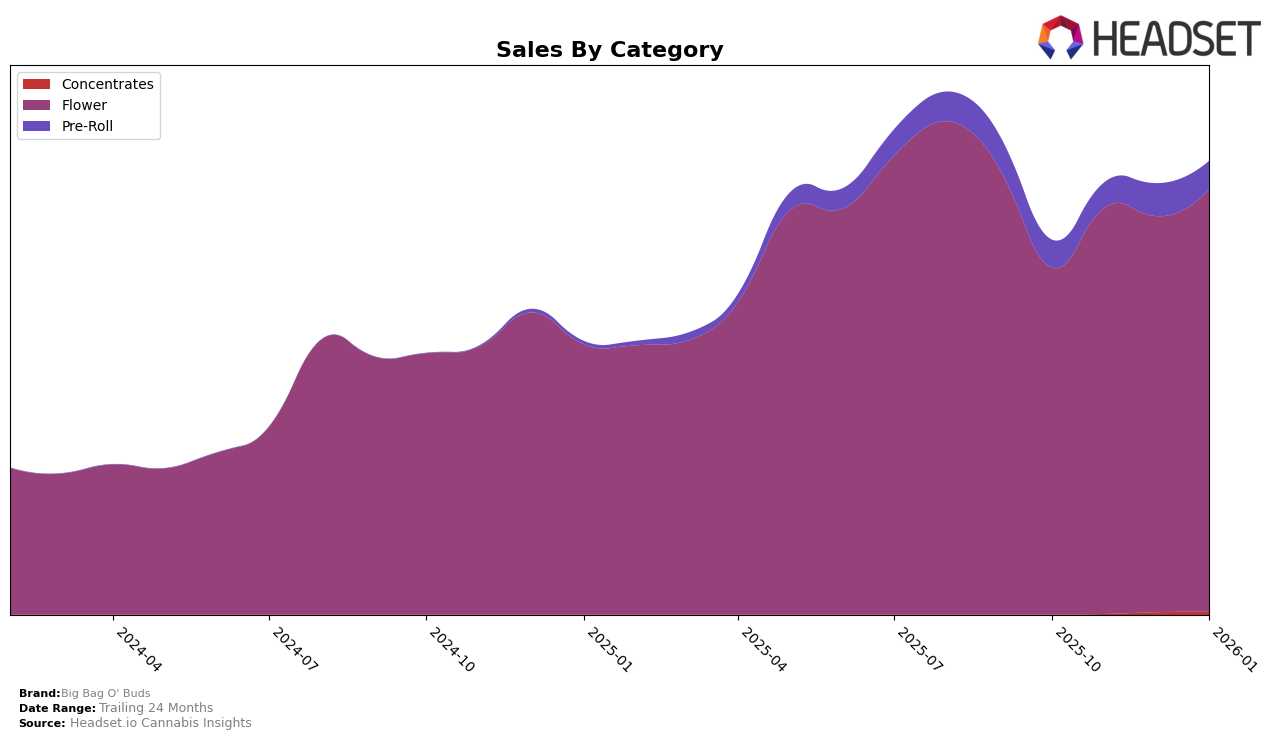

Big Bag O' Buds has shown impressive performance in the Flower category across multiple Canadian provinces. In Alberta, the brand maintained a consistent ranking of 4th place from October to December 2025, before moving up to 3rd place in January 2026. This upward trend is notable given the competitive landscape. Similarly, in British Columbia, Big Bag O' Buds achieved a remarkable leap from 14th place in October 2025 to securing the top spot in November and January, indicating strong consumer preference and market penetration. In Ontario, the brand held steady in 4th place throughout the same period, demonstrating consistent performance in a major market. Meanwhile, in Saskatchewan, the brand fluctuated slightly but remained within the top 4, showcasing its resilience and adaptability in different market conditions.

In contrast, the Pre-Roll category paints a different picture for Big Bag O' Buds. In Alberta, the brand's ranking oscillated, moving from 40th in October to 36th in January, indicating some volatility but also a slight improvement over time. However, in Ontario, Big Bag O' Buds did not break into the top 30, maintaining a ranking in the mid-60s throughout the observed months, suggesting challenges in capturing market share in this category. This disparity between the Flower and Pre-Roll categories highlights the brand's stronger foothold in the former, while indicating potential areas for growth and strategic focus in the latter.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Big Bag O' Buds consistently held the 4th rank from October 2025 to January 2026, indicating stable performance amidst fluctuating sales figures. Despite a dip in sales from October to November, Big Bag O' Buds managed to maintain its rank, showcasing resilience against competitors like Shred, which consistently held the 3rd position. Meanwhile, Spinach dominated the top ranks, although it slipped from 1st to 2nd in November and remained there through January. Pure Sunfarms and The Original Fraser Valley Weed Co. showed a competitive shuffle, with the latter climbing from 6th to 5th, highlighting a dynamic market environment. This stability in ranking for Big Bag O' Buds, despite sales fluctuations, suggests a strong brand loyalty or strategic market positioning that could be leveraged for future growth.

Notable Products

In January 2026, Purple Cherry Punch (3.5g) maintained its top position in the rankings for Big Bag O' Buds, with an impressive sales figure of 23,153 units, continuing its lead from December 2025. GMO Kush (3.5g) held steady at the second rank, showing consistency in its performance over the months. Purple Cherry Punch (28g) climbed to the third rank, up from fourth in November 2025, indicating a growing preference for larger quantities. Blueberry Dream (28g) remained in fourth place, maintaining its position from December 2025, while Ultra Sour (28g) consistently held the fifth spot across the months. Overall, the rankings suggest a stable demand for these top products, with minor shifts reflecting changes in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.