Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

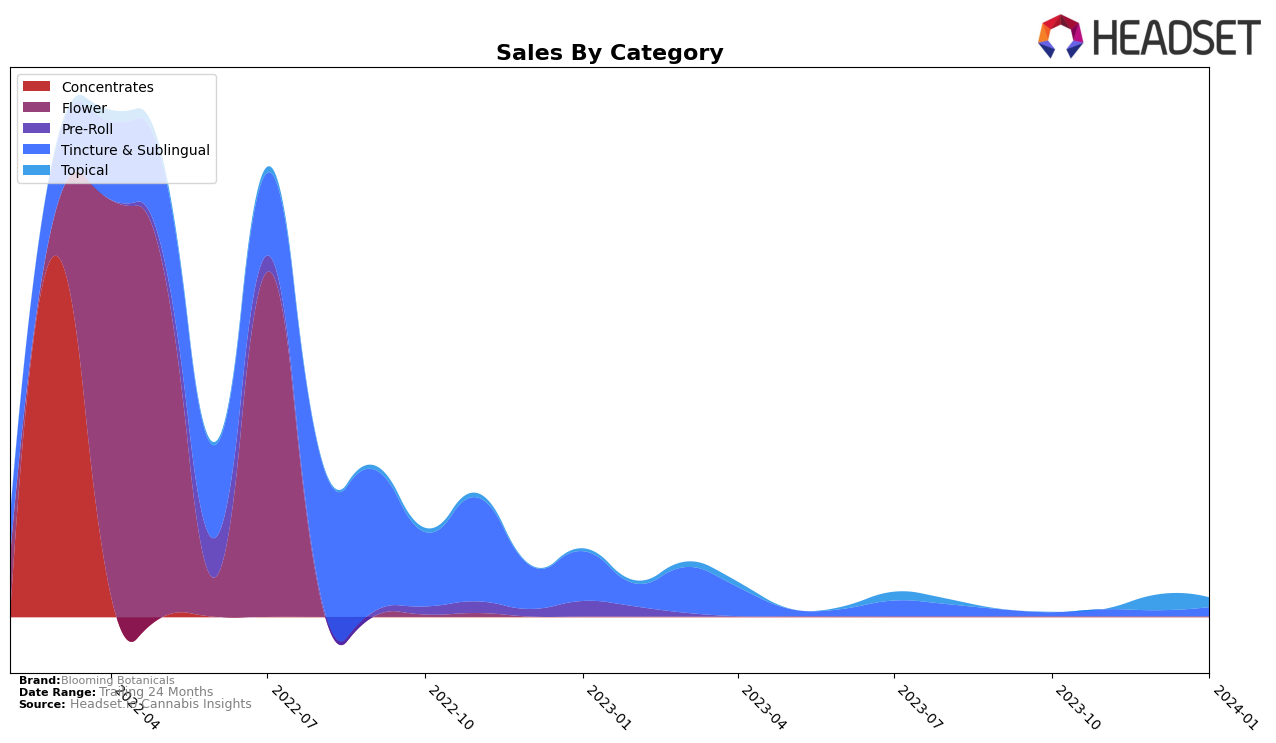

In Michigan, Blooming Botanicals has shown a notable presence in the Tincture & Sublingual category, with a steady climb in rankings from October 2023 to January 2024, moving from not being in the top 20 to securing the 18th position by December and maintaining it into January. This upward trend is a positive indicator of the brand's growing acceptance and preference among consumers in this category. The sales figures underscore this growth trajectory, with a significant jump observed from October's sales of 882 units to 2,128 units by January 2024. However, their performance in the Topical category tells a different story. The brand did not rank in the top 20 for October and November but made a surprising entry at the 18th position in December 2023 and held onto it in January 2024. The sales in December for the Topical category were impressive, marking a substantial increase to 3,730 units, indicating a strong market entry and consumer interest in their topical products.

While Blooming Botanicals' performance in the Tincture & Sublingual category in Michigan reflects a steady increase in consumer preference and market penetration, the late but strong entry in the Topical category highlights the brand's potential for rapid growth and acceptance in new categories. The absence from the top 20 rankings in the initial months for the Topical category could be seen as a missed opportunity or a period of strategizing before making a significant impact. The contrasting trajectories in these categories underscore the dynamic nature of consumer preferences and the importance of strategic market entries. Although specific sales figures after October are withheld, the directional movement in sales and rankings provides valuable insights into the brand's overall performance and potential areas of focus for future growth.

Competitive Landscape

In the competitive landscape of the topical cannabis market in Michigan, Blooming Botanicals has shown a notable entry in the rankings in December 2023, securing the 18th position and maintaining it into January 2024. This is a significant achievement considering the brand's absence in the top 20 rankings in the preceding months of October and November 2023. Competing brands such as Tree House CBD and Meg & Zen have experienced fluctuations in their rankings, with Tree House CBD seeing a decline from 17th in October 2023 to 20th in January 2024, and Meg & Zen moving from 14th in October 2023 to 16th in January 2024. Leilani Bee made a significant jump from being outside the top 20 in October 2023 to 19th in January 2024, indicating a volatile market. Lion Order has shown impressive growth, moving from not being in the top 20 in October to securing the 17th spot in January 2024. Blooming Botanicals' entry and position in the market are noteworthy, especially considering the dynamic shifts among its competitors, suggesting a competitive but promising landscape for the brand.

Notable Products

In January 2024, the top-selling product for Blooming Botanicals was the CBD Healing Salve (500mg CBD) in the Topical category, maintaining its number one rank from December 2023 with 58 units sold. Following closely was the CBG Full Spectrum Oil Tincture (1000mg CBG, 30ml, 1oz) from the Tincture & Sublingual category, which also held its previous month's position at rank two. The CBD Tumeric Tincture (1000mg CBD, 30ml) experienced a notable rise, moving up to the third position from not being in the top ranks in the previous months. The CBD Lavender Tincture (2000mg CBD, 30ml) from the Tincture & Sublingual category showed a consistent performance, securing the fourth spot, down one rank from December. These rankings indicate a stable consumer preference for tinctures in Blooming Botanicals' product line, with the CBD Healing Salve standing out as the top topical choice.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.