Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

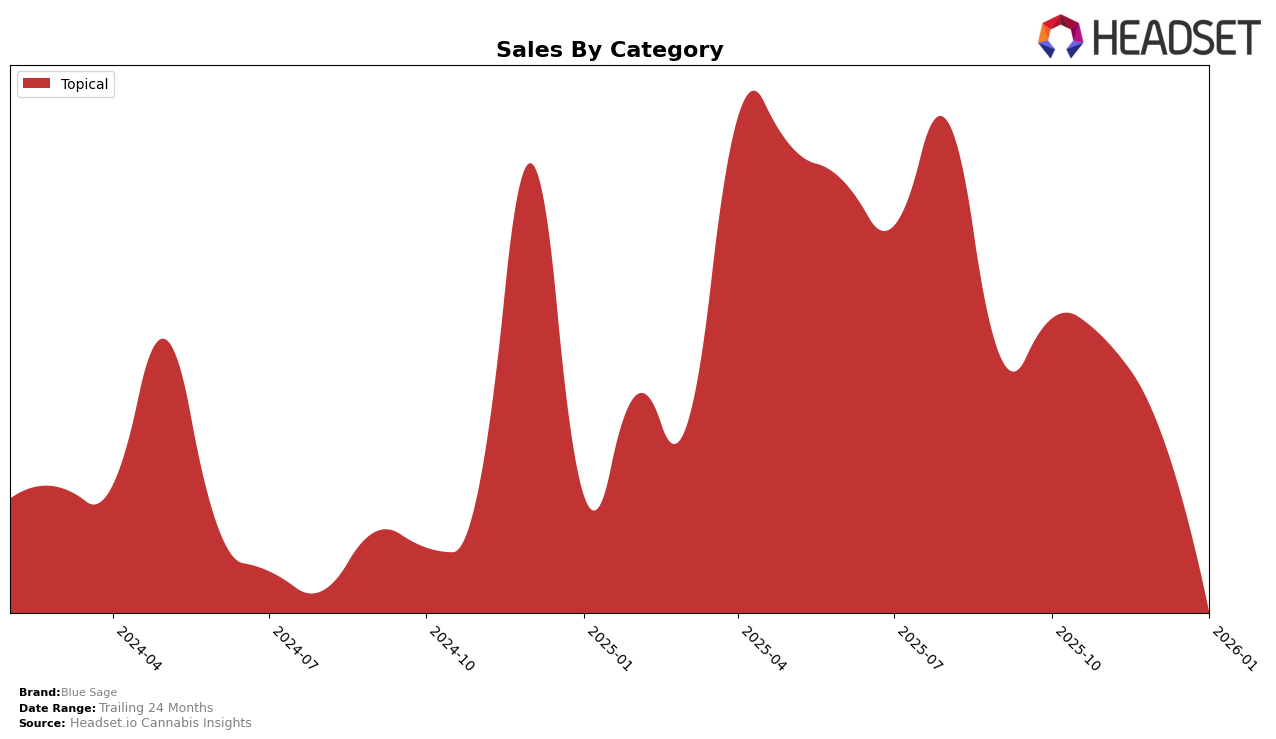

Blue Sage has demonstrated a consistent performance in the Topical category in California. The brand maintained its 13th position in both October and November of 2025, indicating a stable market presence. However, it is notable that Blue Sage did not appear in the top 30 rankings for December 2025 and January 2026, which could suggest a decline in market competitiveness or a shift in consumer preferences. Despite the absence from the rankings in the latter months, the sales figures in October and November were relatively steady, with a slight decline from $10,954 in October to $10,523 in November.

This performance highlights the challenges Blue Sage faces in maintaining a top-tier position in a competitive market. The absence from the rankings in December and January could be indicative of increased competition or internal strategic shifts that may not have resonated with consumers. While the brand's early performance in the quarter showed promise, the subsequent months suggest a need for strategic adjustments to regain visibility and market share. Observing how Blue Sage adapts to these challenges will be crucial for understanding its future trajectory in California's Topical category.

Competitive Landscape

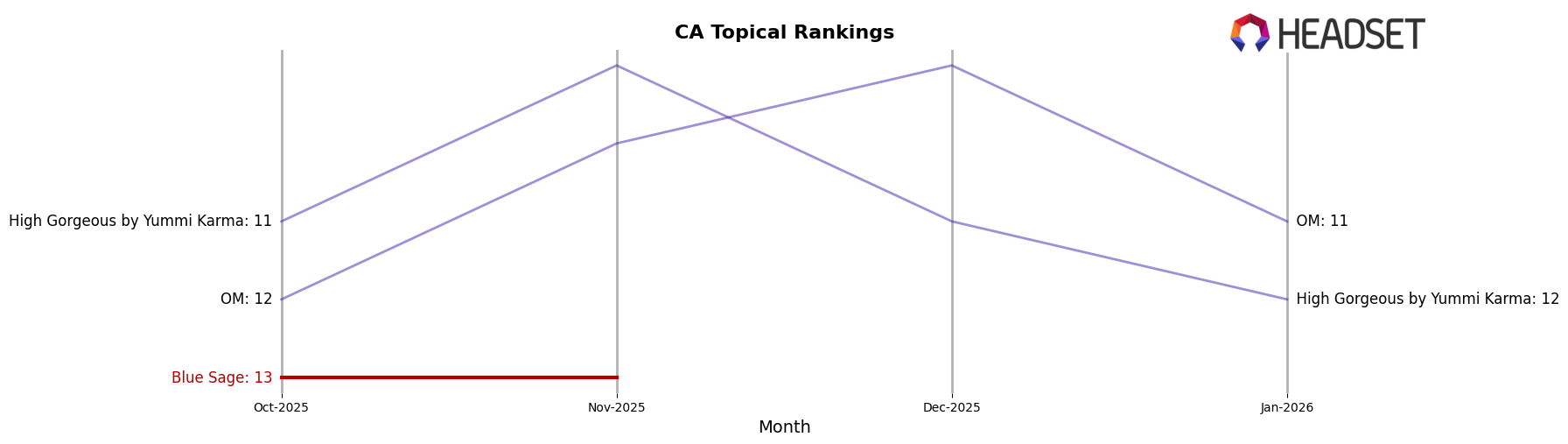

In the competitive landscape of the California topical cannabis market, Blue Sage has experienced some fluctuations in its rank and sales performance. Notably, Blue Sage was ranked 13th in both October and November 2025, but it did not appear in the top 20 for December 2025 and January 2026, indicating a potential decline in market presence or sales volume during those months. In contrast, High Gorgeous by Yummi Karma and OM have shown more stability and upward momentum. High Gorgeous by Yummi Karma improved its rank from 11th in October 2025 to 9th in November 2025, although it slightly dropped to 12th by January 2026. Meanwhile, OM demonstrated a consistent upward trend, moving from 12th in October 2025 to 9th by December 2025, before settling at 11th in January 2026. These competitors' ability to maintain and improve their rankings suggests a stronger market position, which could impact Blue Sage's sales and brand visibility if the trend continues.

Notable Products

In January 2026, Blue Sage's top-performing product was The Original Cream 322mg THC 50ml, maintaining its first-place rank consistently from October 2025 through January 2026, with a sales figure of 68 units. Citrus Cedar Cream 393mg THC 50ml followed in second place, climbing from the fifth rank in November 2025 to secure the second spot in December 2025 and maintaining it in January 2026. Orange Chai Cream 404mg THC 50ml held the third position in January 2026, having fluctuated in rank from first in November 2025 to third in subsequent months. The larger variant, Orange Chai Cream 880mg THC 118ml, ranked fourth in January 2026, showing a consistent decline from its second-place position in November 2025. Lastly, Citrus Cedar Cream 1000mg THC 4oz remained in fifth place in January 2026, consistent with its performance in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.