Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

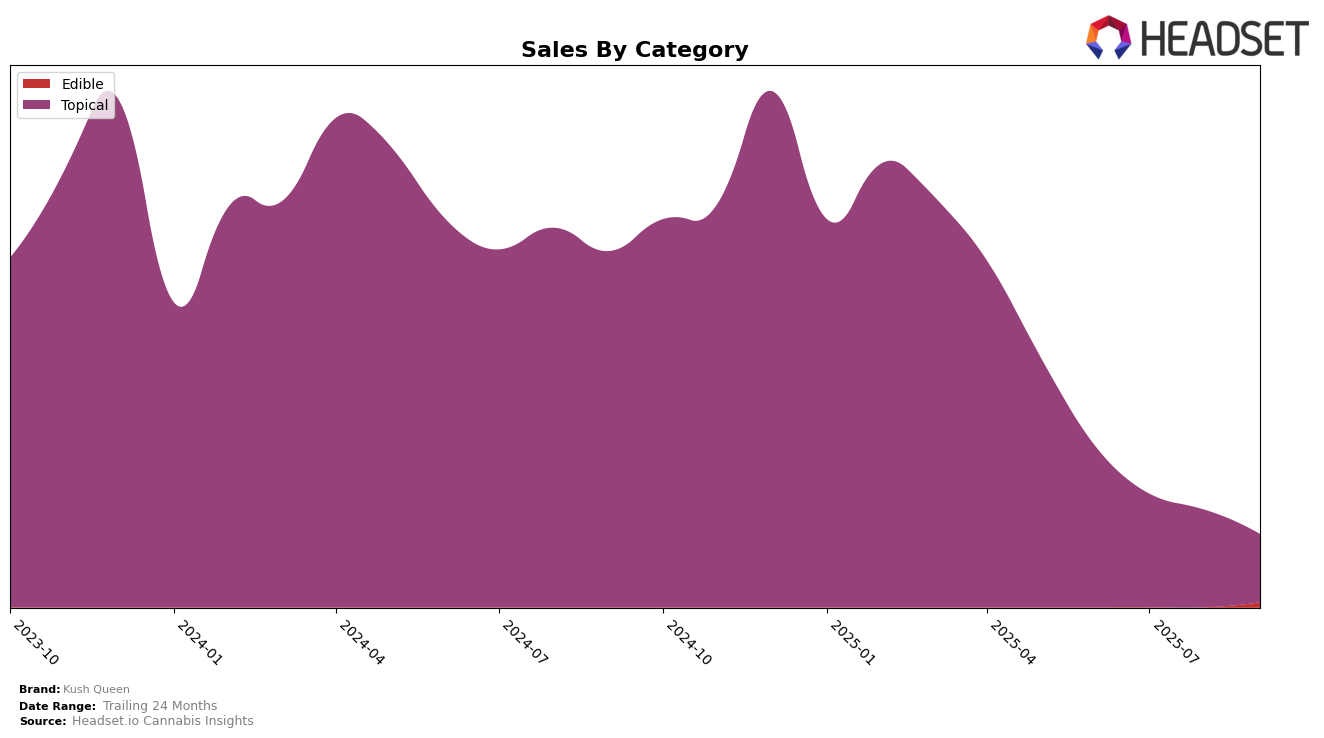

Kush Queen, a brand known for its topical cannabis products, has shown varied performance across different states and categories. In California, Kush Queen was ranked 12th in the topical category in June 2025. However, in the subsequent months of July, August, and September 2025, the brand did not appear in the top 30 rankings for this category, indicating a potential decline in market presence or increased competition. The absence from the top rankings could be concerning, as maintaining a position within the top 30 is often critical for brand visibility and consumer retention in such a competitive market.

Despite the lack of ranking data for July through September, the sales figures from June 2025, which stood at $13,037, provide a baseline for understanding the brand's market performance. This sales figure is indicative of the brand's potential reach and consumer base within California. The drop from the rankings in the following months suggests that Kush Queen may need to reassess its strategy in the state to regain its standing. While the sales data for the later months is not available, the trend points towards a need for strategic adjustments to recapture market share and improve brand visibility in the competitive cannabis topical market.

Competitive Landscape

In the competitive landscape of California's topical cannabis market, Kush Queen experienced a notable decline in rank from June to September 2025, indicating a potential challenge in maintaining its market position. While Kush Queen was ranked 12th in June, it did not appear in the top 20 for the subsequent months, suggesting a significant drop in visibility and possibly sales. In contrast, High Gorgeous by Yummi Karma consistently held the 12th position from July to September, demonstrating stable performance. Meanwhile, Blue Sage showed fluctuations, ranking 11th in June and August but dropping to 13th in July and September. These dynamics highlight the competitive pressures Kush Queen faces, as its competitors maintain or improve their standings, potentially capturing market share that Kush Queen might be losing.

Notable Products

In September 2025, the top-performing product for Kush Queen was the CBD/THC 1:1 Relieve Bath Bomb, which climbed to the number one spot from its previous fifth-place ranking in August, with sales reaching 116 units. The CBD/THC 1:1 Relax Bath Bomb also showed strong performance, maintaining a steady presence and rising to second place, despite a slight dip in sales compared to previous months. The CBD/THC 1:1 Sleep Bath Bomb dropped to third place, continuing its downward trend from the top spot in June. Notably, the CBD/THC 1:1 Awaken Bath Bomb fell to fourth place, showing a significant decline in sales. The newly introduced CBD/THC 2:1 Watermelon Gummy made a notable entry at fifth place, indicating potential growth in the edibles category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.