Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

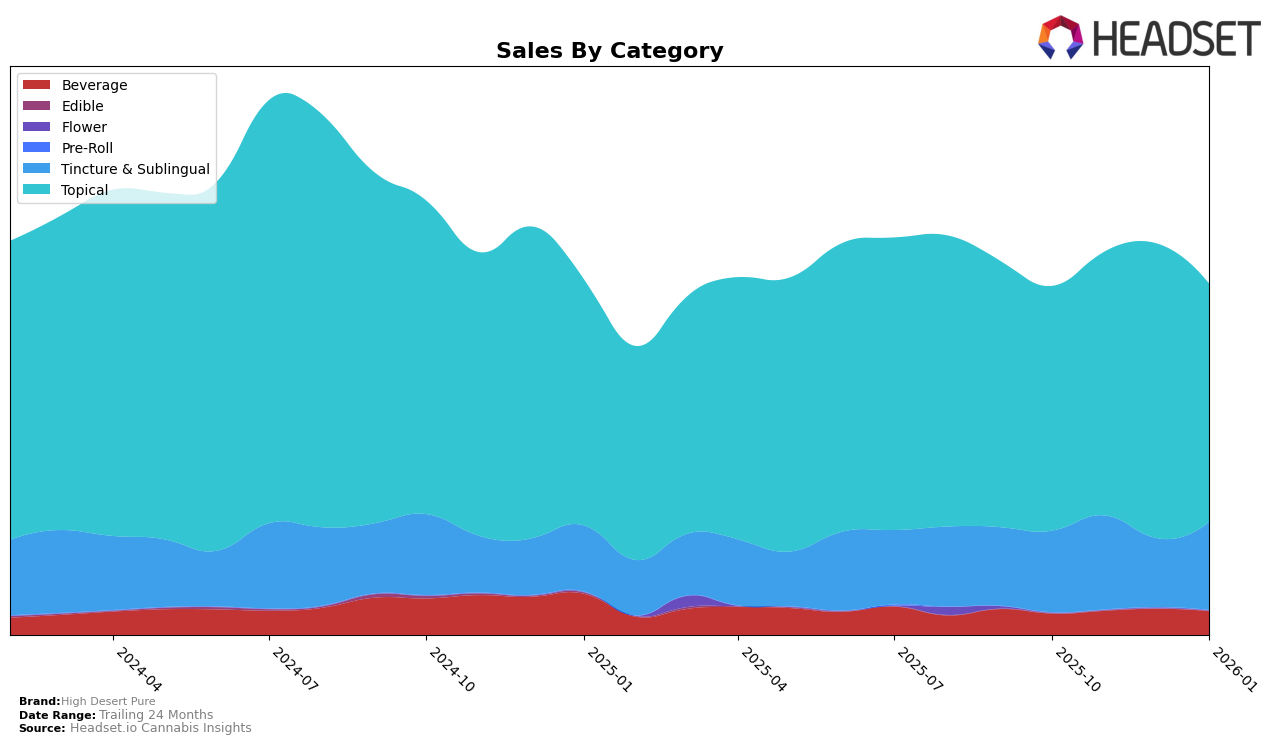

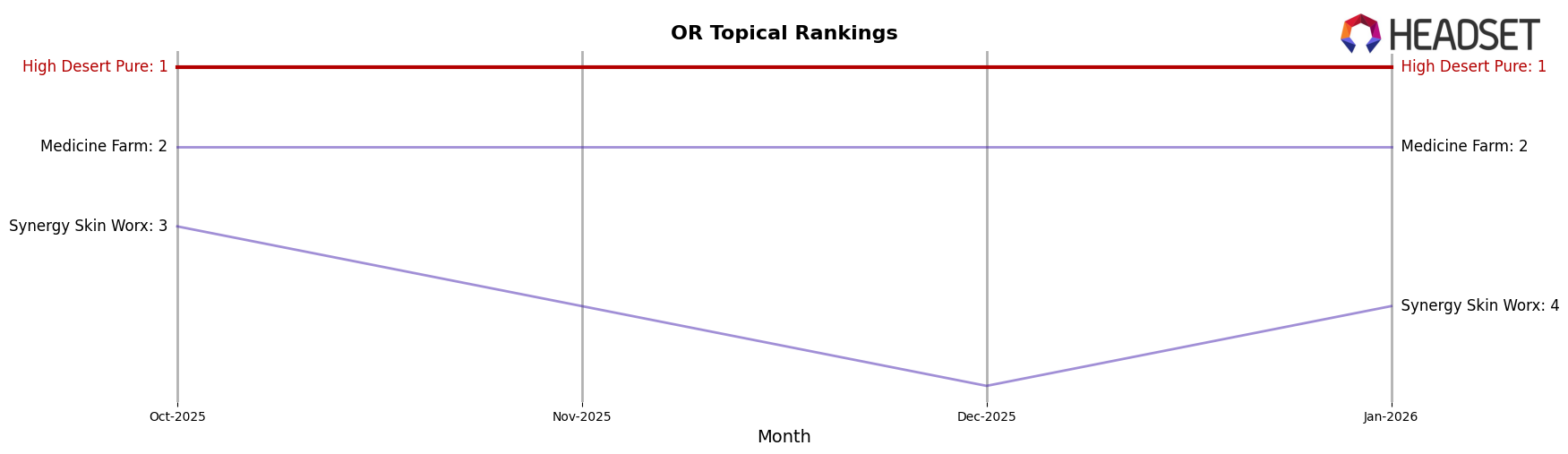

High Desert Pure has demonstrated a strong presence in the topical category within both California and Oregon. In California, the brand maintained a consistent position, ranking 10th in both October 2025 and January 2026, with a slight dip to 12th in November and December 2025. This fluctuation suggests a competitive market, yet their ability to regain the 10th spot by January 2026 indicates resilience and possibly successful marketing strategies. In Oregon, High Desert Pure has shown exceptional dominance, consistently holding the top rank in the topical category across all observed months. This unwavering leadership in Oregon's topical segment highlights the brand's strong foothold and consumer preference in the state.

In addition to topicals, High Desert Pure has also made significant strides in other categories within Oregon. The brand has maintained a steady 4th rank in the tincture and sublingual category throughout the observed months, showcasing a stable market presence. Their performance in the beverage category is noteworthy as well, with a slight improvement from 9th to 8th place by January 2026, indicating positive momentum. However, the absence of High Desert Pure from the top 30 rankings in any additional categories in California suggests room for growth and expansion. This disparity between their performance in California and Oregon could be indicative of regional market dynamics and consumer preferences.

Competitive Landscape

In the Oregon topical cannabis market, High Desert Pure has consistently maintained its position as the leading brand from October 2025 through January 2026, holding the number one rank each month. This stability in rank suggests a strong brand presence and customer loyalty, which is further underscored by its substantial sales figures that significantly outpace those of its competitors. For instance, Medicine Farm, which consistently ranks second, has sales figures that are less than a third of High Desert Pure's, indicating a clear market leader. Meanwhile, Synergy Skin Worx has seen fluctuations in its rank, moving from third to fifth and back to fourth, reflecting a less stable market position. These dynamics highlight High Desert Pure's dominance in the Oregon topical category, suggesting that competitors have significant ground to cover to challenge its leadership.

Notable Products

In January 2026, the top-performing product for High Desert Pure was the CBD/THC 1:1 Ginger Lime Lotion, maintaining its consistent first-place ranking since October 2025, with sales reaching 687 units. The CBD/THC/CBN 15:5:2 Hibernate Honey Almond Tincture saw a significant rise, climbing to second place from fourth in December 2025, with sales at 612 units. The Celebrate Chocolate Coconut Full Spectrum Tincture secured the third position, after a brief absence in December, with sales of 543 units. The CBD/THC 1:1 Clinical Strength Menthol Lotion dropped to fourth place, despite previously holding second place in December 2025. A new entry, the CBD/THC 1:1 Light Tropic Lotion, debuted in January 2026 at fifth place, indicating a strong start in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.