Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

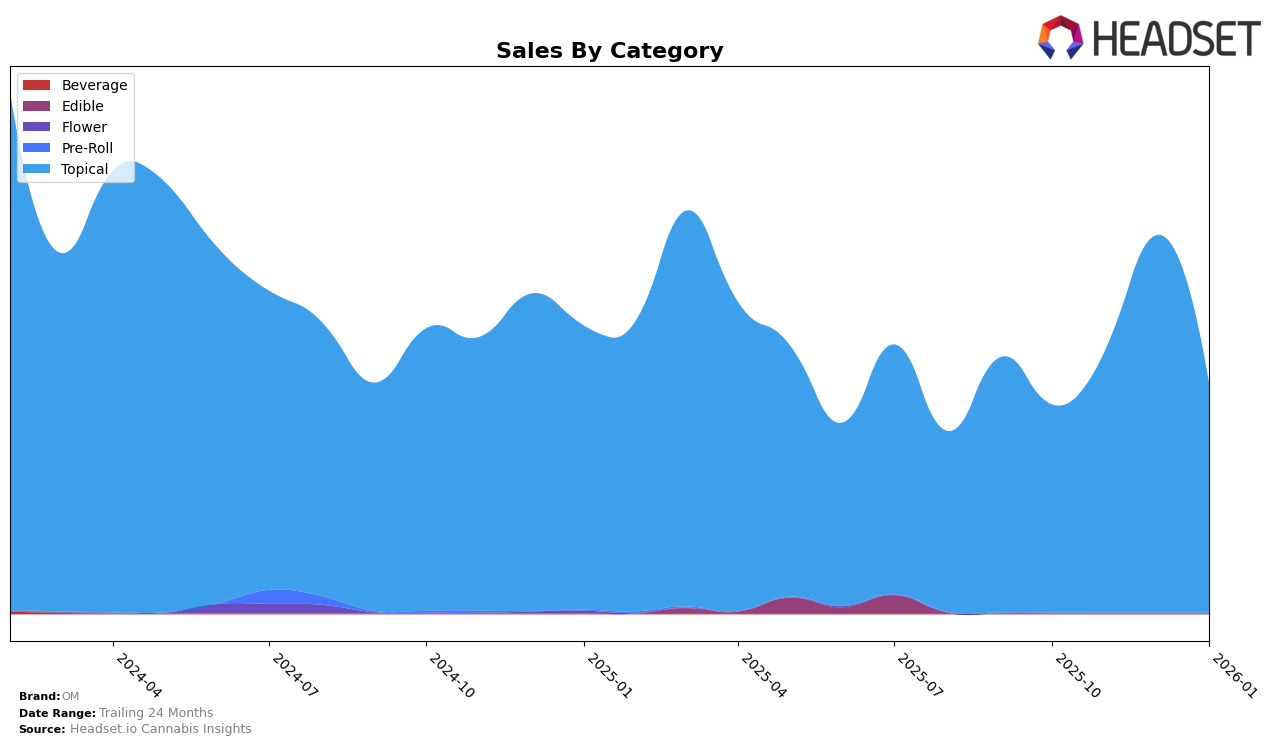

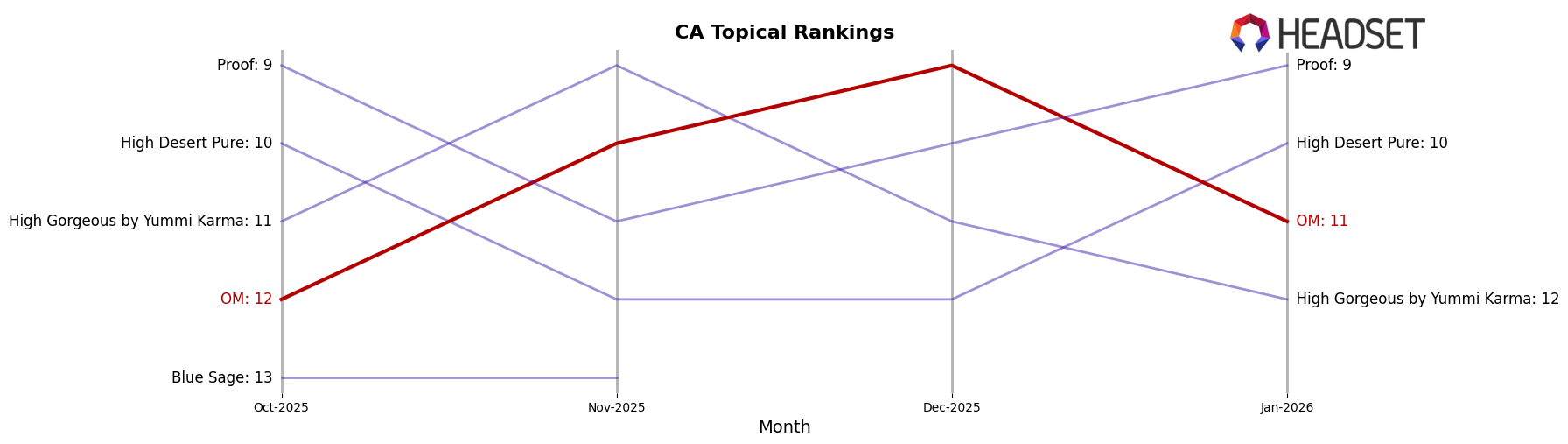

In the California market, OM has shown a consistent presence in the Topical category. Starting in October 2025, OM was ranked 12th, and it climbed to 10th in November and 9th in December, before slightly dropping to 11th in January 2026. This indicates a generally positive trend, with a notable peak in December. The brand's sales in this category also reflect this movement, with a significant increase from October to December, before experiencing a decline in January. The fluctuation suggests a responsiveness to seasonal demand or promotional activities that could be further explored.

OM's absence from the top 30 in other categories or states suggests potential opportunities for expansion or areas needing strategic adjustments. The fact that OM maintains a stable ranking within the top 15 in the Topical category in California highlights its strength and brand recognition in this specific segment. However, the lack of presence in other categories or regions might indicate untapped markets or challenges in scaling the brand's reach beyond its current stronghold. This could be a critical focus for OM as it looks to broaden its market influence and diversify its product offerings.

Competitive Landscape

In the competitive landscape of the topical cannabis market in California, OM has shown a dynamic shift in its ranking and sales performance over the recent months. Notably, OM improved its rank from 12th in October 2025 to 9th by December 2025, before slightly dropping to 11th in January 2026. This fluctuation indicates a competitive tussle with brands like High Gorgeous by Yummi Karma, which also experienced a rank change, peaking at 9th in November 2025. Despite the rank drop in January, OM's sales in December 2025 were notably higher than those of High Desert Pure and Proof, suggesting a strong market presence during the holiday season. However, OM's sales dipped in January 2026, aligning with its rank decrease, which could be attributed to the competitive pressure from Proof, which maintained a consistent performance. The absence of Blue Sage from the top 20 after November 2025 highlights the intense competition and the necessity for OM to continually innovate to maintain and improve its market position.

Notable Products

In January 2026, the top-performing product for OM was the CBD/THC 1:1 Recovery Epsom Bath Salts, which ascended to the first position with sales of 161 units. The CBD/THC 1:1 Arnica Pain Relief Epsom Bath Salts maintained its strong performance, holding onto the second spot. Notably, the Arnica Relief Bath Bomb dropped to third place, despite its previous second-place ranking in December 2025. The CBD/THC 1:1 Lavender Epsom Bath Salts experienced a significant drop from its consistent first-place ranking in the previous months to fourth place. A new entry, the CBN/THC 1:5 Lavender Sweet Dreams Rosin Bath Bomb, debuted in fifth position, showcasing its potential in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.