Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

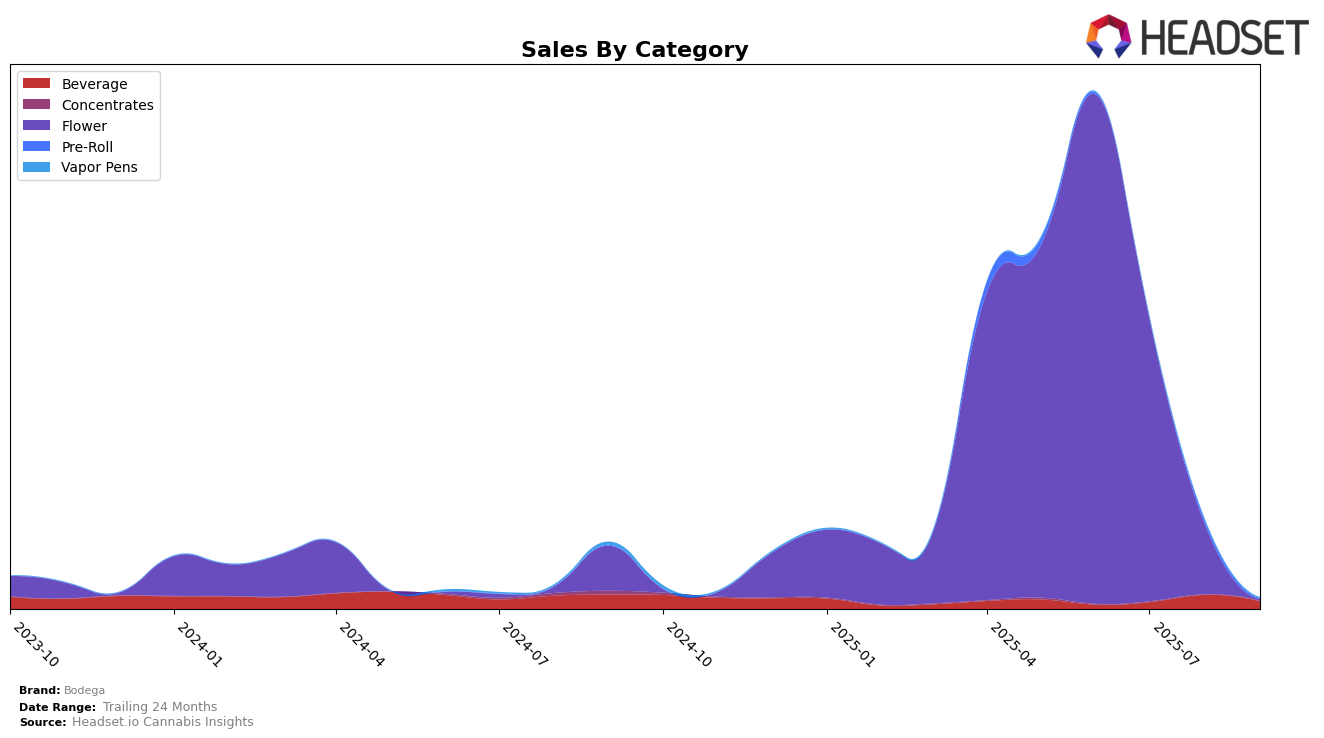

Bodega's performance in the Michigan market for the Flower category has seen a significant shift over the past few months. As of June 2025, Bodega was ranked 80th, but it did not appear in the top 30 rankings for July, August, or September. This absence from the top 30 might indicate a decline in its competitive standing or a shift in consumer preferences. The sales figures for June, which stood at $333,295, provide a snapshot of its earlier market presence, but the lack of subsequent ranking data suggests that Bodega might need to reassess its strategy or offerings to regain its position in the competitive Flower category.

While Bodega's performance in Michigan is crucial, it's also important to explore how they are faring across other states and categories. However, the absence of additional ranking data for other states or categories makes it challenging to draw comprehensive conclusions about their overall market presence. The lack of top 30 rankings in other regions or product categories could be seen as a missed opportunity for Bodega to expand its footprint and diversify its offerings. This information gap highlights the need for Bodega to potentially explore new markets or enhance its product lines to capture a broader audience and improve its market position.

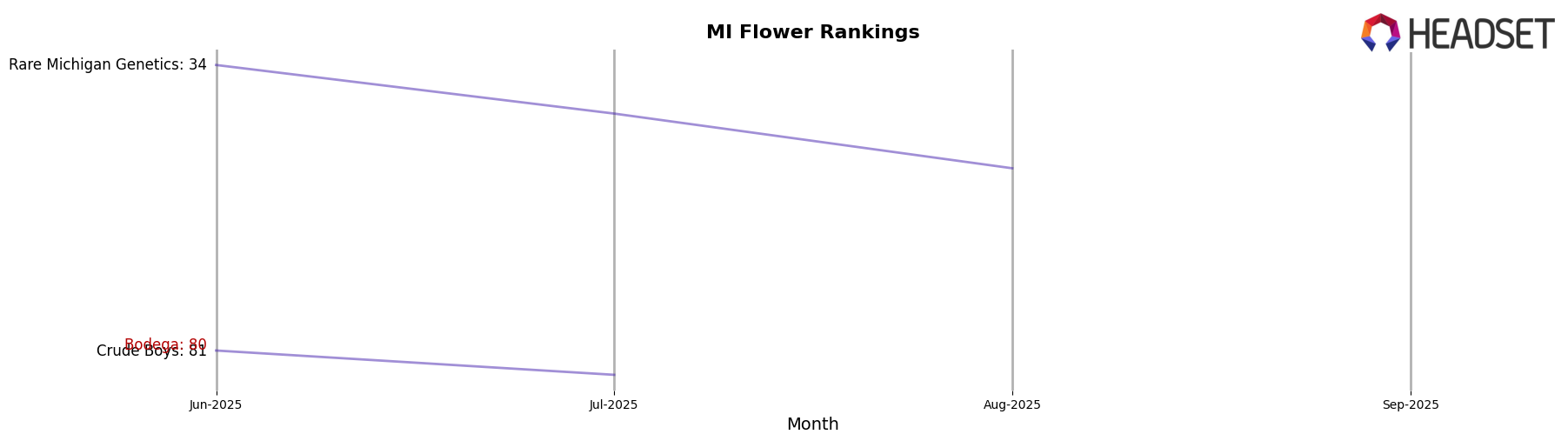

Competitive Landscape

In the competitive landscape of the Michigan flower market, Bodega has experienced a notable absence from the top 20 rankings since June 2025, where it held the 80th position. This indicates a challenging period for Bodega, especially when compared to competitors like Crude Boys and Rare Michigan Genetics. While Crude Boys also fell out of the top 20 after July 2025, Rare Michigan Genetics maintained a presence, albeit with a declining trend from 34th in June to 51st in August. This suggests that while Bodega is facing challenges in maintaining its market position, there is potential to learn from Rare Michigan Genetics, which, despite a decrease in rank, managed to stay within the top 20 for a longer period. This competitive insight highlights the need for strategic adjustments by Bodega to regain and sustain its market presence in Michigan's flower category.

Notable Products

In September 2025, Bodega's top-performing product was the Cherry Limeade Cooler Cannabis-Infused Beverage, maintaining its number one rank from August with notable sales of 431 units. The Pineapple Cooler Cannabis-Infused Beverage climbed to second place, showing an improvement from its third-place ranking in August. The Pear Cooler Cannabis-Infused Beverage also rose in the rankings, moving up to third place from fifth in the previous month. Rainbow Road, a Flower category product, debuted at fourth place, marking its first appearance in the rankings. The Cloudz- Blueberry Boogie Down Distillate Cartridge secured the fifth spot, highlighting its steady entry into the top-selling products for September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.