Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

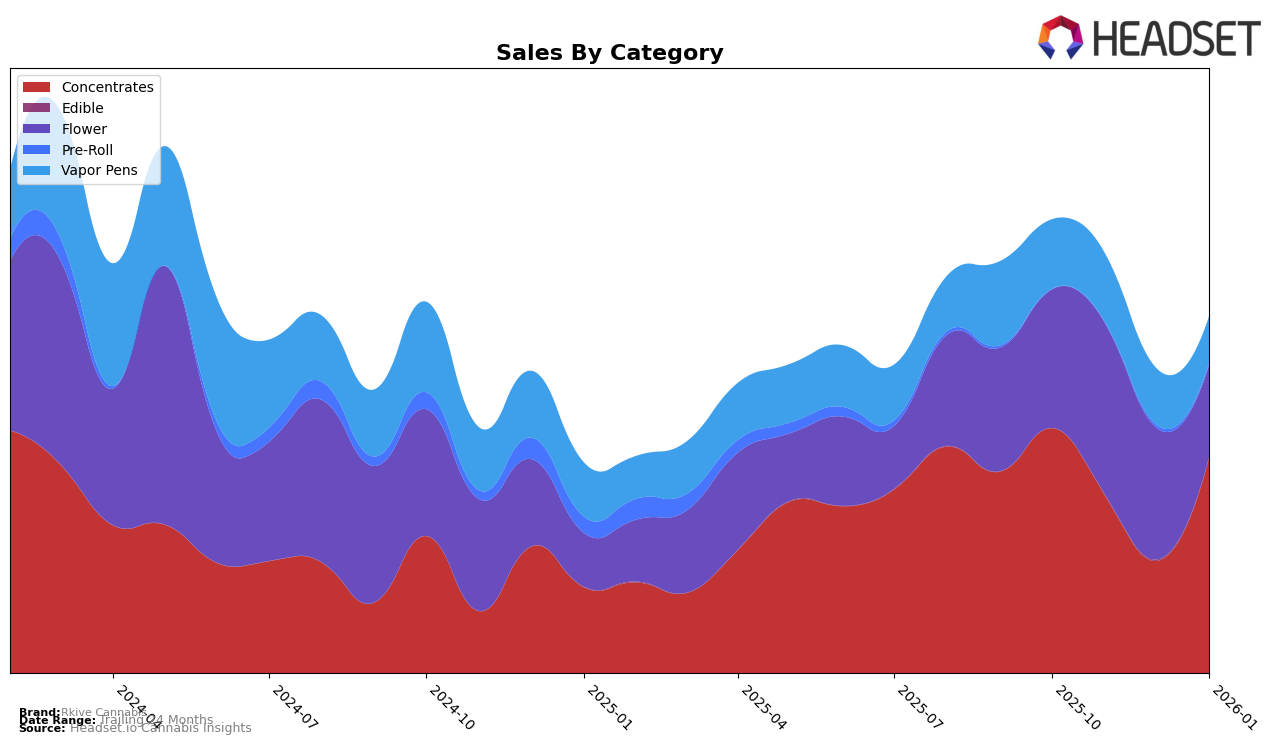

In the state of Michigan, Rkive Cannabis has shown notable fluctuations across different product categories. The brand's performance in the Concentrates category is particularly impressive, where it started at a strong 3rd place in October 2025, experienced a dip to 11th in December, but rebounded to reclaim the 3rd spot by January 2026. This volatility suggests a competitive market landscape, but Rkive Cannabis's ability to climb back indicates resilience and potential consumer preference. However, it's essential to note that the Flower category tells a different story, with Rkive Cannabis not making it into the top 30, ranking as low as 97th in January 2026. This suggests a potential area for growth or reevaluation of strategy in that segment.

As for the Vapor Pens category in Michigan, Rkive Cannabis has consistently remained outside the top 30, with rankings hovering in the 50s range. The brand's highest position was 44th in November 2025, but it slipped to 59th by January 2026. This steady decline could indicate increased competition or a shift in consumer preferences. Despite the challenges in the Vapor Pens and Flower categories, the Concentrates category remains a stronghold for Rkive Cannabis, potentially offering a strategic focus point for future growth. Understanding these dynamics could be crucial for stakeholders looking to capitalize on the brand's strengths and address its weaknesses in the Michigan market.

Competitive Landscape

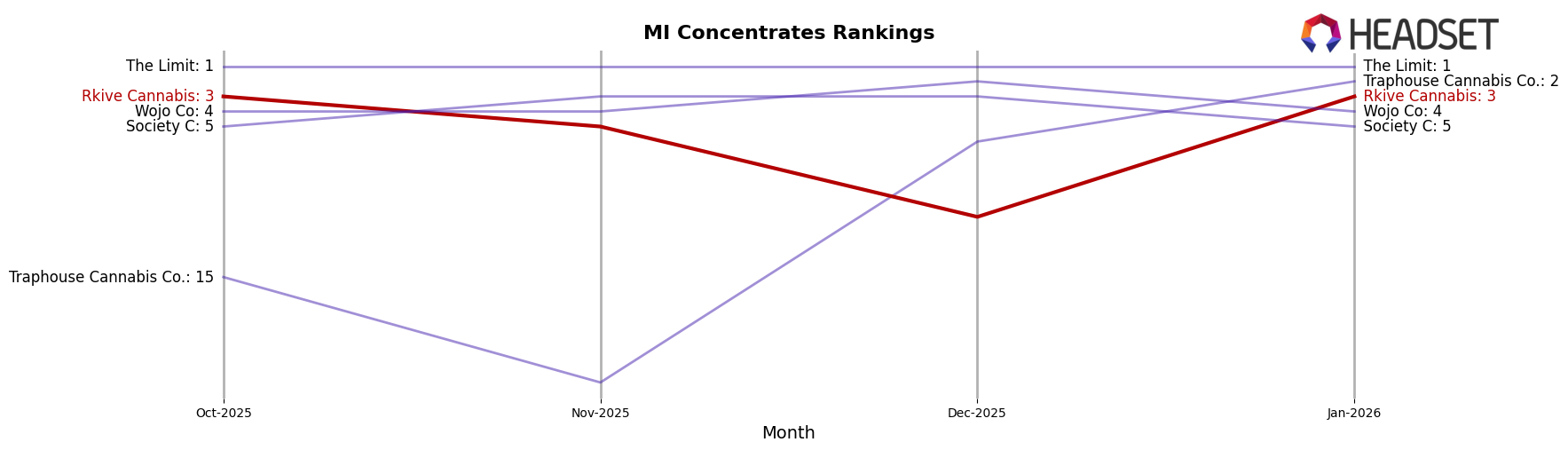

In the competitive landscape of the Michigan concentrates market, Rkive Cannabis has experienced notable fluctuations in its ranking over recent months. Starting strong in October 2025 with a rank of 3rd, Rkive Cannabis saw a dip to 5th in November and further to 11th in December, before rebounding to 3rd in January 2026. This volatility in rank is mirrored in its sales performance, with a significant drop in December followed by a recovery in January. The brand faces stiff competition from The Limit, which consistently holds the top position, and Society C, which maintains a steady presence in the top five. Meanwhile, Traphouse Cannabis Co. made a remarkable leap from 22nd in November to 2nd in January, indicating a dynamic market environment. Rkive Cannabis's ability to recover its rank suggests resilience, but the brand must strategize to stabilize its position amidst aggressive competitors like Wojo Co, which also consistently ranks high.

Notable Products

In January 2026, Rkive Cannabis saw Runtz (3.5g) take the top spot in sales, climbing from its consistent second-place ranking in previous months, with a notable sales figure of 4364 units. Tahitian Dream Live Resin (1g) surged to second place, improving from fifth place in December 2025 with significant sales growth. Olswell x Rkive - Blue Zclair Hash Rosin (5g) made a strong debut in third place, marking its first appearance in the rankings. Sudz (3.5g) slipped to fourth position, a drop from its third-place ranking in November 2025. Black Maple (3.5g) rounded out the top five, maintaining a steady presence despite a decrease in sales figures from December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.