Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

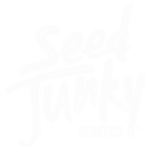

Seed Junky Genetics has shown a varied performance across states and cannabis categories, with notable improvements in some areas. In Arizona, the brand has experienced a consistent upward trend in the Flower category, climbing from the 50th position in October 2025 to 36th by January 2026, alongside a significant increase in sales. However, their Pre-Roll category performance in the same state was less consistent, peaking at 43rd in December before slipping slightly to 44th in January. In California, Seed Junky Genetics made a striking leap in the Flower category, moving from being unranked in October to reaching the 53rd position by January. This upward trajectory indicates a growing presence and acceptance in the Californian market.

Meanwhile, in Michigan, Seed Junky Genetics has demonstrated a strong foothold in the Pre-Roll category, maintaining a steady 16th rank from December 2025 through January 2026. This consistency suggests a solid consumer base for their Pre-Roll products in the state. However, their performance in the Flower category was less stable, being unranked in October and December, but reappearing at 96th in January, indicating fluctuations in market penetration. The brand's varied rankings across different categories and states highlight both challenges and opportunities, suggesting areas where Seed Junky Genetics could focus to enhance its market presence further.

Competitive Landscape

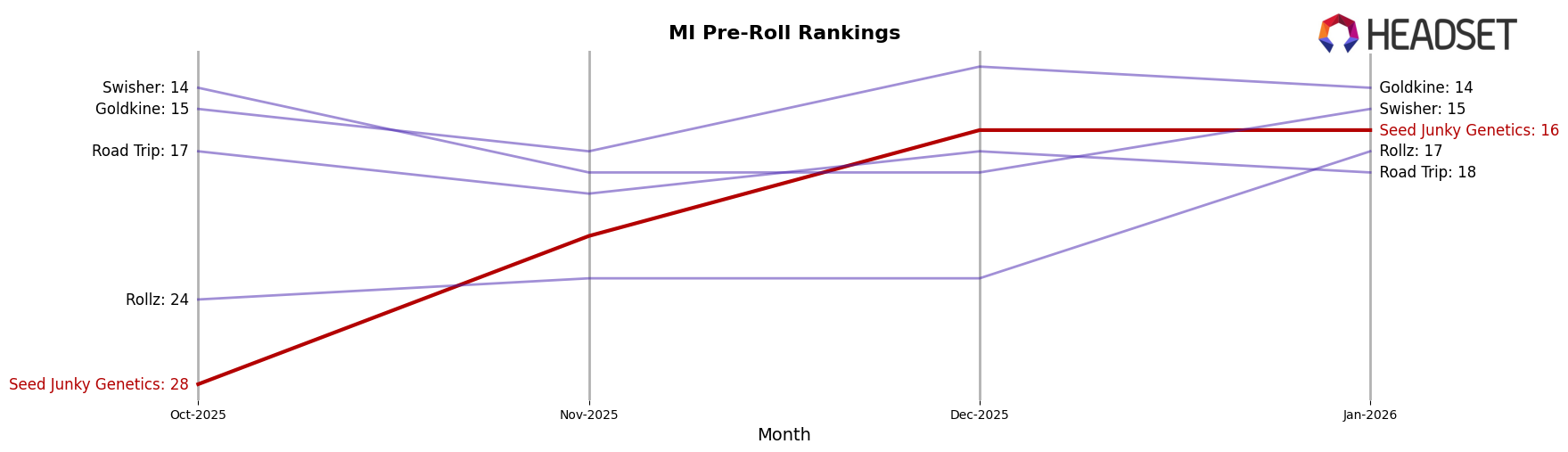

In the competitive landscape of the Michigan Pre-Roll category, Seed Junky Genetics has shown a notable upward trajectory in rankings, moving from 28th place in October 2025 to 16th by January 2026. This improvement in rank is indicative of a positive trend in sales performance, as evidenced by a steady increase in sales from October to December, followed by a slight dip in January. In comparison, Goldkine and Swisher have maintained higher ranks, with Goldkine consistently outperforming Seed Junky Genetics in sales, despite experiencing fluctuations in their own rankings. Meanwhile, Road Trip and Rollz have shown less stability, with Road Trip dropping slightly in rank and Rollz making a significant leap in January. The competitive dynamics suggest that while Seed Junky Genetics is gaining ground, it faces stiff competition from established brands like Goldkine and Swisher, which continue to lead in sales and rank within the Michigan Pre-Roll market.

Notable Products

In January 2026, Seed Junky Genetics saw Gello Shotz Pre-Roll (1g) rise to the top of the sales rankings, securing the number one position with a notable sales figure of 6245 units. Gas Face Pre-Roll (1g) maintained a strong performance, holding steady at the second position, despite a decrease in sales compared to December 2025. Zebra Ztripez Pre-Roll (1g) made a significant debut, entering the rankings at third place. Tropical Burst Pre-Roll (1g) followed closely, ranking fourth, while Sour Shotz Pre-Roll (1g) consistently held the fifth position across the months. This analysis highlights the dynamic shifts in product popularity, with Gello Shotz Pre-Roll (1g) notably climbing from fourth in previous months to lead in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.