Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

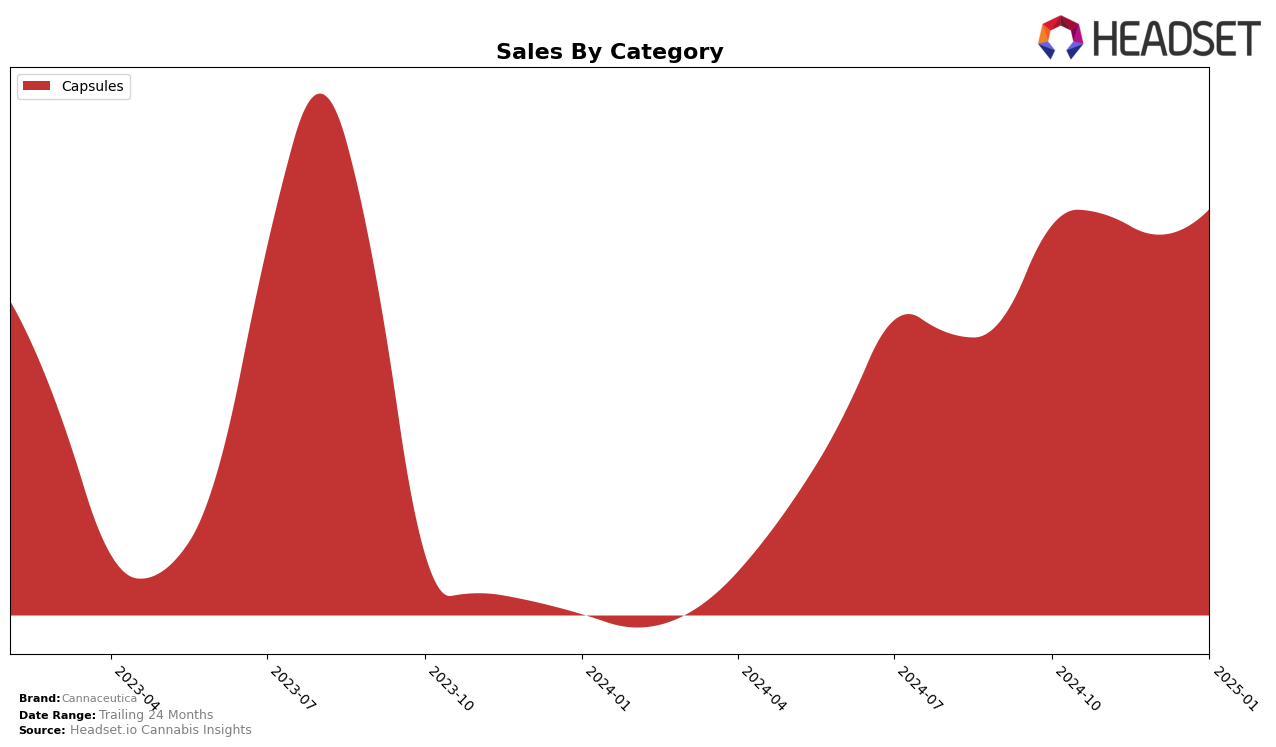

Cannaceutica has consistently maintained a strong presence in the capsules category within Maryland, holding steady at the sixth position from October 2024 through January 2025. This stability in ranking suggests a solid consumer base and effective brand positioning in the state. Despite a slight dip in sales during December 2024, the brand quickly recovered in January 2025, indicating resilience and potential seasonal influences on purchasing behavior. The consistent performance in Maryland highlights Cannaceutica's ability to sustain consumer interest and sales in a competitive market.

While Cannaceutica's performance in Maryland is noteworthy, the absence of rankings in other states or categories suggests areas for potential growth or challenges in market penetration. Not appearing in the top 30 brands in other regions could either indicate a strategic focus on Maryland or highlight opportunities for expansion and increased visibility elsewhere. The brand's consistent rank in Maryland could serve as a model for exploring similar stability and success in other markets. However, without a presence in the top rankings of other states, it remains crucial for Cannaceutica to evaluate its strategies and explore new avenues for growth and diversification.

Competitive Landscape

In the Maryland capsules market, Cannaceutica has maintained a consistent rank of 6th place from October 2024 through January 2025, indicating a stable position in a competitive landscape. Despite this consistency, Cannaceutica faces significant competition from brands like Avexia, which has consistently ranked higher, holding the 2nd position in three out of the four months analyzed. Avexia's sales figures are also notably higher, suggesting a strong market presence and consumer preference. Meanwhile, Kalm Fusion (K Fusion) trails just behind Cannaceutica, maintaining a 7th place rank for the same period, except for January 2025, where it did not appear in the top 20. This absence could indicate a potential decline in their market influence, which might present an opportunity for Cannaceutica to strengthen its position and potentially move up in rank. Overall, while Cannaceutica's sales have shown slight fluctuations, the brand remains a stable player in the Maryland capsules category, with opportunities to capitalize on shifts in the competitive landscape.

Notable Products

In January 2025, Cannaceutica's top-performing product was the Broad Spectrum Cannabis Oil Capsule 10-Pack (100mg), which maintained its number one rank from previous months, achieving an impressive sales figure of 883 units. The CBD:THC Broad Spectrum Cannabis Oil Capsule 20-Pack (50mg CBD, 150mg THC) held steady in the second position, with a notable increase in sales to 630 units from December 2024. The Broad Spectrum Cannabis Oil Capsule 40-Pack (100mg) consistently ranked third, showing a stable trend in sales over the past months. This consistency in rankings highlights the strong market preference and demand for Cannaceutica's capsule products. Overall, the sales figures for these top products indicate a growing consumer base and sustained interest in Cannaceutica's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.