Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

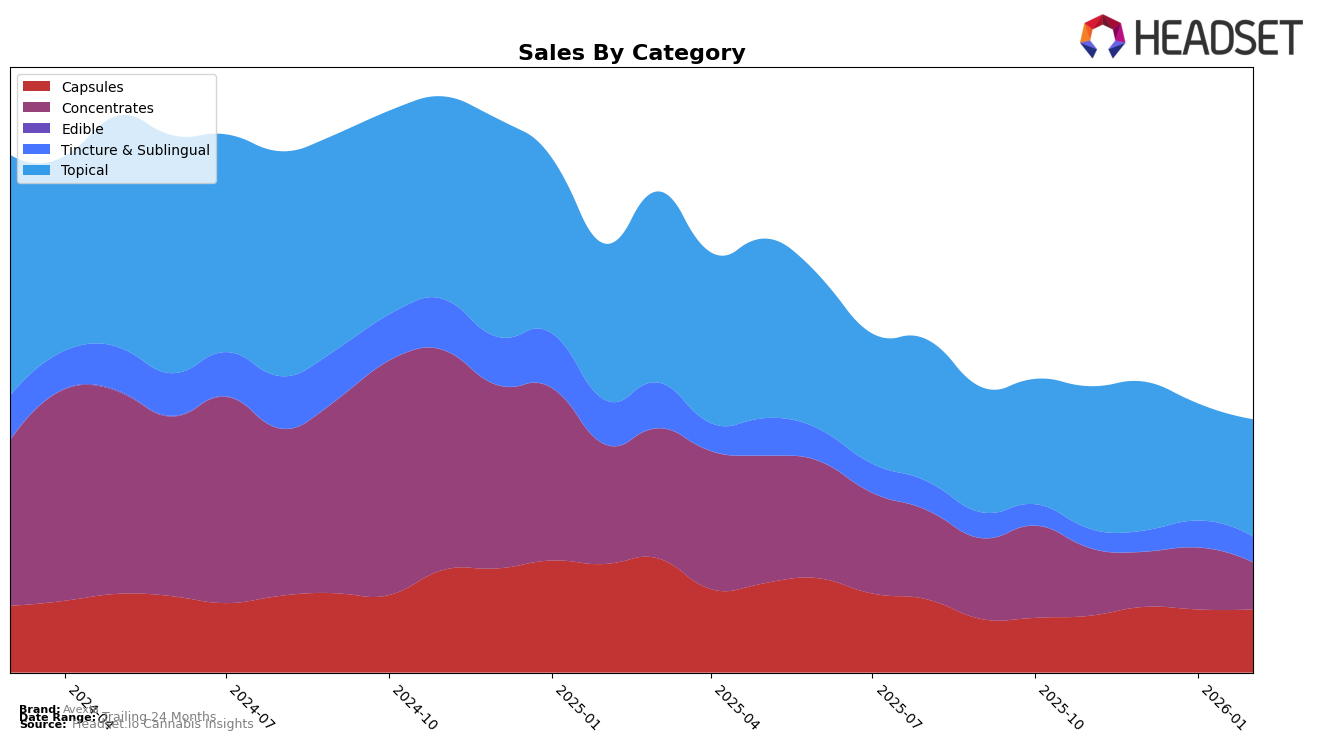

Avexia has demonstrated a strong presence in the Illinois market, particularly in the Capsules and Topical categories. The brand consistently held the second rank in Capsules from November 2025 through February 2026, indicating a stable performance. In the Topical category, Avexia maintained the top position across the same period, showcasing its dominance and consumer preference in this segment. However, its performance in Concentrates was less impressive, fluctuating around the 26th to 28th positions, which suggests room for improvement in this category. In Maryland, Avexia also showed resilience in Capsules, consistently ranking in the top three, although it temporarily slipped to third place in January 2026.

In New Jersey, Avexia's performance in Concentrates was notable, with a peak at the 12th position in January 2026, although it dropped to 16th by February. The brand's entry into the Tincture & Sublingual category was marked by a strong debut at the fourth position, maintaining this rank in both January and February 2026. Meanwhile, in Ohio, Avexia held steady in the Tincture & Sublingual category, improving to the third rank by January 2026. Its performance in Topicals was also commendable, consistently ranking in the top five. However, the absence of Avexia from the top 30 in Maryland's Concentrates category by February 2026 highlights a potential area for strategic focus and growth. These insights provide a glimpse into Avexia's market dynamics and suggest areas where the brand could bolster its presence.

Competitive Landscape

In the Illinois Topical category, Avexia has consistently maintained its top position from November 2025 through February 2026, showcasing its strong market presence and consumer preference. Despite fluctuations in sales figures, Avexia's rank remains unaffected, indicating a robust brand loyalty and effective market strategy. Competitors like Doctor Solomon's have shown a slight decline in rank, dropping from second to third place by February 2026, which could suggest challenges in maintaining their market share. Meanwhile, Pheotera Grove has remained stable in the fourth position, indicating steady performance but not enough to challenge Avexia's dominance. These insights highlight Avexia's stronghold in the market, suggesting that competitors need to innovate or adjust strategies to compete effectively.

Notable Products

For February 2026, Avexia's top-performing product is the CBD/THC 1:1 Harmony Pain Relief Balm (100mg CBD, 100mg THC, 2oz) in the Topical category, maintaining its first-place rank consistently from November 2025. The CBN/CBD/THC 1:1:1 Comfort Tablets 40-Pack remains steadfast in the second position, with sales figures reaching 1847 units. The CBD/THC 4:1 Relief Tablets 40-Pack continues to hold the third rank, showing stable performance over the months. Notably, the CBD/THC 1:1 Harmony Micro-Dosed Tablets 40-Pack improved its ranking to fourth place, up from fifth in January 2026. The CBG/THC 1:1 Ascend Tablets 40-Pack maintains its fifth position, indicating steady demand in the Capsules category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.