Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

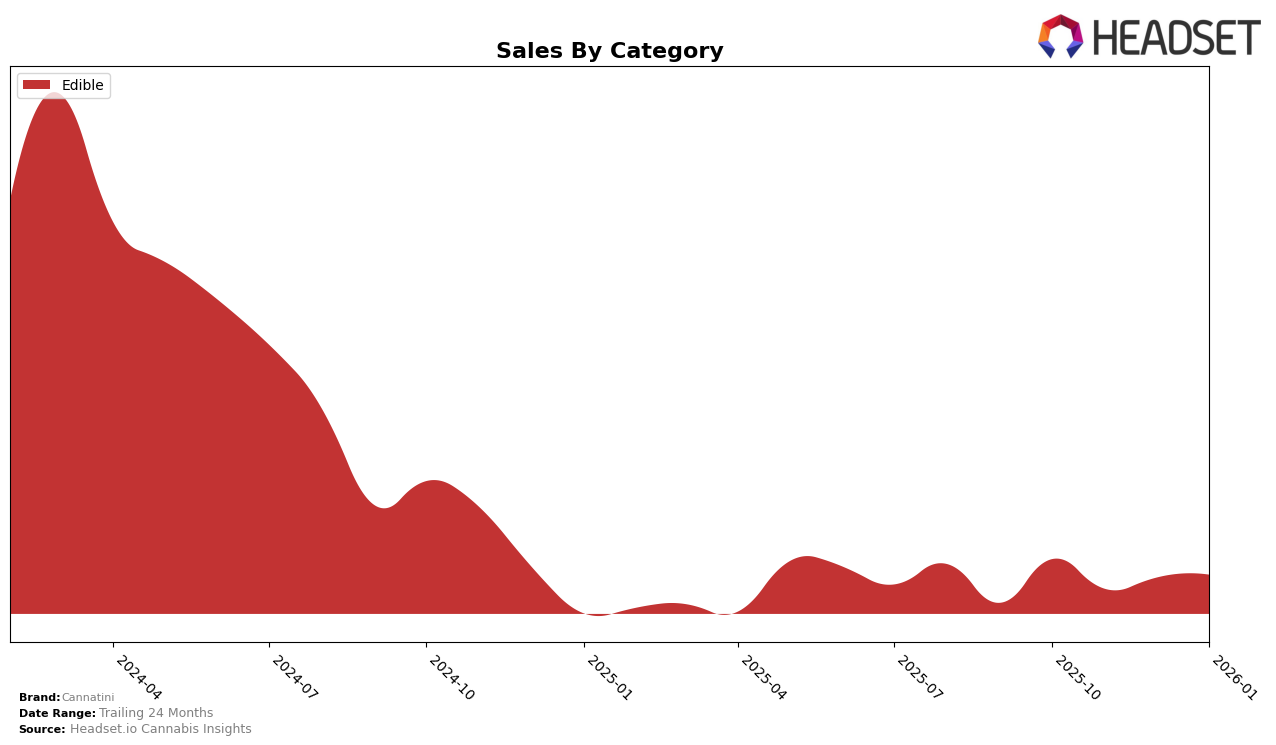

In the state of Massachusetts, Cannatini has shown a dynamic performance in the Edible category over the past few months. Starting at rank 25 in October 2025, the brand experienced a slight decline to rank 31 in November, which indicates a temporary dip in their market presence. However, Cannatini managed to recover and re-enter the top 30 by December, finishing the month at rank 30 and improving further to rank 27 in January 2026. This fluctuation suggests that while the brand faced some challenges, it has been able to maintain and slightly improve its position, indicating resilience in a competitive market.

Despite the fluctuations in ranking, Cannatini's sales figures in Massachusetts reveal a consistent performance with minor variances. The brand's sales peaked in October 2025, with a slight drop in November, followed by a gradual recovery in the subsequent months. This trend suggests that while Cannatini's market rank may have experienced ups and downs, the brand has managed to sustain its sales volume, which is a positive sign of consumer loyalty and effective market strategies. However, the brand's absence from the top 30 in November highlights areas for potential improvement in maintaining a stable market position throughout the year.

Competitive Landscape

In the Massachusetts edibles market, Cannatini has experienced fluctuating rankings over the past few months, moving from 25th in October 2025 to 27th in January 2026. Despite these changes, Cannatini's sales have shown a slight recovery from November to January, indicating a potential stabilization. Notably, Sparq Cannabis Company has consistently outperformed Cannatini, maintaining a higher rank and experiencing a significant sales spike in December 2025. Meanwhile, Go To has shown a strong upward trend, surpassing Cannatini in January 2026. Jams and Dorks have also been close competitors, with Jams briefly overtaking Cannatini in December. These dynamics suggest that while Cannatini remains a key player, it faces stiff competition and must strategize to improve its market position.

Notable Products

In January 2026, Cannatini's top-performing product was the Sativa Tropical White Sangria RSO Fruit Chews 20-Pack (100mg), maintaining its lead from December 2025 with sales of 795 units. The Indica Sour Grape Sangria RSO Gummies 20-Pack (100mg) held steady in the second position, showing a slight recovery in sales compared to December. The THC/CBD/CBN 2:1:1 Blackberry Martini RSO Chews with Melatonin 20-Pack (100mg THC, 50mg CBD, 50mg CBN) made a significant leap to third place from its previous fifth position, marking a notable increase in popularity. The Indica Sour Grape Sangria RSO Chews 20-Pack (100mg) slipped to fourth place, consistently declining in sales over the months. Meanwhile, the THC/THCV 1:1 Sativa Peach Tequila Sunrise RSO Chews 20-Pack (100mg THC, 100mg THCV) re-entered the top five, indicating a resurgence in consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.