Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

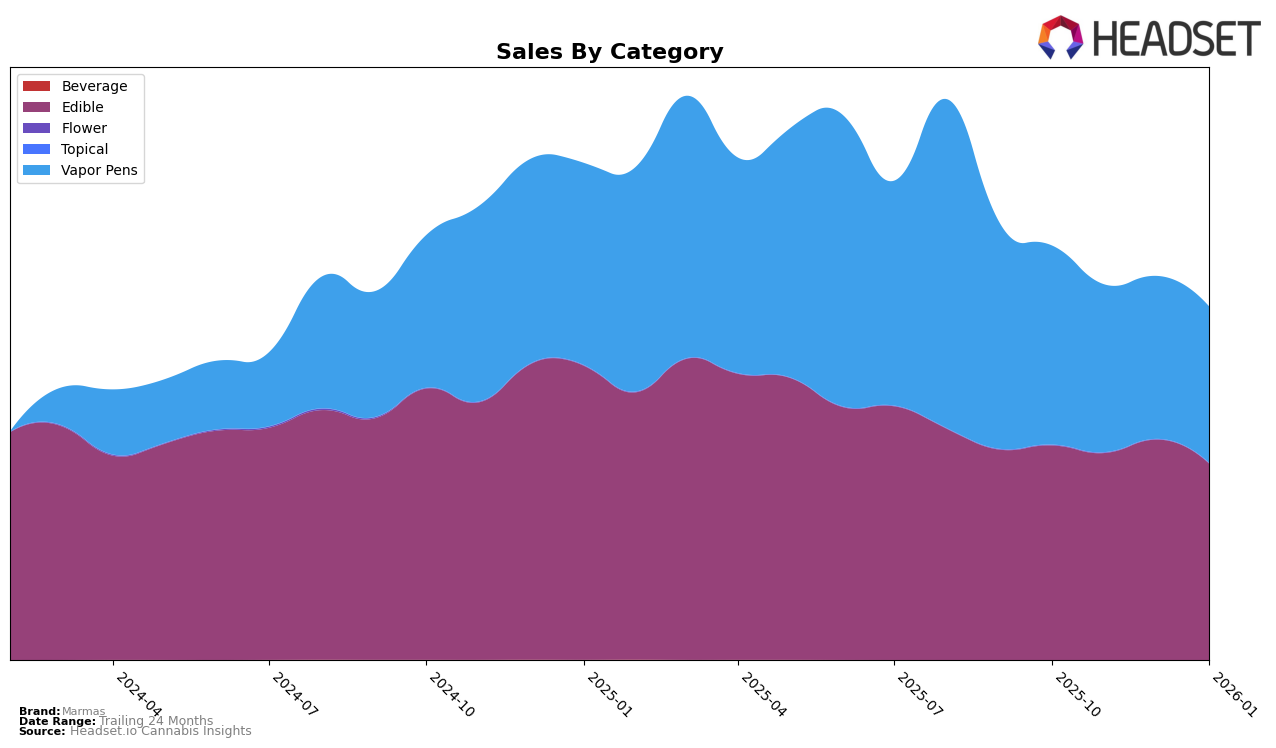

Marmas has shown varied performance across different states and categories, with some notable movements in rankings. In Illinois, their presence in the Vapor Pens category has been outside the top 30, with rankings fluctuating between 46 and 54 over the last few months. Despite these lower rankings, there was a positive upward movement in January 2026, improving to rank 51. This indicates potential growth or market adjustments in Illinois. Meanwhile, in Massachusetts, Marmas maintained a steady presence in the Edible category, hovering around the 31st to 33rd positions, suggesting a consistent market demand for their products in this category.

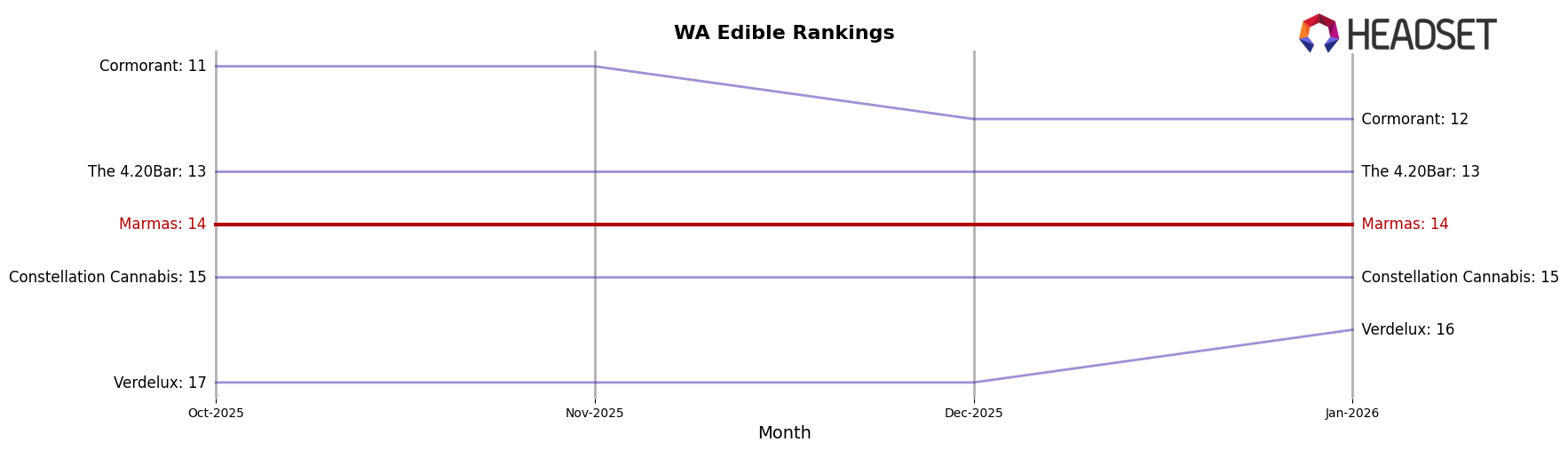

In Washington, Marmas has maintained a strong position in the Edible category, consistently ranking 14th over the past few months, which underscores their stable market presence and consumer preference in this category. However, their performance in the Vapor Pens category in Washington has been less impressive, with rankings ranging from 73 to 91, indicating challenges in gaining a stronger foothold. The absence of Marmas in the top 30 in some categories across states could be seen as a significant area for improvement or a strategic decision to focus on particular markets. Overall, while Marmas has shown some resilience and consistency in certain areas, there are clear opportunities for growth and expansion in others.

Competitive Landscape

In the Washington edible market, Marmas consistently held the 14th rank from October 2025 to January 2026, indicating a stable position amidst a competitive landscape. Despite maintaining its rank, Marmas experienced a fluctuation in sales, peaking in December 2025 before a slight decline in January 2026. This stability in rank contrasts with competitors like Cormorant, which saw a drop from 11th to 12th rank, and Verdelux, which improved its position from 17th to 16th. Meanwhile, The 4.20Bar and Constellation Cannabis maintained their ranks at 13th and 15th, respectively, with The 4.20Bar consistently outperforming Marmas in sales. These dynamics suggest that while Marmas remains a steady player, there is potential for upward movement if it can capitalize on the sales fluctuations of its competitors.

Notable Products

In January 2026, Marmas' top-performing product was the Tranqility - CBD/THC 4:1 Huckleberry Marmalade Candy Bites 10-Pack, maintaining its number one rank for the fourth consecutive month with sales of 2156 units. The Strawberry Marmalade Candy Bites held steady at the second position, although its sales saw a slight decrease from the previous month. Indica Huckleberry Gummies remained consistently in third place, showcasing stable sales figures. The Sour Blue Raspberry Marmalade Gummies also kept their fourth spot but experienced a drop in sales compared to December. Notably, the new entrant, CBD/THC/CBN 1:1:1 Bedtime Blue Raspberry Gummies, debuted at fifth place, contributing to the diversity of Marmas' top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.