Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

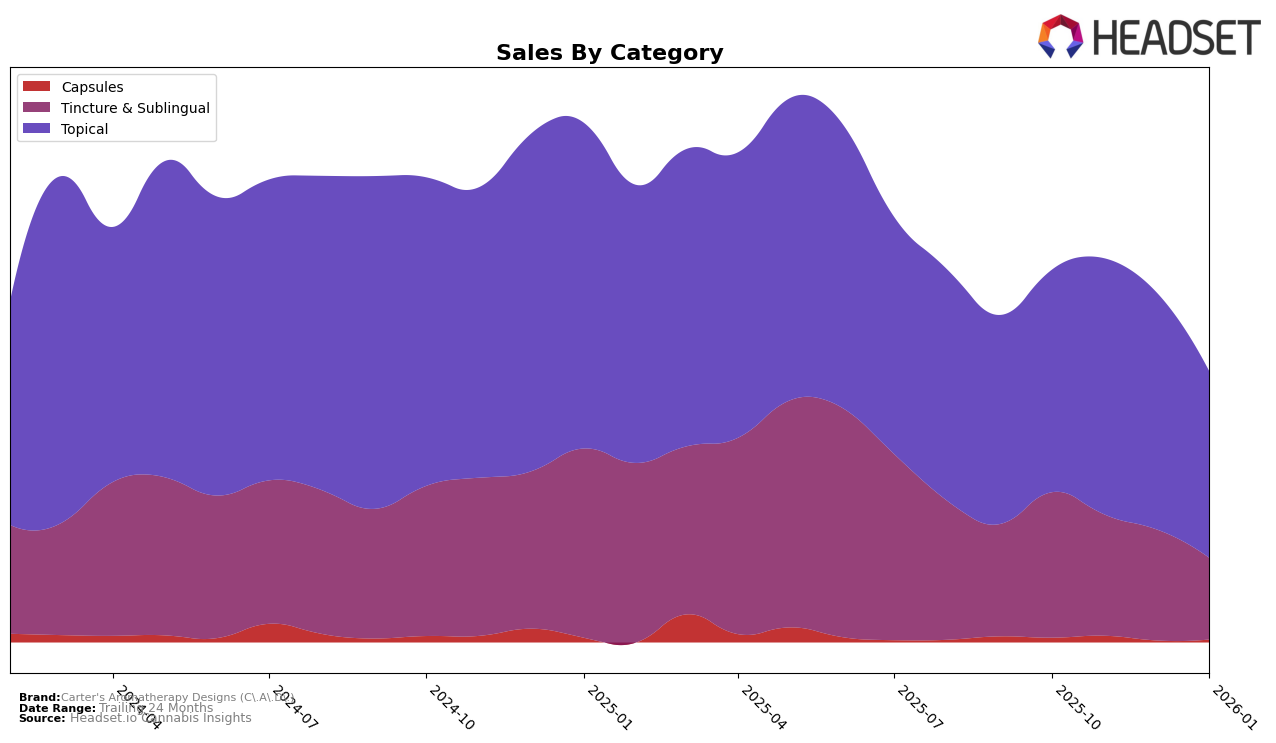

In the state of California, Carter's Aromatherapy Designs (C.A.D.) has shown varying performance across different product categories over the recent months. In the Tincture & Sublingual category, C.A.D. has seen a slight decline in its ranking, moving from 17th in October 2025 to 19th by January 2026. This downward trend is accompanied by a consistent decrease in sales, which may indicate increased competition or shifting consumer preferences within this category. Despite these challenges, C.A.D. has maintained a presence within the top 20, suggesting a resilient market position even amidst fluctuating sales figures.

Conversely, C.A.D.'s performance in the Topical category in California has been relatively stable and strong. The brand consistently held a position within the top 5 from October 2025 to January 2026, which underscores its strength and popularity in this segment. Although there was a slight dip in sales from November to January, the brand's ability to maintain its ranking suggests a loyal customer base and effective product positioning. The consistency in these rankings highlights C.A.D.'s potential to capitalize on its established reputation in the Topical category, even as it navigates a competitive landscape.

Competitive Landscape

In the competitive landscape of California's topical cannabis market, Carter's Aromatherapy Designs (C.A.D.) has maintained a stable presence, consistently ranking 5th from November 2025 to January 2026, despite a slight dip from its 4th position in October 2025. This steadiness in ranking highlights its resilience amidst fluctuating sales figures, particularly in comparison to competitors like Sweet ReLeaf (CA), which experienced more volatility in rankings, moving from 5th to 4th, then back to 6th, and up again to 4th. Meanwhile, Buddies consistently held the 3rd position, indicating a strong market presence with significantly higher sales figures. Care By Design and Liquid Flower also showed fluctuations, with Liquid Flower briefly surpassing C.A.D. in December 2025. These dynamics suggest that while C.A.D. maintains a solid mid-tier position, there is room for strategic growth to challenge higher-ranked competitors, especially as the market shows signs of volatility and opportunity for advancement.

Notable Products

In January 2026, Carter's Aromatherapy Designs (C.A.D.) maintained strong sales with their CBD/THC 2:1 Rasta Pain Cream (1000mg CBD, 500mg THC, 2oz) continuing to hold the top rank in the Topical category, although its sales slightly decreased to 209 units. The CBD:THC 2:1 Mimosa Cream (215mg CBD, 130mg THC, 1.9oz) remained steady at the second position with an increase in sales to 195 units. The CBN:CBD:THC Cooling Transdermal Patch (30mg CBD, 25mg CBN, 25mg THC) showed significant improvement, climbing to third place in January from its previous fifth-place ranking in December. Nana's Nighttime CBN Tincture (220mg CBN, 220mg THC) secured the fourth spot in the Tincture & Sublingual category, showing consistency in its sales performance. Lastly, the CBD/THC Balance Tincture (650mg CBD, 20mg THC) dropped slightly to fifth place, indicating a minor decline in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.