Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

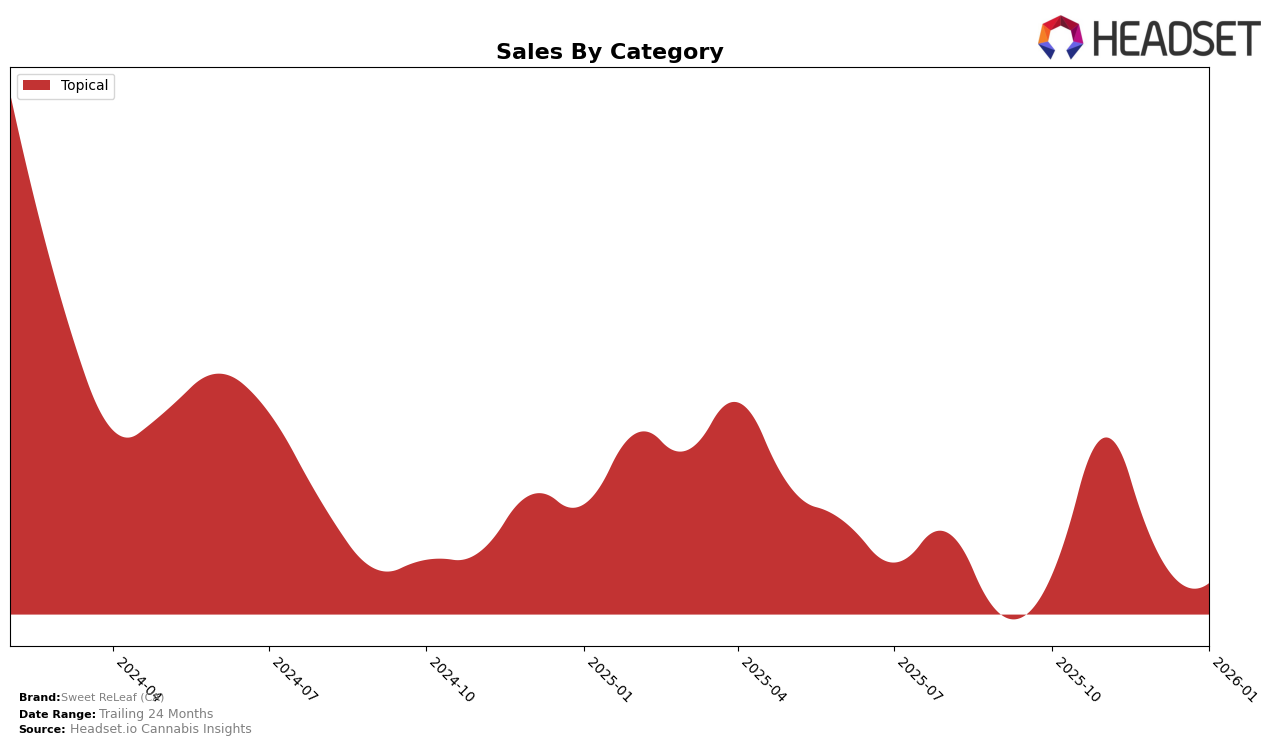

Sweet ReLeaf (CA) has shown notable performance in the Topical category within California. Over the past few months, the brand has consistently ranked within the top 10, demonstrating a strong foothold in this segment. In October 2025, Sweet ReLeaf held the 5th position, improving to 4th in November, then dropping slightly to 6th in December, before returning to 4th in January 2026. This fluctuation suggests a competitive market landscape, but Sweet ReLeaf's ability to rebound to a higher rank indicates resilience and a strong consumer base. The highest sales figure during this period was recorded in November, highlighting a peak in consumer demand or possibly a successful marketing campaign.

Interestingly, Sweet ReLeaf's absence from the top 30 in other categories or states could be viewed as a limitation in their market penetration or product diversification. This lack of presence outside the Topical category in California may suggest a focused strategy on a niche market, which could be beneficial in terms of brand specialization but might also imply missed opportunities in broader market segments. The brand's consistent performance within its niche, however, underscores its strength and potential for targeted growth, especially if they can leverage their existing success to explore new categories or geographic markets in the future.

Competitive Landscape

In the competitive landscape of the California topical cannabis market, Sweet ReLeaf (CA) has demonstrated a dynamic performance from October 2025 to January 2026. Despite facing stiff competition, Sweet ReLeaf (CA) improved its rank from 5th in October to 4th in November, although it briefly slipped to 6th in December before rebounding to 4th in January. This fluctuation highlights the brand's resilience and ability to recover quickly in a competitive market. Notably, Mary's Medicinals consistently held the top position, maintaining a strong lead with sales significantly higher than Sweet ReLeaf (CA). Meanwhile, Buddies remained steady in 3rd place, and Carter's Aromatherapy Designs (C.A.D.) and Liquid Flower also presented formidable competition, with ranks closely interchanging with Sweet ReLeaf (CA). This competitive environment underscores the importance for Sweet ReLeaf (CA) to leverage strategic marketing and product differentiation to enhance its market share and solidify its position in the California topical category.

Notable Products

In January 2026, Sweet ReLeaf (CA) saw the CBD/THC 1:14 Comfort + Extra Strength Body Butter (37.5mg CBD, 525mg THC, 100ml) and the CBD/THC 1:14 Comfort + Extra Strength Body Butter (9.5mg CBD, 131mg THC, 25ml) both share the top position in the rankings. Notably, the CBD/THC 1:14 Comfort + Extra Strength Body Butter (9.5mg CBD, 131mg THC, 25ml) maintained its top rank from December 2025, with a sales figure of 292 units. The CBD/THC 1:14 Body Butter Comfort Plus Creme (18.75mg CBD, 263mg THC, 50ml) improved its position, rising to the second rank from third place in the previous months. Meanwhile, CBD:THC 1:14 Comfort Warm Dry Oil (19.5mg CBD, 270mg THC, 30ml, 1oz) climbed to third place, showing significant growth since its debut in December 2025. Overall, the Topical category dominated the rankings, with consistent performances across these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.