Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

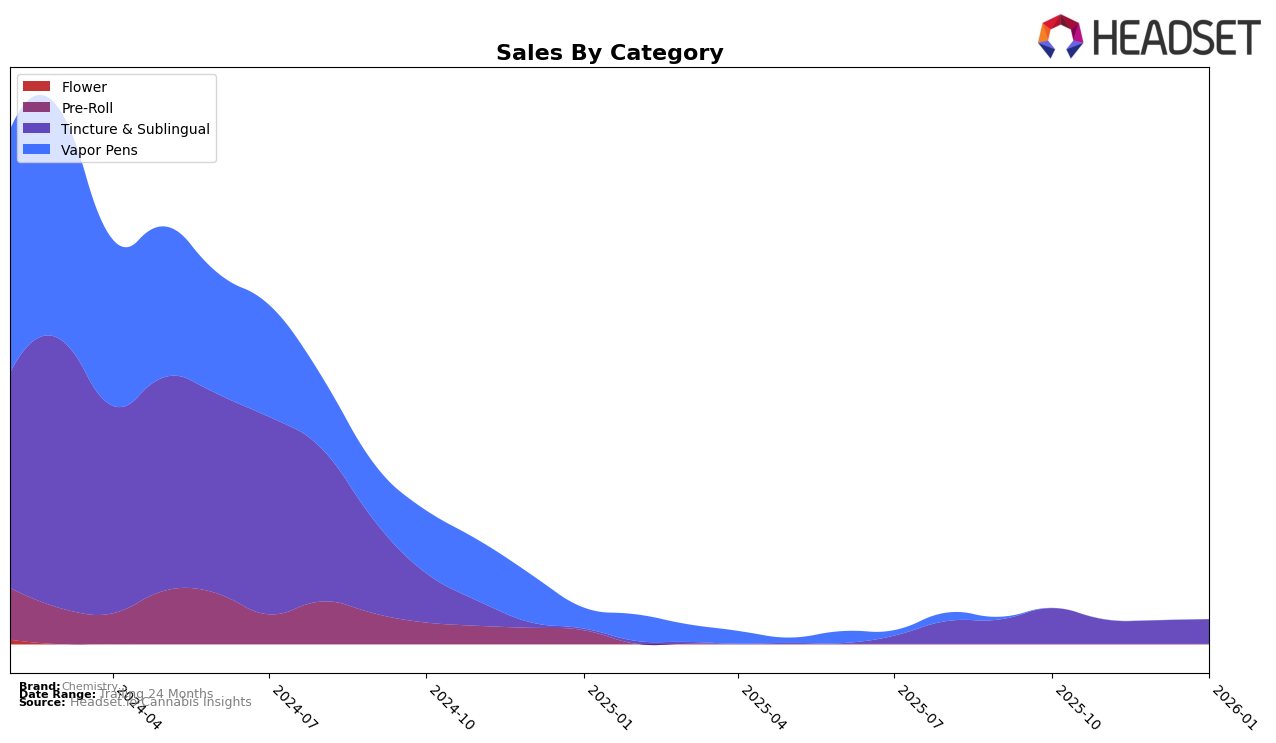

In the state of California, Chemistry has shown a noteworthy presence in the Tincture & Sublingual category. As of October 2025, the brand secured the 21st position, indicating a solid foothold within this competitive segment. However, the absence of rankings for the subsequent months suggests that Chemistry did not maintain its top 30 status in the following months, which could be a point of concern regarding their market penetration or competitive strategy in this category. This fluctuation highlights the challenges brands face in maintaining consistent visibility and performance in a highly dynamic market like California's.

The data indicates that Chemistry's sales figures for October 2025 were $10,141, but without subsequent rankings or sales data for the following months, it is difficult to assess whether this figure represented a peak or a baseline for the brand. The lack of top 30 rankings in November, December, and January may suggest a decline in market performance, or possibly a strategic pivot in focus away from this category. This kind of movement can reflect broader trends in consumer preferences or shifts in brand strategy, which are crucial for stakeholders to monitor for future decision-making.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, Chemistry has faced significant challenges in maintaining a top 20 rank. As of October 2025, Chemistry was ranked 21st, indicating it was just outside of the top 20, and it did not appear in the rankings for the subsequent months. This suggests that Chemistry has struggled to compete against brands like Breez, which consistently maintained a presence in the top 20, even improving its rank from 20th in November 2025 to 17th in December 2025. Additionally, Emerald Spirit Botanicals briefly appeared in the rankings in November 2025 at 21st, indicating a competitive environment where new entrants can quickly challenge existing players. Meanwhile, Casa Flor entered the rankings in January 2026 at 21st, showcasing the dynamic shifts in brand performance within this category. These competitive pressures highlight the need for Chemistry to innovate and differentiate itself to regain its position in the top 20 and boost sales in the California market.

Notable Products

In January 2026, the top-performing product from Chemistry was Moods- CBD:THC 5:1 Yellow Tincture, maintaining its leading position with sales of 97 units. Moods - CBD/THC 3:1 Energize Orange Tincture rose to the second spot from third in December, showing a notable increase in sales to 71 units. Moods- CBD:THC 1:1 Pink Tincture dropped from the second to the third rank, with sales slightly declining to 56 units. The Moods- CBD:THC 1:10 Blue Tincture remained steady at fourth place, while Moods - CBD/THC 1:3 Purple Tincture consistently held the fifth position across the months. These rankings suggest a stable preference for the Yellow Tincture, while the Orange Tincture saw a resurgence in popularity compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.