Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

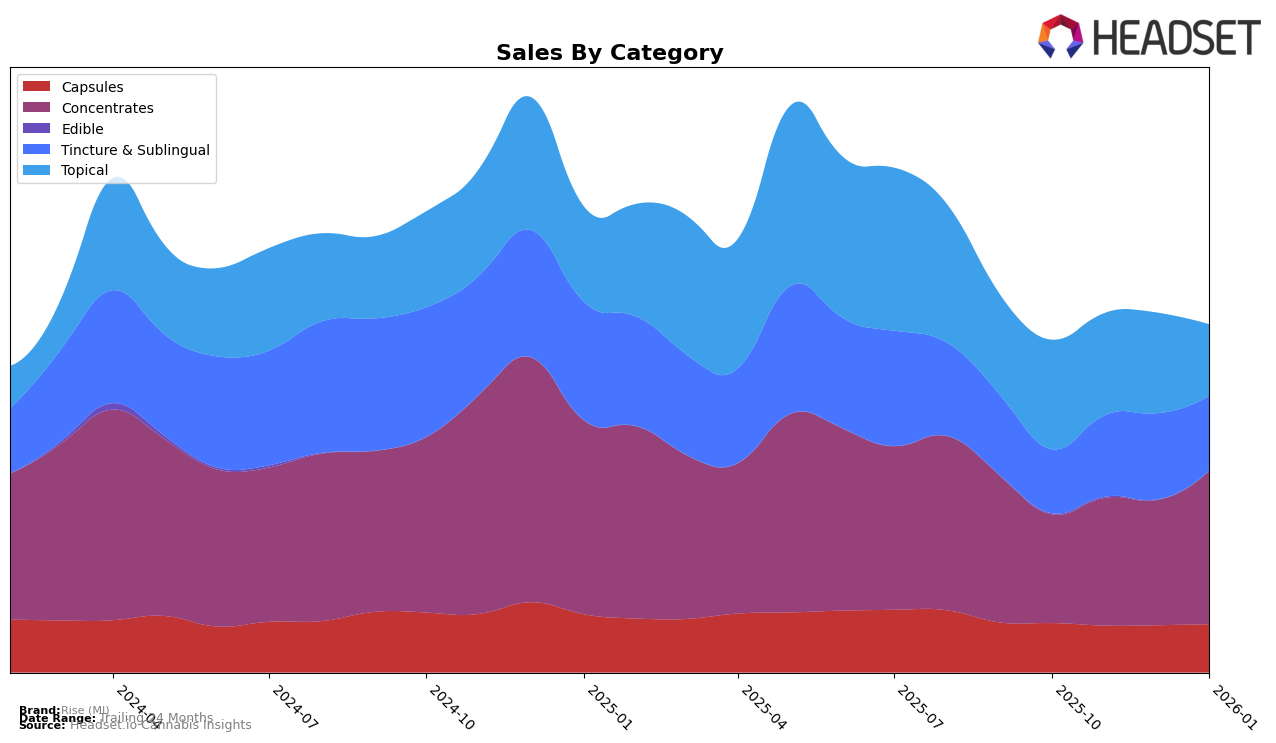

Rise (MI) has demonstrated a robust performance in the Michigan market, particularly in the Capsules category, where it has consistently held the number one position from October 2025 through January 2026. This dominance is indicative of a strong consumer preference and possibly effective product positioning. In the Tincture & Sublingual category, Rise (MI) showed impressive upward movement, climbing from third place in October to securing the top spot by December, which it maintained into January. This suggests a growing acceptance and demand for their products in this category, despite a slight dip in sales in January compared to December.

Conversely, in the Concentrates category, Rise (MI) has not broken into the top 30 rankings, indicating potential challenges or a more competitive landscape. However, it's noteworthy that their ranking improved from 44th in October to 34th by January, suggesting a positive trend and potential for future growth if sustained. In the Topical category, Rise (MI) has maintained a steady third-place ranking, although sales have shown a downward trend, particularly in January. This could signal a need for strategy reassessment to maintain or improve their standing in this segment. Overall, while Rise (MI) has seen successes and challenges across categories, its performance in Michigan reflects both strongholds and opportunities for further market penetration.

Competitive Landscape

In the competitive landscape of the Michigan concentrates market, Rise (MI) has shown a notable upward trajectory in both rank and sales over the past few months. From October 2025 to January 2026, Rise (MI) improved its rank from 44th to 34th, indicating a positive trend in market presence. This improvement is underscored by a significant increase in sales, particularly in January 2026, where Rise (MI) outperformed brands like Cloud Cover (C3) and True North Collective, both of which have fluctuated in their rankings. Notably, Exotic Matter, despite a dip in January, remains a strong competitor with consistently higher sales. Meanwhile, Monopoly Melts made a remarkable leap in rank, surpassing Rise (MI) in January, which suggests an emerging competitive threat. These dynamics highlight the competitive pressures and opportunities for Rise (MI) to further capitalize on its current momentum in the Michigan concentrates market.

Notable Products

In January 2026, the top-performing product for Rise (MI) was the RSO Syringe (1g) in the Concentrates category, which reclaimed the number one rank with sales reaching 1529 units. The THC Tincture (200mg) emerged as a strong contender, securing the second rank, marking its first appearance in the rankings. The Hybrid RSO Dart (1g) also made a notable entry, ranking third in January after being unranked in the previous two months. The CBN/CBD/THC 1:1:1 PM Evening Tincture experienced a decline, dropping to the fourth position from its earlier top rank in November 2025. Meanwhile, the CBD Tincture (2500mg CBD) maintained a steady presence, rounding out the top five products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.