Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

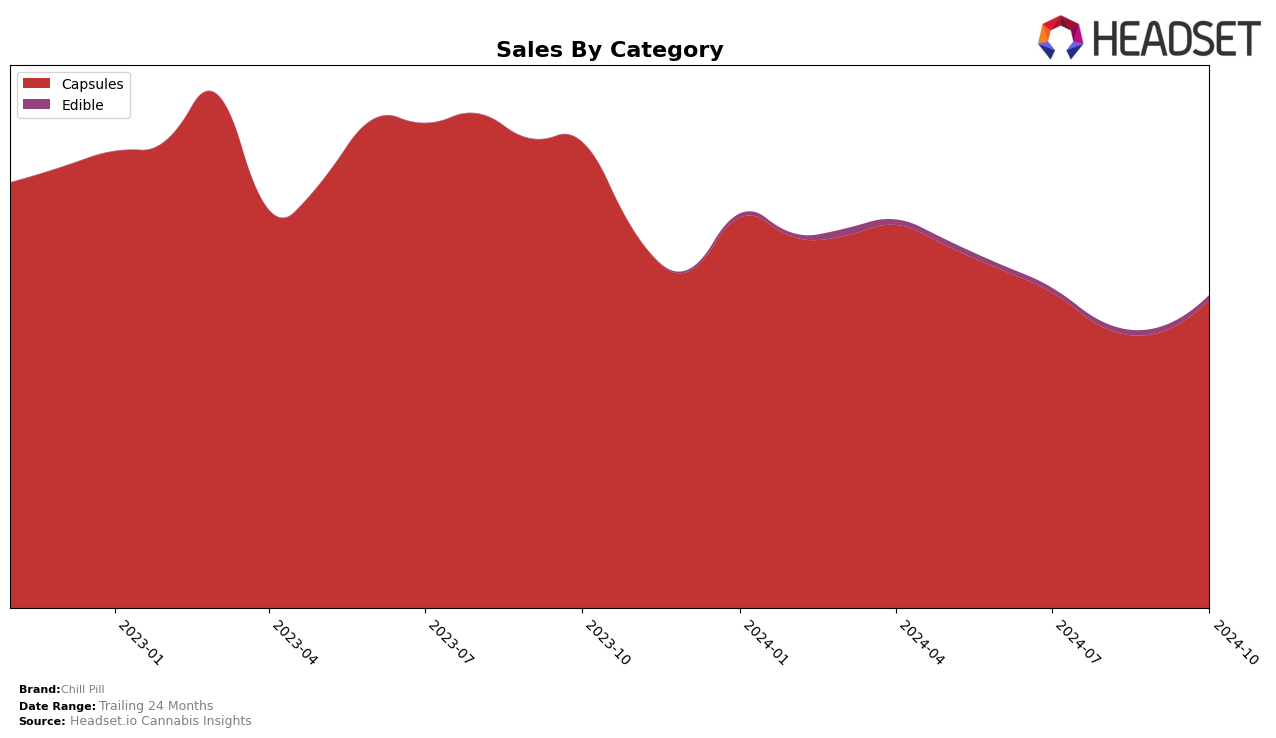

Chill Pill has demonstrated a consistent performance in the Capsules category within Arizona, maintaining the top rank from July to October 2024. Despite a slight fluctuation in sales figures over these months, the brand has managed to retain its number one position, which is a testament to its strong market presence and consumer loyalty. This stability is particularly noteworthy given the competitive nature of the cannabis market, where maintaining a leading position requires continuous innovation and effective marketing strategies. However, it is important to note that while Chill Pill excels in Arizona, its absence from the top 30 rankings in other states and provinces suggests potential areas for growth and market expansion.

The consistent ranking of Chill Pill as the top brand in the Capsules category in Arizona is a positive indicator of its strong foothold in this particular market. However, the lack of presence in the top 30 rankings in other states and provinces highlights a significant opportunity for the brand to explore new markets and diversify its geographical reach. This could involve strategic initiatives such as tailored marketing campaigns or product adaptations to meet the preferences of consumers in different regions. By leveraging its success in Arizona, Chill Pill could potentially replicate its winning formula in other markets, thereby enhancing its overall brand presence and sales performance across the cannabis industry.

Competitive Landscape

In the Arizona capsules market, Chill Pill has consistently maintained its top position from July to October 2024, showcasing its strong brand presence and consumer loyalty. Despite fluctuations in sales figures, Chill Pill's ability to retain the number one rank indicates a robust market strategy and product appeal. Competitors like Sweet Science and Press have shown some movement in rankings, with Sweet Science briefly dropping to third place in September before reclaiming the second spot in October, while Press consistently held the third rank except for a brief rise to second in September. These shifts highlight a competitive landscape where Chill Pill's dominance is challenged but not overtaken, suggesting that while competitors are making strategic gains, Chill Pill's market leadership remains unshaken, potentially due to its superior product offerings or brand loyalty.

Notable Products

In October 2024, the top-performing product from Chill Pill was Night Caps - Indica Capsule 10-Pack (100mg), maintaining its number one rank consistently from previous months with a notable sales figure of 1974 units. The Daytime - Sativa Capsule 20-Pack (100mg) showed a significant improvement, moving up to the second rank from a stable third position in prior months. Anytime Caps - Hybrid Capsule 10-Pack (100mg) dropped to third place, despite previously holding the second rank consistently. Day Caps - Sativa Capsule 10-Pack (100mg) remained steady in fourth place, showing a slight increase in sales. Meanwhile, NightCaps - Indica Capsule 20-Pack (100mg) held its rank at fifth, with a modest sales increase compared to September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.