Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

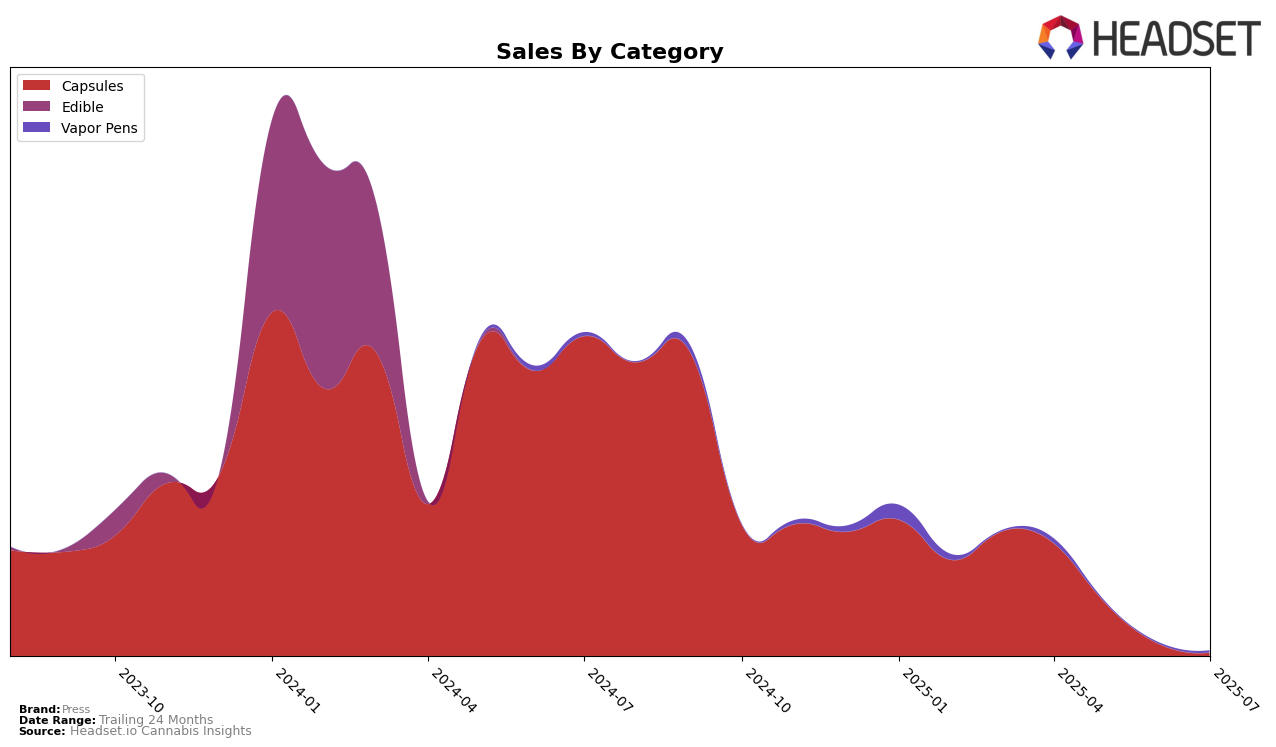

In the analysis of Press's performance across various states, noteworthy movements are observed in the Capsules category. In Arizona, Press held a strong position in April 2025, ranking 3rd in the Capsules category. This high ranking indicates a solid foothold in the market, although subsequent months' data is not available, suggesting that Press may not have maintained a top 30 position. On the other hand, in California, Press was ranked 14th in April 2025, showing a presence in a highly competitive market. However, like Arizona, the absence of rankings in the following months might imply a decline or stagnation in their market performance.

While specific sales figures are sparse, the available data reveals that in April 2025, Press achieved sales of $16,929 in California, which is a significant figure considering the competitive nature of the market. The lack of ranking in subsequent months across both states could be a point of concern, indicating either a drop in popularity or increased competition. This trend necessitates a closer examination of market dynamics and consumer preferences to understand Press's fluctuating positions. Observing these movements can provide insights into the brand's strategy and adaptability in different state markets.

Competitive Landscape

In the Arizona capsules market, Press has demonstrated a strong presence, initially ranking third in April 2025. However, the absence of rank data for the subsequent months suggests that Press did not maintain a top 20 position, indicating potential challenges in sustaining its market position. In contrast, competitors like Sweet Science and Life Is Chill have consistently held the second and first ranks, respectively, throughout the period from April to July 2025. This stability in ranking, coupled with their significantly higher sales figures, highlights a competitive edge that Press may need to address. The data suggests that while Press had a promising start, it may need to strategize effectively to regain and maintain its competitive standing in the Arizona capsules market.

Notable Products

In July 2025, the top-performing product for Press was the Port Berry Cold Cure Live Rosin Disposable (0.5g) in the Vapor Pens category, which climbed from the fourth position in June to secure the top rank, with sales reaching 14 units. The THC Hard Pressed Tablets 20-Pack (1000mg) maintained a strong presence, moving up to second place despite a slight decrease in sales figures. The CBD/THC 1:1 Rally Tablets 15-Pack (75mg CBD, 75mg THC) also saw an improvement, advancing from fifth to third place. Notably, the CBD/THC 1:1 Doze Tablets 20-Pack, which had been a consistent performer in prior months, did not feature in the rankings for July. The CBD/THC 1:1 Shine Tablets 20-Pack, previously in the top four, did not appear in the July rankings either, indicating a shift in consumer preferences towards other products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.