Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

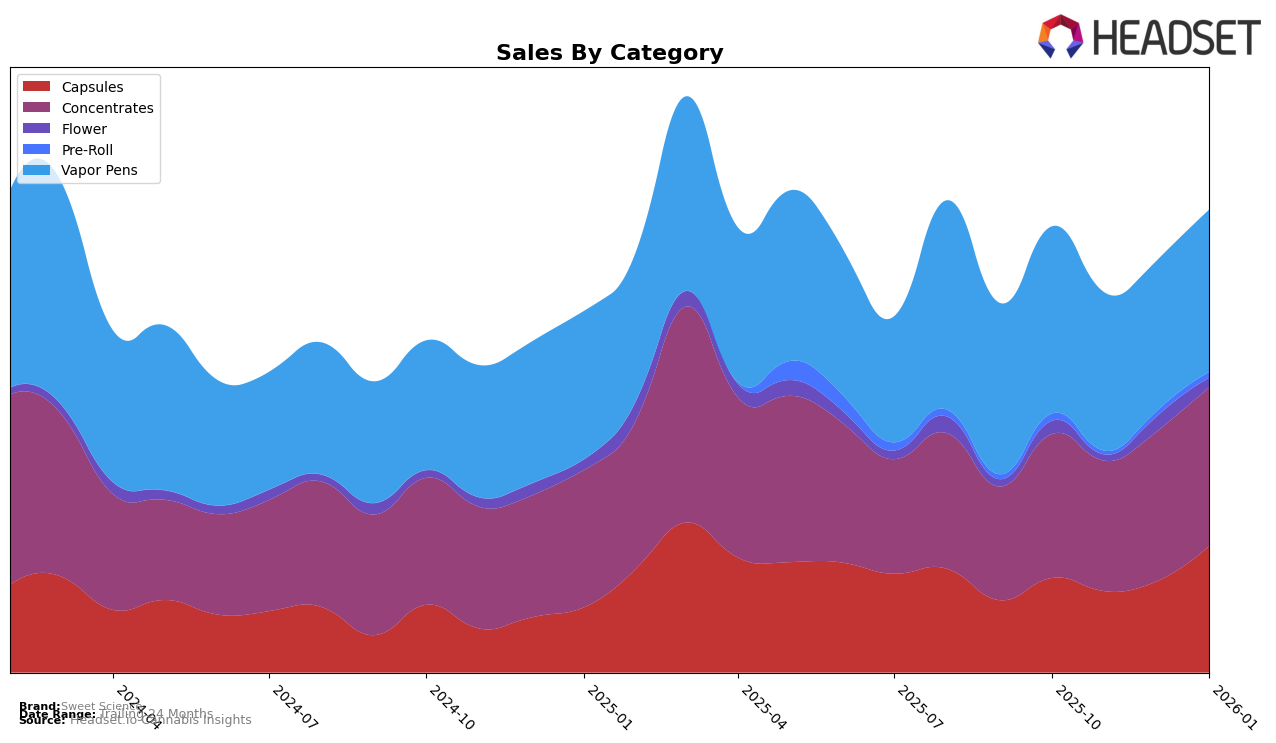

Sweet Science has demonstrated a consistent performance in the Arizona market, particularly within the Capsules and Concentrates categories. The brand has maintained a stronghold in the Capsules category, consistently ranking 2nd from October 2025 through January 2026. This stability suggests a solid consumer base and potentially effective marketing strategies within this product line. In the Concentrates category, Sweet Science has also shown consistency with a steady 16th place ranking over the same period, indicating a stable presence, albeit with room for improvement. However, it's worth noting that Sweet Science did not make it into the top 30 for Vapor Pens, which could be a point of concern, suggesting a need for strategy reassessment or increased market penetration efforts in this category.

Despite not breaking into the top 30 for Vapor Pens, Sweet Science's sales figures in the Capsules category have shown a significant upward trend, with January 2026 sales reaching a notable peak. This increase in sales could be indicative of successful product launches or promotions during this period. Conversely, while the Concentrates category has maintained a steady rank, the sales trajectory also shows a positive trend, suggesting growing consumer interest or loyalty. The performance across these categories highlights Sweet Science's strengths and potential areas for growth within the Arizona market. However, the absence from the top rankings in Vapor Pens suggests that while Sweet Science is strong in certain areas, there is untapped potential in others.

Competitive Landscape

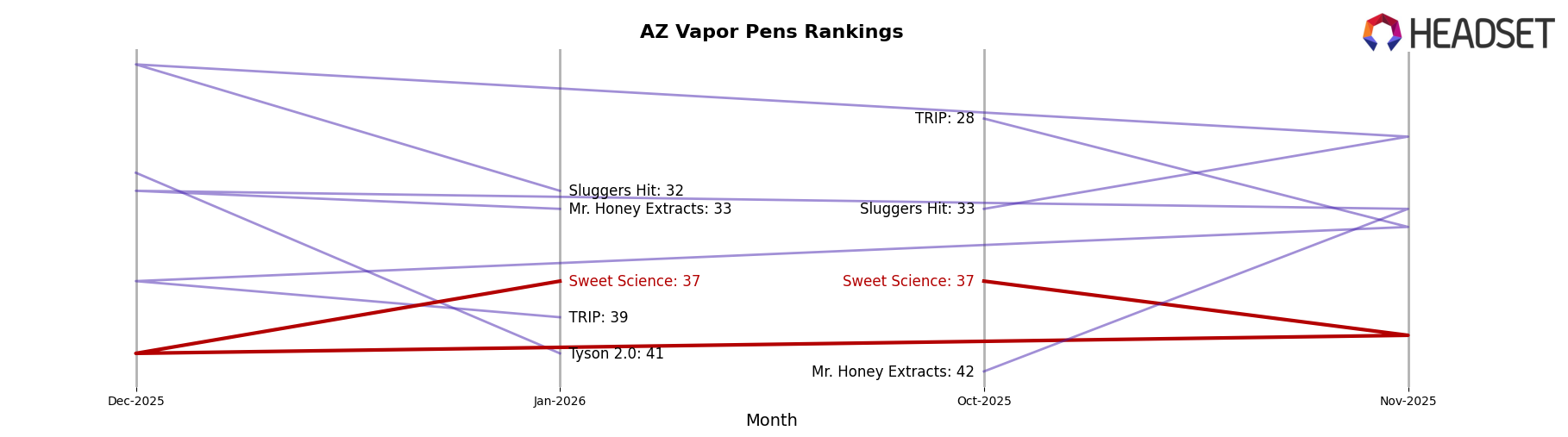

In the competitive landscape of vapor pens in Arizona, Sweet Science has shown resilience amidst fluctuating market dynamics. Over the four-month period from October 2025 to January 2026, Sweet Science experienced a slight dip in rank, moving from 37th to 41st, before rebounding back to 37th. This indicates a stable presence in the market despite the competitive pressures. Notably, TRIP maintained a higher rank than Sweet Science throughout this period, although it also experienced a downward trend from 28th to 39th. Meanwhile, Mr. Honey Extracts demonstrated a stronger upward trajectory, climbing from 42nd to 33rd, surpassing Sweet Science in November. Additionally, Sluggers Hit showed impressive growth, peaking at 25th in December before slightly dropping to 32nd in January. These shifts highlight the competitive volatility in the Arizona vapor pen market, suggesting that Sweet Science may need to innovate or adjust its strategies to maintain and improve its market position.

Notable Products

In January 2026, Sweet Science's THC Capsules (70mg) maintained its top position in the Capsules category, achieving the highest sales with a figure of 1295. Cherry Cheesecake Batter (1g) in the Concentrates category held steady at second place, consistently improving from third place in November 2025. Platinum OG Distillate Cartridge (2g) remained in third place within the Vapor Pens category, showing stable performance despite a slight dip in sales. Skywalker OG Distillate Cartridge (2g) also retained its fourth place ranking in the Vapor Pens category, with sales showing a minor decline. Notably, Platinum OG Dabbable Syringe (1g) emerged in the fifth position within Concentrates, marking its debut in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.