Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

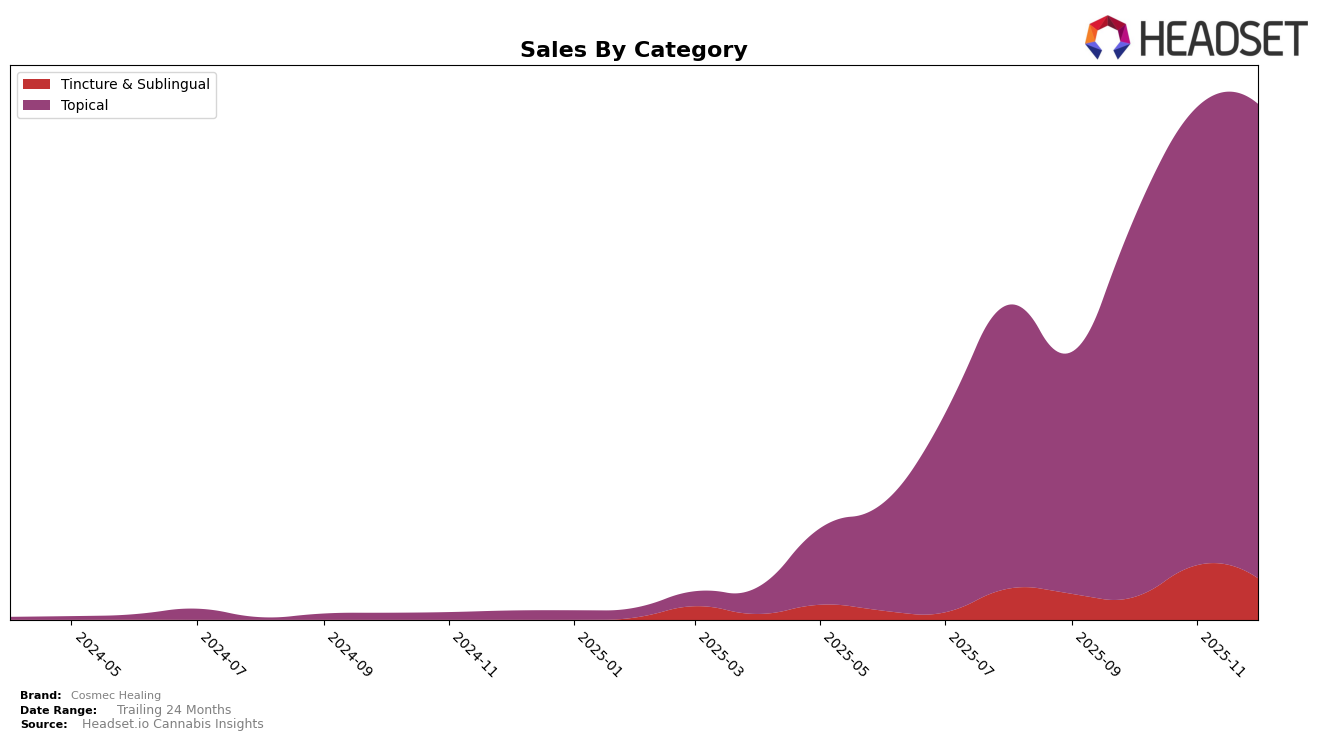

Cosmec Healing has demonstrated a strong and consistent performance in the topical category within Maryland. Over the last few months of 2025, the brand has maintained its position as the third-ranked brand in this category, showcasing a steady hold on consumer preferences. This stability in ranking suggests a loyal customer base and effective market strategies. Notably, the brand's sales figures have shown a progressive increase from September to December, with December sales reaching a notable $30,985. This upward trend in sales indicates a growing demand for Cosmec Healing's products in the state, aligning with its consistent ranking performance.

Interestingly, while Cosmec Healing has maintained a solid presence in the Maryland market, it is important to note that the brand does not appear in the top 30 rankings for other states or provinces. This absence could indicate either a strategic focus on the Maryland market or potential challenges in expanding their reach to other regions. The lack of presence in other markets could be seen as a missed opportunity for growth, especially given their success in Maryland. However, the brand's ability to maintain and grow its market share in a competitive category like topicals within Maryland is commendable and could serve as a foundation for future expansion efforts.

Competitive Landscape

In the Maryland topical cannabis market, Cosmec Healing has shown a steady performance, maintaining its rank at 3rd place from October to December 2025, after climbing from 4th in September. This consistent ranking indicates a solid position in the market, though it remains behind competitors like Avexia and Doctor Solomon's. Notably, Doctor Solomon's experienced a drop from 1st to 2nd place in December, allowing Avexia to take the top spot. This shift in leadership among the top two brands could present an opportunity for Cosmec Healing to capitalize on any market disruptions. While Cosmec Healing's sales have been increasing steadily, the brand still trails significantly behind the sales figures of the top two competitors, suggesting room for growth and the potential benefit of strategic marketing efforts to increase market share.

Notable Products

In December 2025, the CBD/CBN/THC 4:2:1 Recovery Salve Balm maintained its position as the top-performing product for Cosmec Healing, with sales reaching 664 units. The CBG/CBD 2:1 Connect Tincture advanced to second place, sharing the rank with the CBN/CBD 2:1 Relax Tincture, both showing consistent performance with slight variations in sales. The CBC/CBD 1:2 Relief Tincture held steady in third place, demonstrating stability across the months. Meanwhile, the CBD High Dose Full Spectrum Tincture slipped to fourth place, marking a notable decline from its second-place rank in November. This analysis indicates a strong preference for topical and tincture products, with the Recovery Salve Balm consistently outperforming others.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.