Jan-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

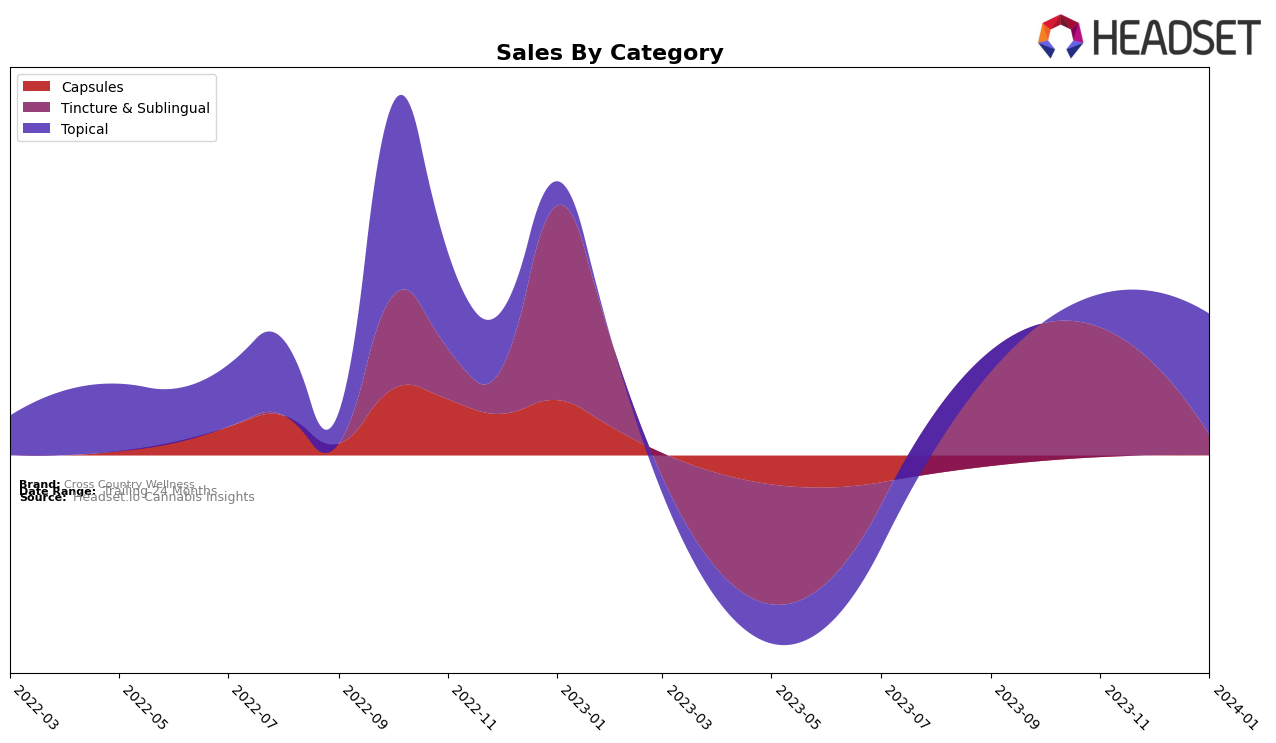

In Nevada, Cross Country Wellness has shown a notable presence in the Tincture & Sublingual category, despite not being ranked in the top 20 brands for October and November 2023. By December 2023, they made a significant entrance at rank 21, improving to rank 18 by January 2024. This upward trajectory indicates a growing consumer interest in their Tincture & Sublingual products within the state. However, the absence from the top 20 in the initial months suggests there was either a strategic shift in their market approach or an increase in consumer recognition and demand over the holiday season. The sales in December, although not the highest, marked a starting point for their ranking journey.

Similarly, in the Topical category within Nevada, Cross Country Wellness demonstrated a stronger initial performance, entering the rankings at 18 in December 2023 and advancing to 16 by January 2024. This category showed not just an entrance into the rankings but also an improvement, coupled with a significant sales increase from 660 units in December to 1102 units in January. This rapid growth and higher ranking in the Topical category as compared to the Tincture & Sublingual category could indicate a stronger market fit or possibly more focused marketing efforts. The absence in the earlier months across both categories could be seen as a missed opportunity, but the subsequent rankings and sales growth highlight a positive momentum for Cross Country Wellness in Nevada's competitive cannabis market.

Competitive Landscape

In the competitive landscape of the topical cannabis category in Nevada, Cross Country Wellness has shown a notable trajectory in terms of rank and sales, despite not being ranked in October and November 2023. By December 2023, it entered the rankings at 18th and improved to 16th by January 2024, indicating a positive momentum in a highly competitive market. This performance is particularly impressive when considering the brand's sales increased significantly from December 2023 to January 2024. In comparison, Rove entered the rankings in December and maintained a close position to Cross Country Wellness by January. Remedy, consistently ranked around the middle of the pack, saw a drop in rank by January, not listed in the top 20, despite starting stronger in October. Just CBD fluctuated in the lower rankings but remained in the top 20 through January. RVDCBD held a stronger position throughout, yet experienced a notable drop in sales by January 2024. Cross Country Wellness's upward movement in rank, alongside a significant sales increase, positions it as a brand with potential for further growth and competitiveness in Nevada's topical cannabis market.

Notable Products

In January 2024, Cross Country Wellness saw CBD Full Spectrum Salve (500mg CBD) in the Topical category rise to the top spot with notable sales of 25 units, improving from its second-place rank in December 2023. Following closely was CBD Full Spectrum Tinctures (1000mg CBD) from the Tincture & Sublingual category, which moved down to second after leading in December. The shift in rankings indicates a change in consumer preference, with a higher demand for topicals over tinctures at the start of the year. This change could reflect seasonal trends or evolving market dynamics within the wellness sector. Overall, these products highlight the diverse offerings of Cross Country Wellness and their ability to cater to varied consumer needs.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.