Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

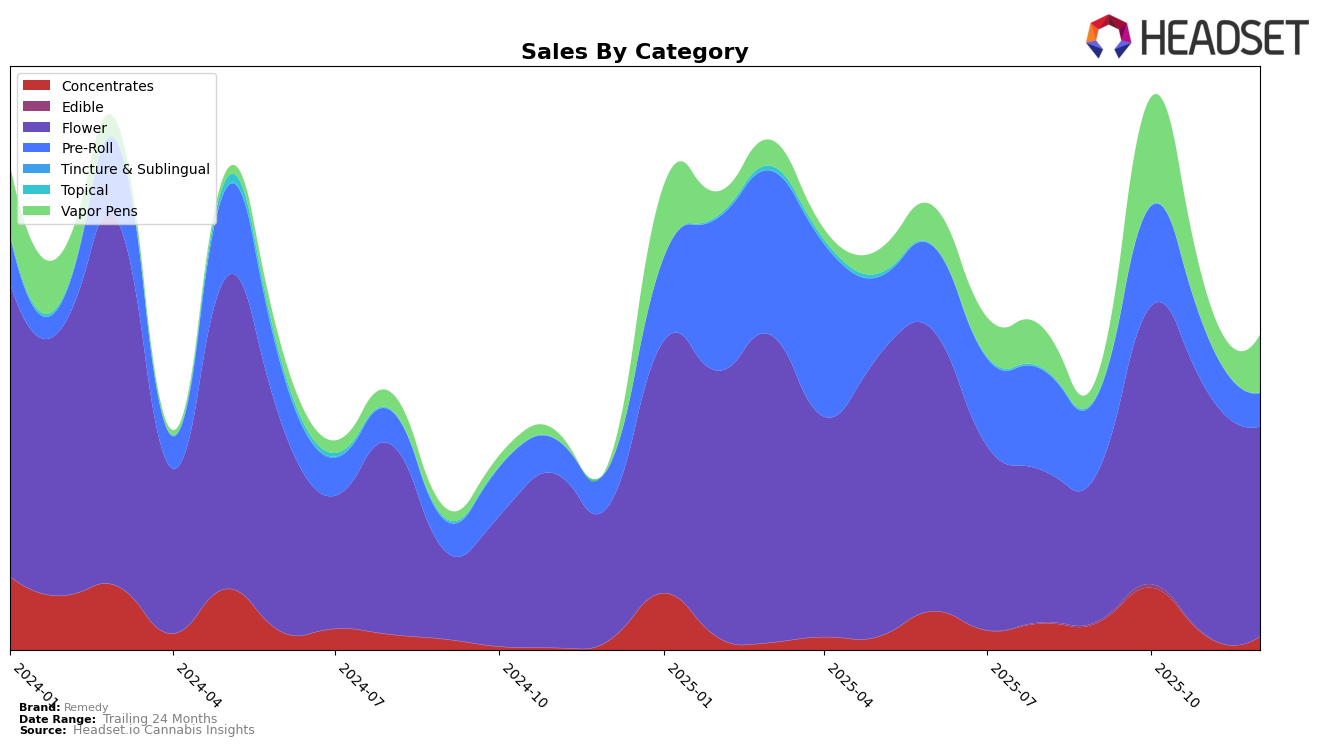

In the state of Nevada, Remedy has shown notable performance across various cannabis categories, particularly in Concentrates and Vapor Pens. The brand's ranking in Concentrates improved significantly from 28th in September 2025 to 17th in October 2025, indicating a strong upward trend and increased consumer interest in this category. However, the absence of rankings for November and December suggests that Remedy did not maintain its position within the top 30 brands, which could be a point of concern for the brand's market strategy. In Vapor Pens, Remedy experienced a fluctuating performance, moving from 55th place in September to 30th in October, then dropping to 47th in November before climbing back to 37th in December. This volatility might suggest a competitive market environment or shifting consumer preferences.

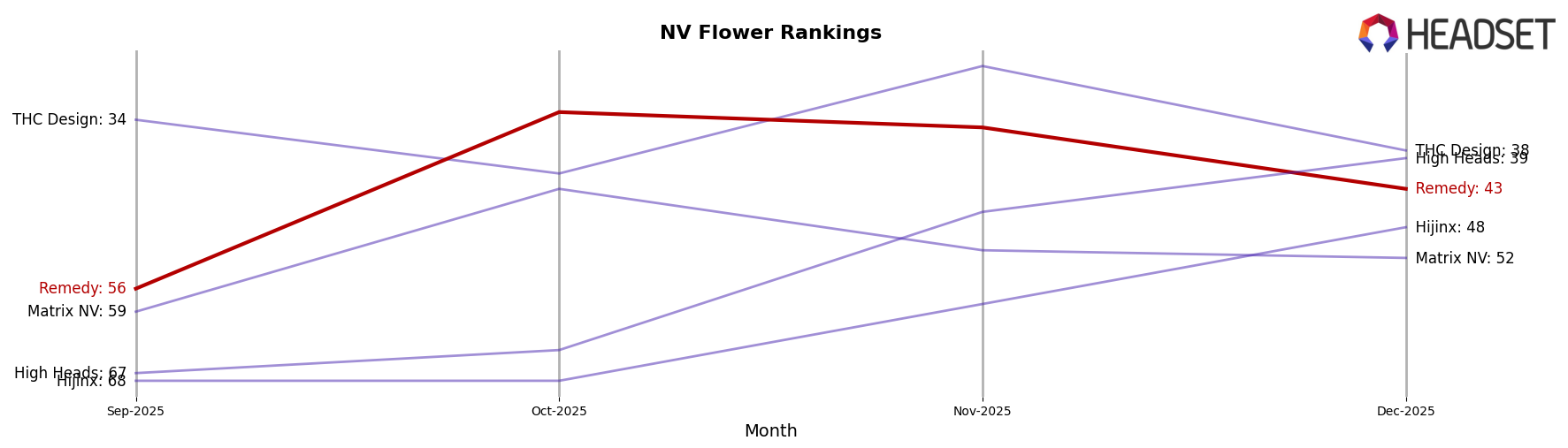

Remedy's performance in the Flower and Pre-Roll categories in Nevada also presents an interesting trajectory. In the Flower category, the brand improved its ranking from 56th in September to 33rd in October, but experienced a slight decline in the following months, ending the year at 43rd in December. This indicates a potential challenge in sustaining growth in this category. Meanwhile, in the Pre-Roll category, Remedy's ranking decreased from 32nd in September to 49th in December, showing a downward trend that may require strategic adjustments. The sales figures reflect these ranking movements, with a notable peak in October for both Flower and Pre-Roll categories, followed by a decline, which could suggest seasonal influences or other market dynamics at play.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Remedy has shown a dynamic performance over the last few months of 2025. Remedy's rank improved significantly from 56th in September to 33rd in October, indicating a strong surge in market presence, which was supported by a notable increase in sales during the same period. However, by December, Remedy's rank had slipped to 43rd, reflecting a potential challenge in maintaining its upward momentum. In contrast, THC Design demonstrated a more stable trajectory, peaking at 27th in November before settling at 38th in December, consistently outperforming Remedy in terms of rank. Meanwhile, High Heads showed a remarkable climb from 67th in September to 39th in December, suggesting a growing competitive threat. Matrix NV and Hijinx remained less competitive, with ranks consistently lower than Remedy's, though Hijinx showed an upward trend towards the end of the year. These dynamics highlight the competitive pressure Remedy faces in sustaining its market position amidst fluctuating ranks and sales in Nevada's flower market.

Notable Products

In December 2025, Chem D (3.5g) emerged as the top-performing product for Remedy, ascending from the second position in November to first place, with sales reaching 777 units. Las Vegas Kush Cake (3.5g), which held the top spot in November, slipped to second, reflecting a slight decrease in sales. Marmalade (3.5g) made a notable entry into the rankings, securing third place after not being ranked in October or November. Bio-Jesus (3.5g) experienced a decline, moving from first place in October to fourth in December. Key Lime Pie (3.5g) rounded out the top five, maintaining a presence in the rankings despite a downward trend in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.