Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

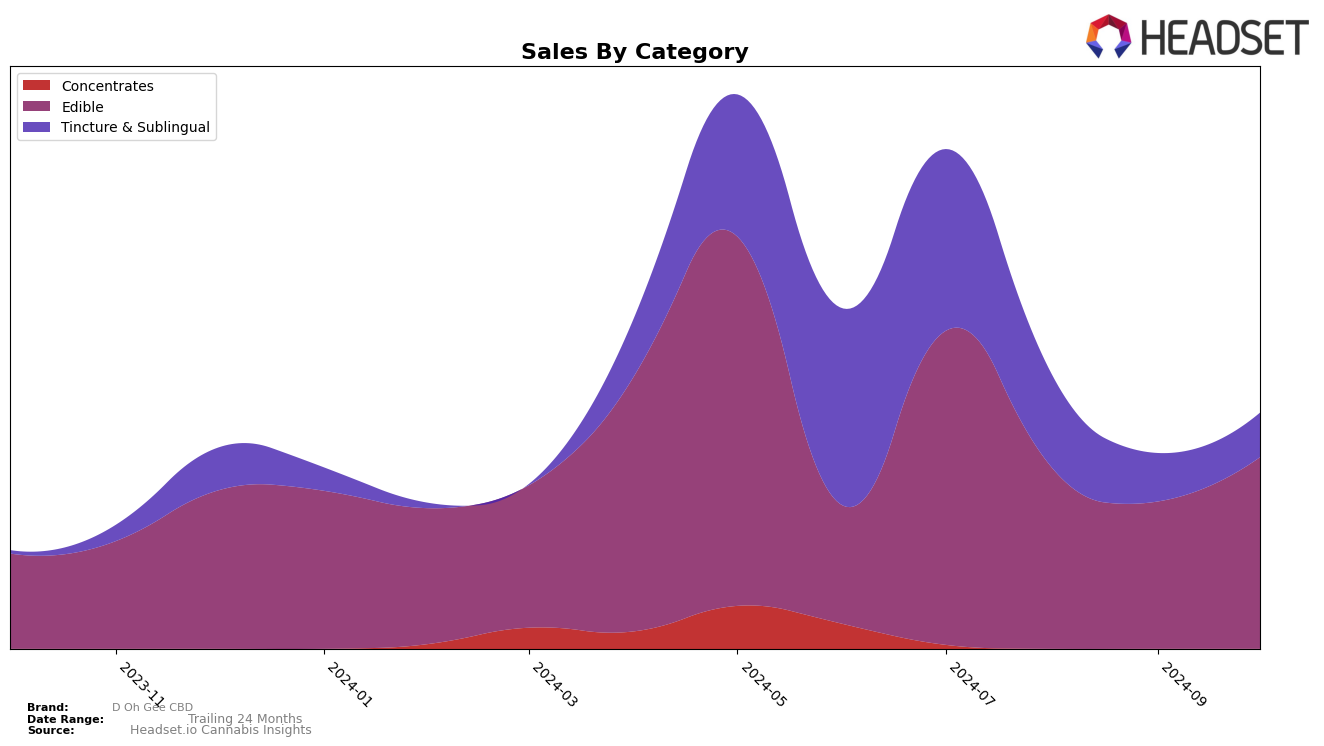

D Oh Gee CBD has shown varied performance across different states and product categories in recent months. Notably, in the Arizona market, the brand was ranked 47th in the Edible category in July 2024, but did not make it into the top 30 in subsequent months. This indicates a potential challenge in maintaining its competitive edge in this category within the state, possibly due to increased competition or shifts in consumer preferences. The absence from the top 30 in later months could be seen as a negative indicator of market traction in Arizona's Edible segment.

The fluctuations in D Oh Gee CBD's rankings highlight the dynamic nature of the cannabis market, where brands must continuously adapt to consumer demands and competitive pressures. While specific sales figures for months after July are not available, the initial sales figure for July provides a baseline for understanding the brand's market presence. Observing these trends can offer valuable insights into the brand's strategic positioning and areas where it might focus on improvement or innovation. The absence from top rankings in other states or categories could suggest opportunities for market expansion or the need for strategic realignment.

```Competitive Landscape

In the competitive landscape of the Arizona edible cannabis market, D Oh Gee CBD has faced significant challenges in maintaining its rank and sales momentum. As of July 2024, D Oh Gee CBD was ranked 47th, but it failed to secure a spot in the top 20 in subsequent months, indicating a struggle to keep pace with competitors. Notably, Hippie Chicks showed a consistent presence, ranking 48th in August and improving to 45th in September, suggesting a gradual upward trend in their market performance. Meanwhile, Lost Farm held a strong position at 20th in July, although it did not appear in the top 20 in the following months, which could imply a temporary dip or strategic shift. These dynamics highlight the competitive pressures on D Oh Gee CBD, underscoring the need for strategic adjustments to enhance visibility and sales in this vibrant market.

Notable Products

In October 2024, the top-performing product for D Oh Gee CBD was the CBD Daily Duck & Pumpkin Bites 10-Pack (50mg CBD) in the Edible category, maintaining its number one rank for four consecutive months with sales of 858 units. The Daily Duck & Pumpkin Bites (150mg CBD) also showed strong performance, holding the second rank, moving up from fourth in July. The CBD Dog Oil Drops Bacon Flavor (300mg CBD) in the Tincture & Sublingual category retained the third position, despite a steady decline in sales over the months. Notably, the Daily Turkey Cranberry Bites (150mg CBD) entered the rankings in September at the fourth position and maintained it through October. The Strawlemon Distillate Syringe (1g) was not ranked in October, having last appeared in the top three in July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.