Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

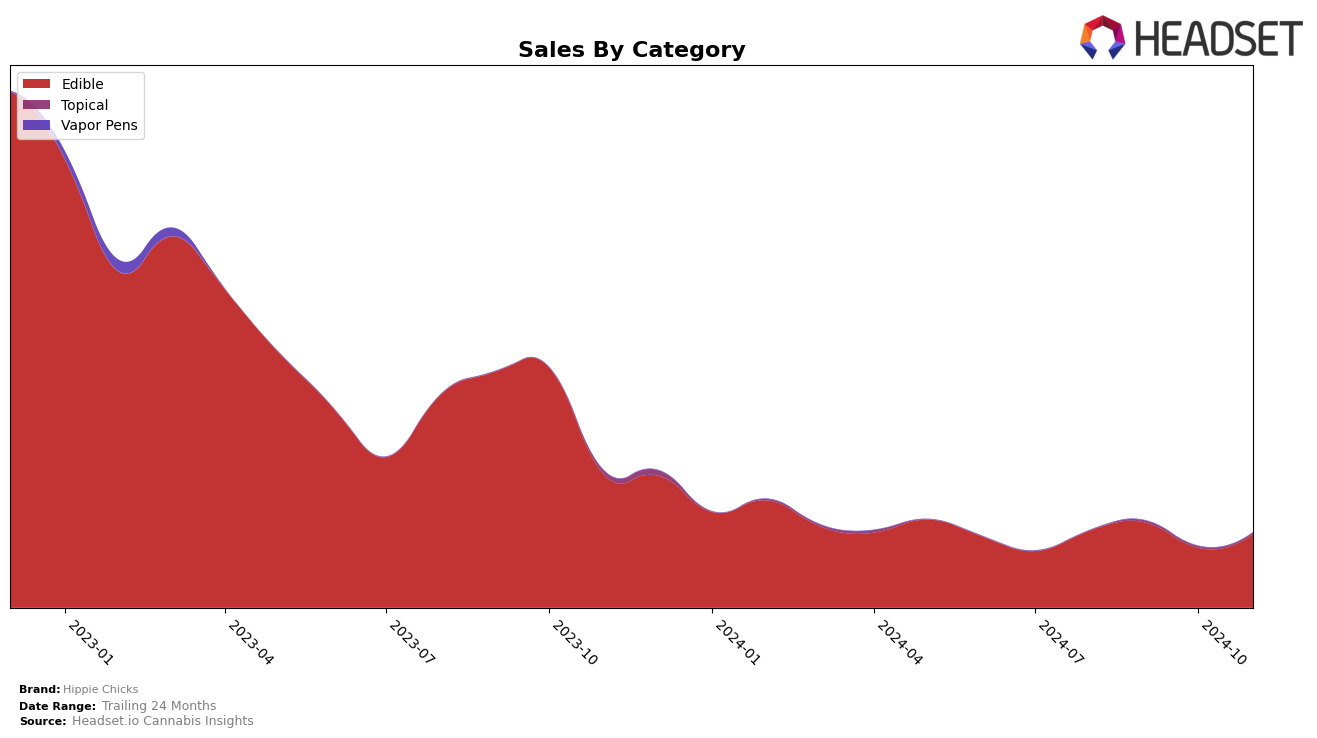

Hippie Chicks has shown some fluctuating performance in the edible category across different states, with notable movements in Arizona. In Arizona, the brand has struggled to maintain a consistent presence in the top 30 rankings. While they were ranked 48th in August 2024 and improved slightly to 45th in September, they failed to make the top 30 in October, indicating a drop in competitive standing. By November, they re-entered the rankings at 49th, suggesting a challenging market environment despite a slight increase in sales from August to September. The inability to maintain a top 30 position in October could be indicative of intensified competition or shifting consumer preferences within the state.

The trends in Arizona highlight the volatility and competitive nature of the cannabis edibles market. The brand's sales figures, although seeing a modest rise from August to September, did not translate into a sustainable improvement in rankings. This suggests that while there might be some positive sales momentum, it hasn't been enough to secure a strong competitive edge. The absence from the top 30 in October is particularly concerning, as it points to potential issues that may need addressing, whether in product offerings, marketing strategies, or distribution channels. The reappearance in November, albeit at a lower rank, does offer a glimmer of hope, but it underscores the need for strategic adjustments to enhance market performance.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Arizona, Hippie Chicks has experienced fluctuating rankings over the past few months, highlighting both challenges and opportunities in this dynamic sector. Despite a brief absence from the top 20 rankings in October 2024, Hippie Chicks managed to re-enter the list in November, albeit at a lower position of 49. This indicates a potential struggle in maintaining consistent market presence compared to competitors like Terra, which has shown a steady improvement, climbing from rank 43 in August to 42 in November. Meanwhile, Khalifa Kush and Sprinkle have also been notable players, with Sprinkle reappearing in the rankings at 48 in November after being absent in October. These shifts suggest that while Hippie Chicks is maintaining a presence, there is significant competition from brands that are either consistently ranked or are making notable comebacks, which could impact Hippie Chicks' sales momentum and market strategy moving forward.

Notable Products

In November 2024, the top-performing product from Hippie Chicks was the Dark Chocolate Salty Bar 10-Pack (100mg), which returned to the number one rank after previously holding the top spot in August. It achieved notable sales figures, reaching 94 units sold. The Razelberri Dark Chocolate 10-Pack (100mg) followed closely in second place, dropping from its first-place position in October. Milky Haze Chocolate Bar 10-Pack (100mg) made a significant leap, moving up from fifth place in October to secure the third spot in November. Caramello Milk Chocolate Bar 10-Pack (100mg) experienced a decline, falling from second in October to fourth in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.