Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

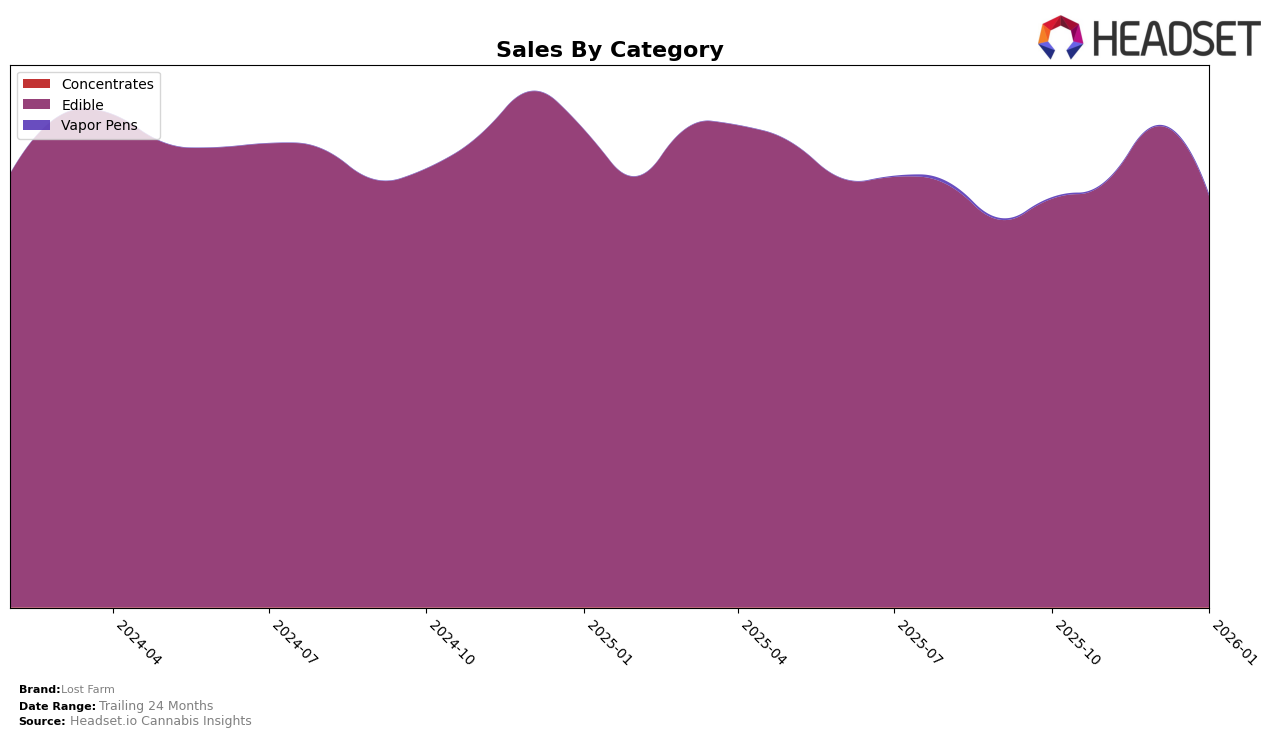

Lost Farm has demonstrated a consistent performance in the California market, maintaining a steady fourth-place ranking in the Edible category from October 2025 through January 2026. This stability is noteworthy, especially given the competitive nature of the California cannabis market. In Illinois, the brand held a strong position as well, fluctuating slightly from fourth to fifth place, indicating a robust presence. However, in Massachusetts, Lost Farm only entered the top 30 in November, reaching 19th place, which suggests potential growth opportunities in this region.

In Michigan, Lost Farm maintained a ranking in the mid-teens, showing some consistency but also room for improvement. Meanwhile, the brand's presence in New Jersey was less stable, with rankings appearing sporadically and not breaking into the top 20 until January 2026. Similarly, in New York, Lost Farm experienced a gradual decline in its ranking from 11th to 14th place, suggesting increased competition or shifting consumer preferences. In Ohio, the brand only appeared in the rankings starting in December, indicating a late but potentially strategic entry into the market.

Competitive Landscape

In the competitive landscape of the California edible market, Lost Farm has maintained a consistent rank of 4th from October 2025 through January 2026. Despite this stability, Lost Farm faces stiff competition from brands like Camino and Kanha / Sunderstorm, which have consistently ranked higher at 2nd and 3rd, respectively. Notably, Camino leads the market with significantly higher sales figures, indicating a strong consumer preference. Meanwhile, Good Tide and Heavy Hitters trail behind Lost Farm, maintaining their 5th and 6th positions. The data suggests that while Lost Farm has a solid foothold in the market, there is potential for growth if they can differentiate themselves further or capture some of the market share from the leading brands.

Notable Products

In January 2026, the top-performing product for Lost Farm was the Blueberry x Blue Dream Live Resin Fruit Chews 10-Pack (100mg), maintaining its first-place ranking from previous months, although its sales slightly decreased to 16,083 units. The Strawberry Lemonade x Super Lemon Haze Live Resin Gummies 10-Pack (100mg) rose to second place, improving from its third-place position in the preceding two months. The Juicy Peach x Mimosa Live Resin Infused Gummies 10-Pack (100mg) secured the third spot, having entered the rankings in December 2025. Raspberry x Wedding Cake Live Resin Gummies 10-Pack (100mg) remained steady at fourth place, while Ice Cream Cake x Watermelon Live Rosin Gummies 10-Pack (100mg) re-entered the rankings at fifth place after not being ranked in the previous months. Overall, the Edible category continues to dominate Lost Farm's top product rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.